Vietnam Bank for Agriculture and Rural Development (Agribank) Dak Nong Branch is actively digitizing all areas of its operations and is aiming for comprehensive digital transformation.

As a leading commercial bank, Agribank Dak Nong Branch always prioritizes digital transformation. This process is continuously and quickly implemented by the unit, aiming to promptly improve financial services, bringing customers diverse and convenient products and services.

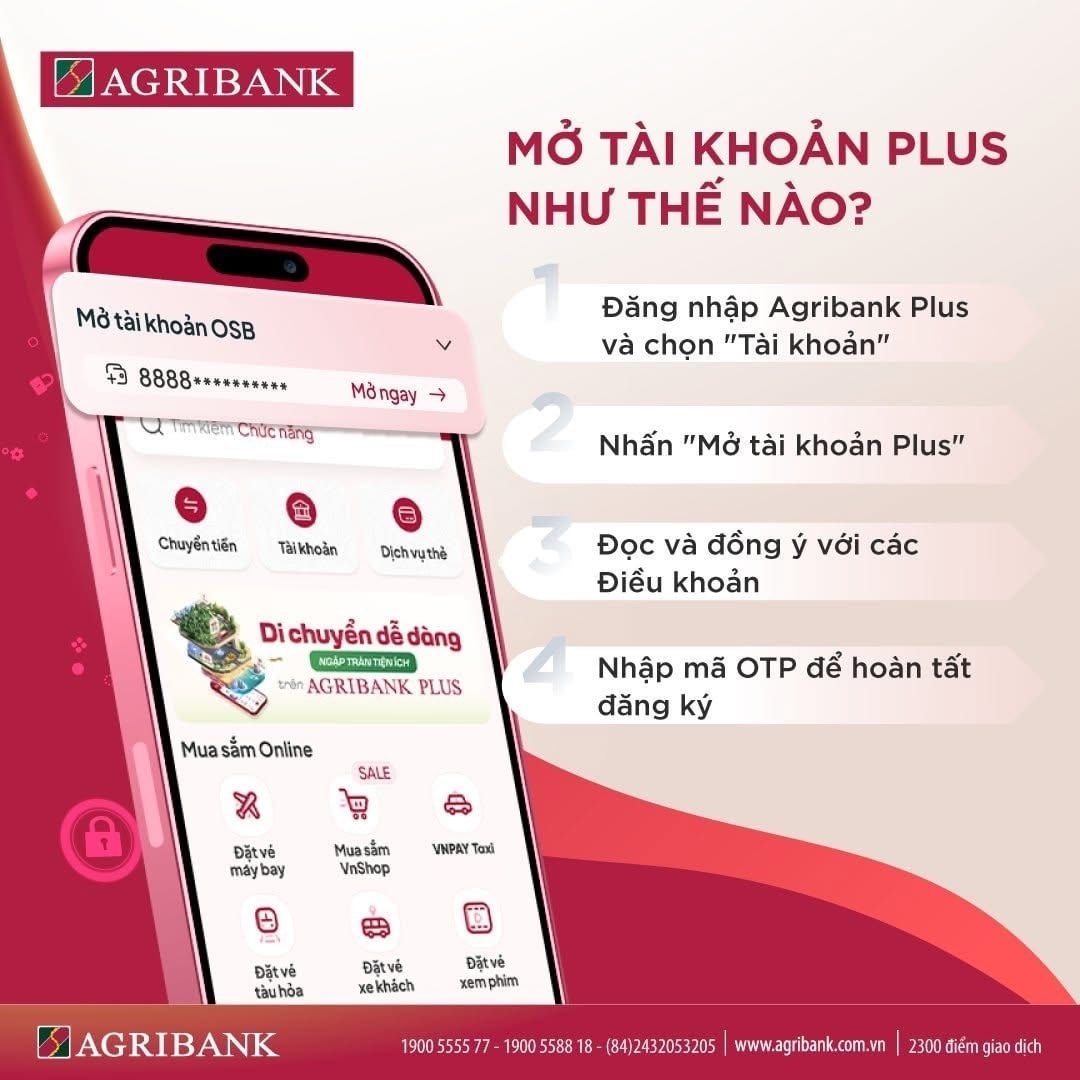

From November 1, 2024, Agribank officially launched and used Plus Accounts on the Agribank Plus application for customers. This is a new breakthrough in personalizing and optimizing customer experience. Plus Accounts help users transact quickly, safely and bring many special rights.

