Vietnam Bank for Agriculture and Rural Development (Agribank) has just been honored in the Top 10 Strong Vietnamese Brands 2024.

Vietnam Economic Times - VnEconomy Magazine has just announced and honored Strong Vietnamese Brands 2024.

With the theme "Pioneering Green Investment", the Vietnam Strong Brands 2024 program conducts surveys, reviews and honors business brands with outstanding achievements in production, business, trade and service activities towards green growth and sustainable development.

The evaluation criteria in 2024 will not only focus on the strategy, action plan and performance of the enterprise in the process of digital transformation, green transformation, developing production models towards energy saving, prioritizing the use of clean energy, but also on policies towards employees and social responsibility to the community.

Over 36 years of construction and development, Agribank has always promoted its pioneering and exemplary role as a key commercial bank in implementing the policies of the Party and the State, operating safely and effectively with total assets of over VND 2.1 million billion; capital reaching over VND 1.95 million billion; outstanding loans to the economy of over VND 1.64 million billion. Agribank provides a variety of services to meet all customer needs, eliminating the gap between rural and urban areas in the use of modern financial and digital banking services.

The Agribank brand is affirmed with important contributions to investing in the development of “Tam Nong”, contributing to the socio-economic development of the country, along with outstanding marks in green transformation, digital transformation, towards the goal of sustainable development. With the key role in providing capital and financial services for the economy, especially in the agricultural and rural areas, Agribank builds a business plan associated with the green economy, environmentally friendly circular economy and is determined to promote green growth.

Agribank continues to effectively implement 7 policy credit programs and national target programs. Since 2016, Agribank has pioneered the implementation of a preferential credit program of 50,000 billion VND to develop clean agriculture for public health with loan interest rates reduced from 0.5%/year to 1.5%/year.

Currently, Agribank is urgently completing procedures and guidelines for piloting the credit program to serve the Project "Sustainable development of 1 million hectares of high-quality rice cultivation and low emission reduction associated with green growth in the Mekong Delta by 2030".

As the State's key commercial bank, in parallel with successfully completing assigned tasks in implementing monetary policy and investing in economic development, each year, Agribank spends hundreds of billions of VND to sponsor many comprehensive and long-term social security programs across the country.

Dinh Son

Source: https://vietnamnet.vn/agribank-duoc-vinh-danh-thuong-hieu-manh-viet-nam-2024-2335412.html

![[Photo] Tan Son Nhat Terminal T3 - key project completed ahead of schedule](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/85f0ae82199548e5a30d478733f4d783)

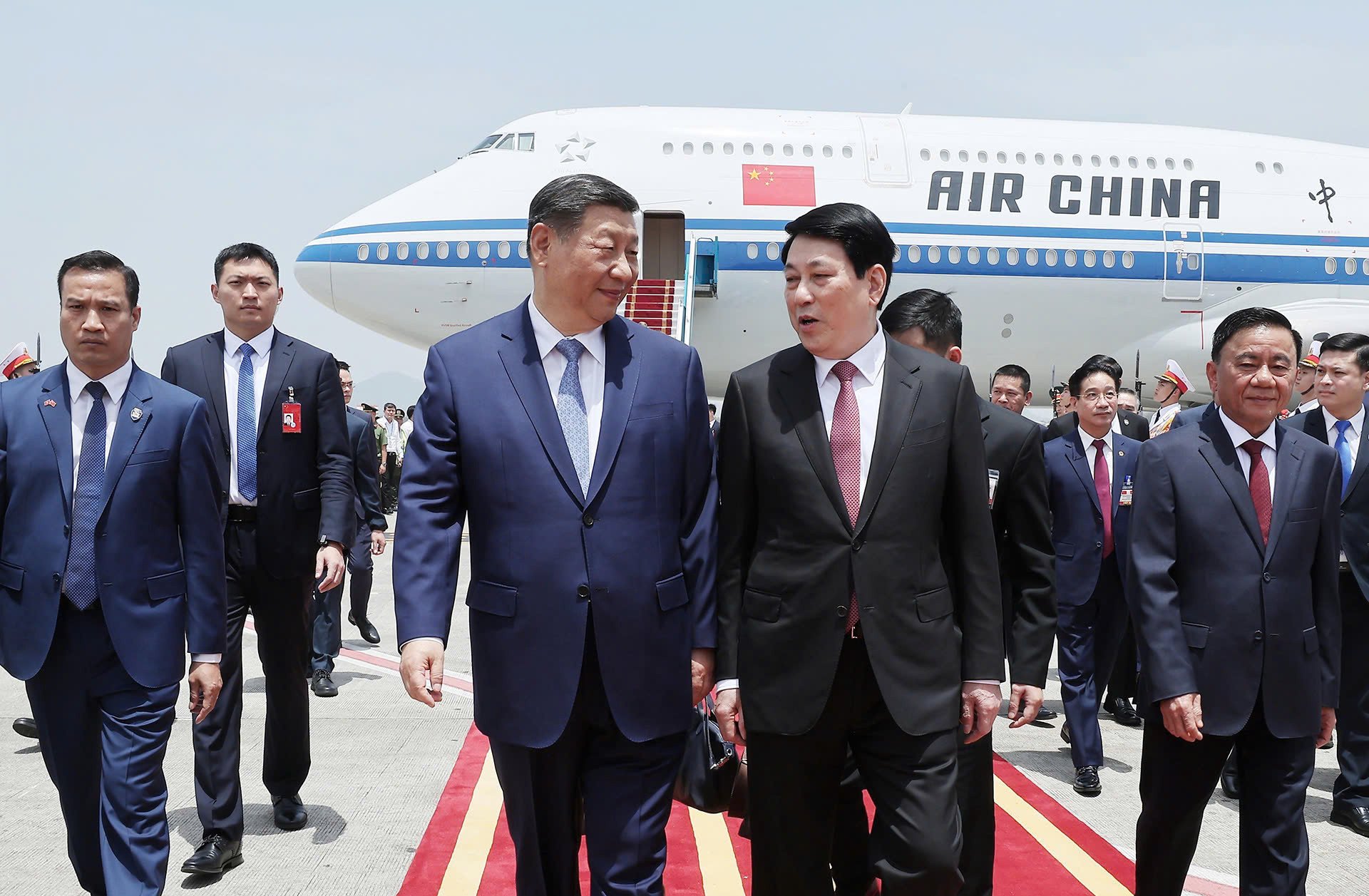

![[Photo] National Assembly Chairman Tran Thanh Man meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/4e8fab54da744230b54598eff0070485)

![[Photo] Prime Minister Pham Minh Chinh meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/893f1141468a49e29fb42607a670b174)

![[Photo] Reception to welcome General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/ef636fe84ae24df48dcc734ac3692867)

Comment (0)