Selling pressure spreads, VN-Index loses more than 13 points in the last session of the week

VN-Index traded in red throughout the weekend session due to selling pressure from domestic investors before closing at 1,255.11 points, down more than 13 points from the reference.

After breaking through the support zone of 1,270 points, the stock market faced stronger selling pressure from domestic investors. VN-Index therefore traded in red throughout the weekend session and at one point lost about 15 points compared to the reference, falling close to the 1,250 point zone. The index narrowed its decrease range to approach the reference, but then faced selling pressure, causing it to fall to 1,255.11 points, down more than 13 points at the close.

This is the third consecutive decline of the VN-Index. Overall this week, the market experienced 4 declines and 1 increase, causing the index to lose about 26 points compared to the end of last week.

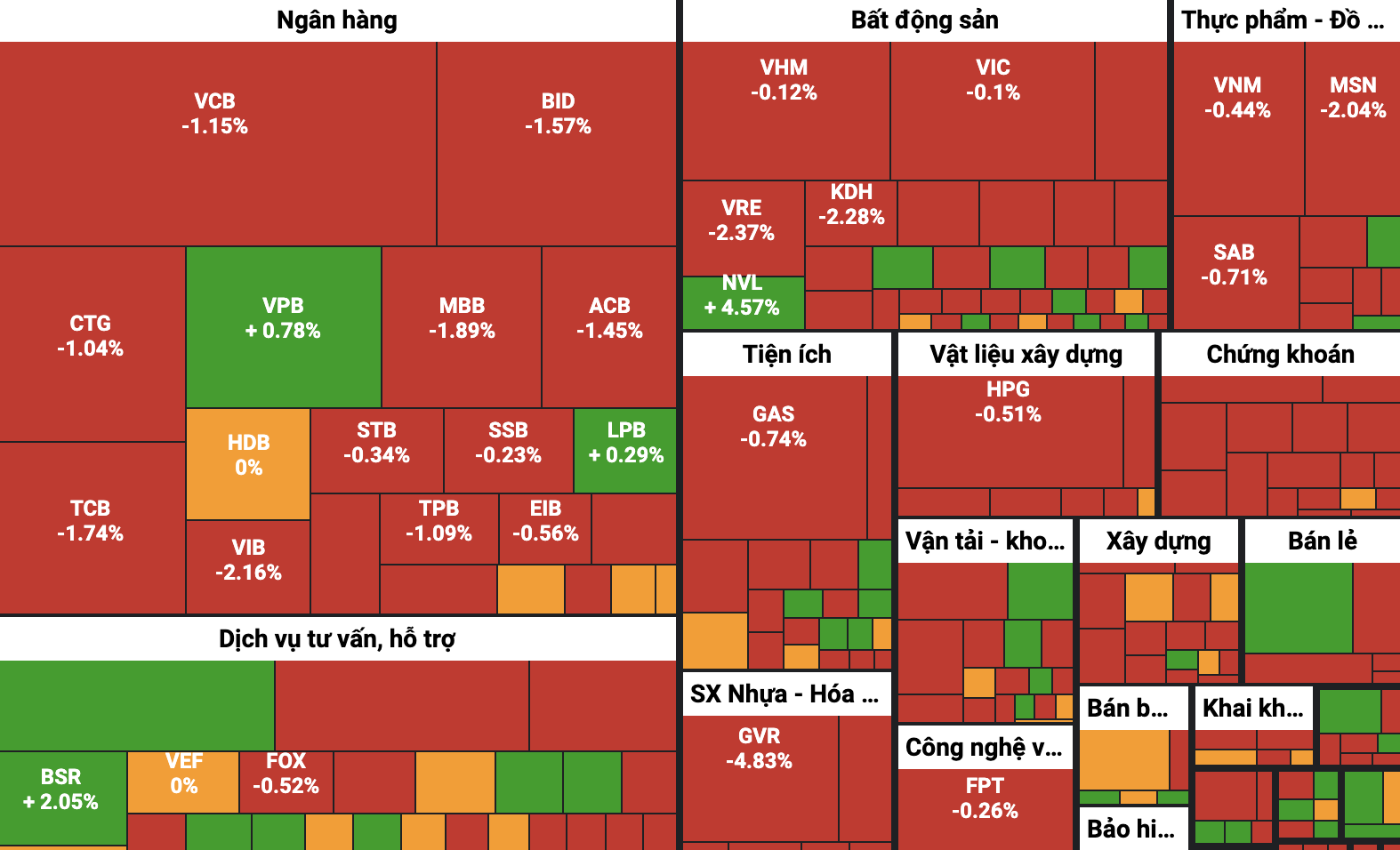

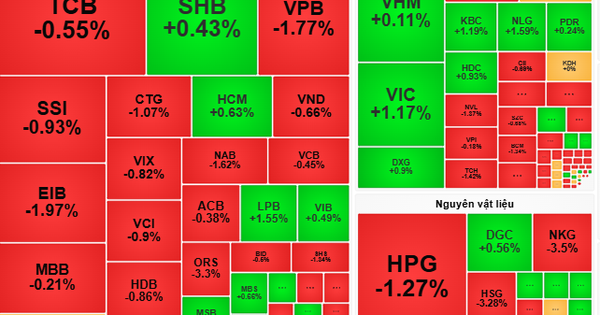

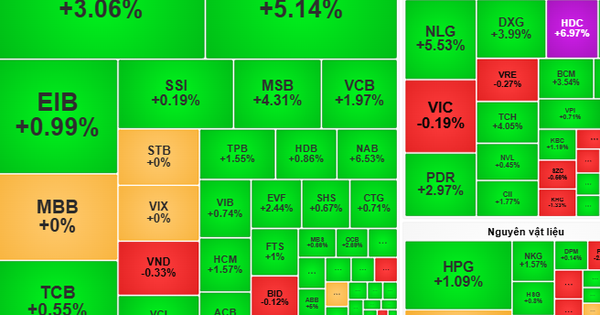

In the last session of the week, the market was in red with 381 stocks falling, of which 11 stocks lost all their amplitude. On the contrary, the number of stocks increasing was only 116, of which 3 stocks hit the ceiling. The large-cap basket recorded strong differentiation when 26 stocks closed below the reference, while the number of stocks increasing was only 2 stocks.

Strong selling pressure came from the securities group when all stocks decreased, many of which lost more than 4% compared to the reference such as VDS, VCI, TVB and VIX. Similarly, red also dominated the other two pillars of the market, banking and steel. The real estate group also faced fierce selling pressure, but in return, there was a bright spot from Novaland (NVL) shares when the market price increased to the ceiling price of VND18,700 at one point before narrowing the increase to 4.6% and closing at VND18,300.

|

| Map of capitalization of Ho Chi Minh City Stock Exchange in session 4/5. |