The Plus account is an effective solution to help reduce congestion and improve transaction processing efficiency, especially during peak holiday periods.

According to reviews, Agribank's Plus account offers a superior transaction experience with fast speed and high security.

Plus account on Agribank Plus provides customers with many outstanding utilities such as: Unique account number, welcome prosperity with the prosperous number 8888, combined with an easy-to-remember personal phone number.

Customers can perform all transactions, from money transfers, flexible online savings with attractive interest rates, easily managing finances anytime, anywhere.

From paying bills to shopping online, booking a taxi... in seconds, thanks to a multi-layered security system that ensures absolute safety. This feature makes Plus Account the ideal solution for users in the digital age, where safety and speed are always a priority.

Plus accounts also offer attractive benefits with 100% free service fees, helping customers save costs while still enjoying all modern banking utilities.

Currently, to promote the development of customers registering, using, and experiencing Plus accounts on the Agribank Plus application, Agribank Dak Nong is synchronously deploying many solutions.

Agribank Dak Nong complies with the provisions of the 2023 Law on Identification, Circular 17/2024/TT-NHNN and Circular 18/2024/TT-NHNN of the State Bank on methods of supporting customers anytime, anywhere.

Agribank will support customers to update biometric information and identification documents to avoid interruption of online transactions from January 1, 2025.

To support customers in updating their identification and biometric information, from December 2, 2024 to January 13, 2025, Agribank Dak Nong will also conduct transactions on Saturdays and Sundays.

For customers who have not provided biometric data on the banking application and have not been cross-checked, please proactively check to match your identification documents and biometric information.

Through this activity, Agribank continues to strengthen support for customers to update information on expired identification documents and biometric information to meet the regulations of the State Bank.

All are aimed at ensuring safety and security in online payments, as well as facilitating customers in making financial transactions, transferring and withdrawing money at ATMs.

Agribank PLUS is just one of many digital applications that Agribank Dak Nong has deployed. Identifying digital transformation as an important strategic step, in recent years, Agribank Dak Nong has proactively applied information technology and developed many banking services.

Many cashless payment services such as: opening eKYC online accounts, non-physical cards, contactless chip cards, ePIN electronic PIN codes, payment by VietQR codes, multi-function ATMs (CDM) ... are put into application.

Public administrative services are actively promoted by Agribank Dak Nong. Many groups of public services have been paid for electronically, bringing convenience and speed to the people.

Typical examples include public services in the fields of education, electricity, water, telecommunications, insurance, hospitals, financial companies, etc.

Agribank Dak Nong also integrates utilities for payment services, tax collection and payment, and fee payment via e-wallet, on the Agribank E-Mobile Banking application.

Along with that, Agribank has signed agreements with units to provide services for collecting electricity, water, tuition, and hospital fees. The payment of pensions and social insurance benefits, contributing to improving management efficiency and transparency of payment transactions in the economy, has also been proactively implemented by Agribank.

Along with developing product and service supply, Agribank Dak Nong focuses on developing distribution channels suitable for the 4.0 trend.

The unit has developed distribution channels via ATM and EDC/POS, Mobile Banking, Internet Banking. Payment connection channels with customers (CMS), mobile banking channels, joint teams, distribution channels with agent banks are also focused by Agribank.

Standardizing transaction points and traditional distribution channels, innovating professional customer service style and attitude, and reforming administrative procedures have been and are being strongly implemented by Agribank.

From here, Agribank Dak Nong aims to create all favorable conditions for customers to access and use capital and banking products and services.

Director of Agribank Dak Nong Branch Phan Cong Que emphasized that digital transformation is an important task of the whole industry. Agribank Dak Nong focuses all resources, accelerates digital transformation to meet the needs of people and businesses.

It can be said that the implementation of the digital transformation action plan is carried out by Agribank Dak Nong with specific goals and a clear roadmap.

Agribank Dak Nong has been and is continuing to gradually improve customer experience, contributing to the early completion of the goal of developing Dak Nong's digital economy and digital society by 2025, with a vision to 2030.

Nguyen Luong - Phong Vu

Source: https://baodaknong.vn/agribank-dak-nong-va-muc-tieu-chuyen-doi-so-toan-dien-237562.html

![[Photo] "Beauties" participate in the parade rehearsal at Bien Hoa airport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/155502af3384431e918de0e2e585d13a)

Comment (0)