Maturity pressure will gradually increase and peak in the third quarter of 2025, somewhat affecting the corporate bond market in the second half of the year.

Corporate bond maturity pressure peaks in Q3/2025

Maturity pressure will gradually increase and peak in the third quarter of 2025, somewhat affecting the corporate bond market in the second half of the year.

According to statistics on the corporate bond market in the fourth quarter of 2024, Phu Hung Securities Company (PHS) said that although there was a slowdown compared to the total issuance volume in the third quarter, compared to previous periods, the issuance volume of corporate bonds in the last 3 quarters has shown a breakthrough.

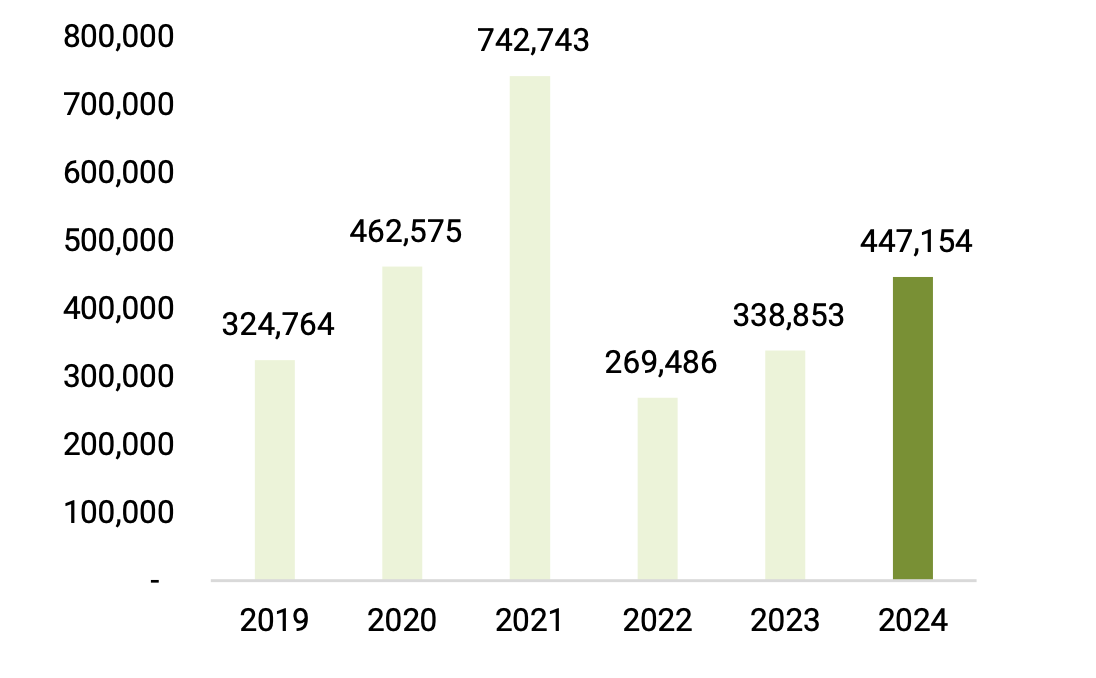

Specifically, according to data from HNX, as of December 31, there were 138 private corporate bond issuances in the fourth quarter worth VND130,420 billion, down 12.1% compared to the previous quarter and unchanged compared to the same period last year. For the whole year of 2024, the total value of new issuances reached more than VND447,000 billion, up nearly 32% compared to 2023.

PHS believes that after a period of confidence crisis that caused a sharp decline in issuance scale in 2022 and a slight recovery in 2023, there has been a stronger improvement in 2024.

|

| Annual issuance value (billion VND), as of posting date December 31, 2024. Source: PHS synthesis |

In the last quarter of 2024, the Vin family continued to successfully issue 18,000 billion VND. Of which, Vinfast recorded the largest new bond issuance with 10,000 billion VND, an average interest rate of 13.5%/year, an average term of 4 years for the purpose of implementing an automobile manufacturing project in Dinh Vu - Cat Hai economic zone, Hai Phong city. In 2024 alone, the Vin family issued a total of 38,500 billion VND. Most of the bonds issued by the Vin family have interest rates ranging from 12-13.5%, which is also high compared to the market.

In terms of the top 10 enterprises with the largest issuance value in 2024, 9 out of 10 issuers belong to the banking group. This is also the group that contributes the most to the recovery of the corporate bond market in 2024. It is expected that with the need for capital to ensure capital safety and credit growth next year, the issuance trend of the banking group will continue to lead the bond market in 2025.

As of December 31, corporate bond repurchases in the fourth quarter reached VND55,850 billion, down 20.6% compared to the third quarter and down 17.6% compared to the same period last year. Repurchases only increased sharply in December, accounting for nearly 50% of the total amount of bonds repurchased in the fourth quarter. Accumulated for the whole year, the total amount of bonds repurchased in 2024 reached nearly VND203,700 billion, down 18% compared to 2023.

The banking group is still the leading group in buying back bonds before maturity when the interest rate of newly issued bonds remains low, accounting for nearly 75% of the total amount of bonds bought back and increasing by 19.7% compared to 2023. Meanwhile, the amount of corporate bonds bought back by real estate enterprises accounts for only 10% and decreases by 56.9% compared to 2023.

Meanwhile, the situation of bonds with delayed principal and interest payments in the second half of 2024 is also much lower than in 2023. This trend is expected to continue to support the market next year, especially when the amount of maturing bonds is also reduced compared to previous years, helping to create confidence for investors to return to the market. The amended Securities Law passed in December 2024 also helps to perfect the legal framework to support the bond market to develop more sustainably.

However, PHS said that the regulation limiting bond extension to a maximum of 2 years will lead to a large volume of bonds maturing from the second quarter of 2025. Accordingly, maturity pressure will gradually increase and peak in the third quarter of 2025, somewhat affecting the corporate bond market in the second half of the year.

Looking ahead to 2025, PHS believes that the riskiest period of the corporate bond market has passed, especially when new legal regulations are applied, making the market more transparent and sustainable. The stable savings interest rate level of 4 - 5.0% also promotes the shift of cash flow from investors to investment channels with higher yields.

In addition, better economic growth also leads to expectations of a recovery in corporate business operations, thereby improving the asset quality of corporates and providing a basis for investors to increase their confidence in the corporate bond market.

Source: https://baodautu.vn/ap-luc-dao-han-trai-phieu-doanh-nghiep-dat-dinh-vao-quy-iii2025-d240091.html

![[Photo] Third meeting of the Organizing Subcommittee serving the 14th National Party Congress](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/3f342a185e714df58aad8c0fc08e4af2)

![[Photo] Relatives of victims of the earthquake in Myanmar were moved and grateful to the rescue team of the Vietnamese Ministry of National Defense.](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/aa6a37e9b59543dfb0ddc7f44162a7a7)

Comment (0)