HVN increased by 6.67% to VND16,000, becoming the most important support for the index. The remaining stocks on the list of positive impacts on the VN-Index are NVL, VPB, MWG, TMS, CMG and HAG respectively. Meanwhile, VCB was the stock that weighed down the index the most when it decreased by 1.15% to VND94,900. Most of the remaining stocks on the list of negative impacts on the index are also in the banking group such as BID, TCB, MBB, CTG and ACB.

Market liquidity in the last session of the week reached more than 1.07 billion shares, an increase of nearly 100 million shares compared to the previous session. NVL led in trading volume when recording nearly 108 million shares changed hands, far surpassing the total matched volume of the two following codes, VIX and SSI. The trading value of the Ho Chi Minh City Stock Exchange today reached VND25,193 billion, a significant increase compared to VND23,862 billion of yesterday's session.

Foreign investors today traded relatively balanced when disbursing 1,964 billion VND and selling 1,938 billion VND, equivalent to a net buying value of 26 billion VND. NVL was the stock that attracted the most cash flow from foreign investors with a net buying value of more than 223 billion VND, followed by MWG with more than 120 billion VND and CTG with more than 64 billion VND. On the contrary, VHM was sold the most by foreign investors with a net value of more than 228 billion VND, followed by PVD with 111 billion VND.

Source

![[Photo] Special relics at the Vietnam Military History Museum associated with the heroic April 30th](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/a49d65b17b804e398de42bc2caba8368)

![[Photo] Moment of love: Myanmar people are moved to thank Vietnamese soldiers](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/9b2e07196eb14aa5aacb1bc9e067ae6f)

![[Photo] General Secretary To Lam receives Japanese Ambassador to Vietnam Ito Naoki](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/3a5d233bc09d4928ac9bfed97674be98)

Comment (0)