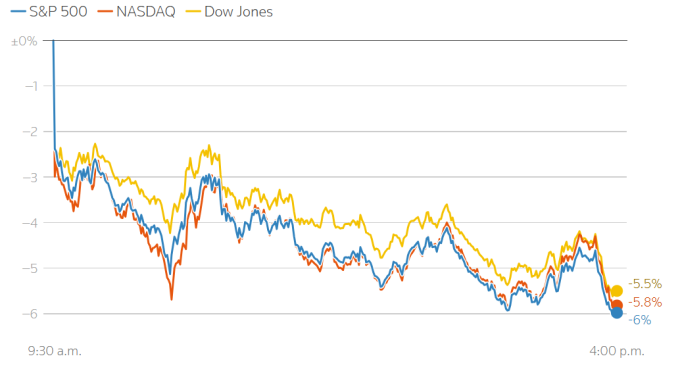

At the close of trading on April 4, the DJIA index fell more than 2,200 points, equivalent to 5.5%. This is the sharpest decline since June 2020. This week is also the first time in history that the DJIA recorded two consecutive sessions of declines of more than 1,500 points.

The S&P 500 lost 5.9% - the lowest since March 2020. Compared to the most recent peak in December 2024, this index is down 17%. In total, in 2 sessions, the capitalization of companies in this index evaporated 5,000 billion USD.

The Nasdaq Composite, which tracks many technology stocks, fell 5.8%, pushing the index into bear territory after falling 22% from its December peak.

The market fell sharply after China announced on April 4 that it would impose an additional 34% import tax on goods from the US in retaliation for the reciprocal tax imposed by President Donald Trump two days ago. Investors are worried that escalating trade tensions will cause US inflation to rise again and lead to an economic recession.

Tech stocks continued to lead the declines on Friday. Apple fell 7%, bringing its weekly loss to 13%. Chipmaker Nvidia fell 7%. Tesla fell 10%. All three companies have a large presence in China and are among the hardest hit by Beijing’s retaliatory tariffs on Washington.

In addition to technology, other stocks such as Boeing and Caterpillar - major exporters to China - fell 9% and 6% respectively.

The group of Chinese technology companies listed in the US did not escape the general situation. Alibaba and JD both fell 7-10%. PDD - the parent company of Temu, Baidu and NetEase fell 5-8%.

In contrast, sportswear stocks reversed course and rose. Nike rose 3%, Hoka, Ugg, Teva more than 5%, after US President Donald Trump said he had a phone call with General Secretary To Lam.

During the phone call, General Secretary To Lam said he was ready to negotiate with the US to reduce import tax to 0% on goods imported from the country, and at the same time proposed that the US apply a similar tax rate on goods imported from Vietnam.

Currently, about 25% of Nike’s supply comes from suppliers in Vietnam. Meanwhile, Deckers has 68 supply partners in Vietnam. Shares of other footwear brands such as Sketchers rallied 2%, Foot Locker rose 1.5%, Crocs rose 5%.

JPMorgan, the largest US bank, on April 4 raised its forecast for the probability of a US and global recession to 60%, from 40% previously. Before JPMorgan, Goldman Sachs made a similar move late last month.

Earlier, US stocks recorded their biggest drop in five years on April 3. The DJIA index fell 1,682 points, or 4%. The S&P 500 lost 4.85%. The Nasdaq Composite had the biggest drop, down 6%.

World gold prices also plummeted, falling by 78 USD to 3,036 USD.

TB (according to VnExpress)Source: https://baohaiduong.vn/5-000-ty-usd-boc-hoi-khoi-thi-truong-chung-khoan-my-408765.html

![[Photo] Overcoming all difficulties, speeding up construction progress of Hoa Binh Hydropower Plant Expansion Project](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/bff04b551e98484c84d74c8faa3526e0)

![[Photo] Closing of the 11th Conference of the 13th Central Committee of the Communist Party of Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/114b57fe6e9b4814a5ddfacf6dfe5b7f)

Comment (0)