3 stocks recommended by Dragon Viet experts to "wait to buy" in July

Sharing about investment opportunities in stocks in the mid & small cap group, Mr. Nguyen Dai Hiep, Director of Investment Consulting for Individual Clients at Rong Viet Securities Company, recommended "waiting to buy" for 3 stocks SZC, BAF, VLB.

In the third quarter of 2024, which will take place in July, the Ho Chi Minh City Stock Exchange (HOSE) will reassess the VN30 and VNFIN LEAD indices for the second time this year with changes to the index portfolio structure. At the same time, the VN DIAMOND indices will be updated with data and the proportion of the component stock portfolio will be recalculated. The results will be officially announced on July 15, 2024 and will take effect on August 5, 2024 .

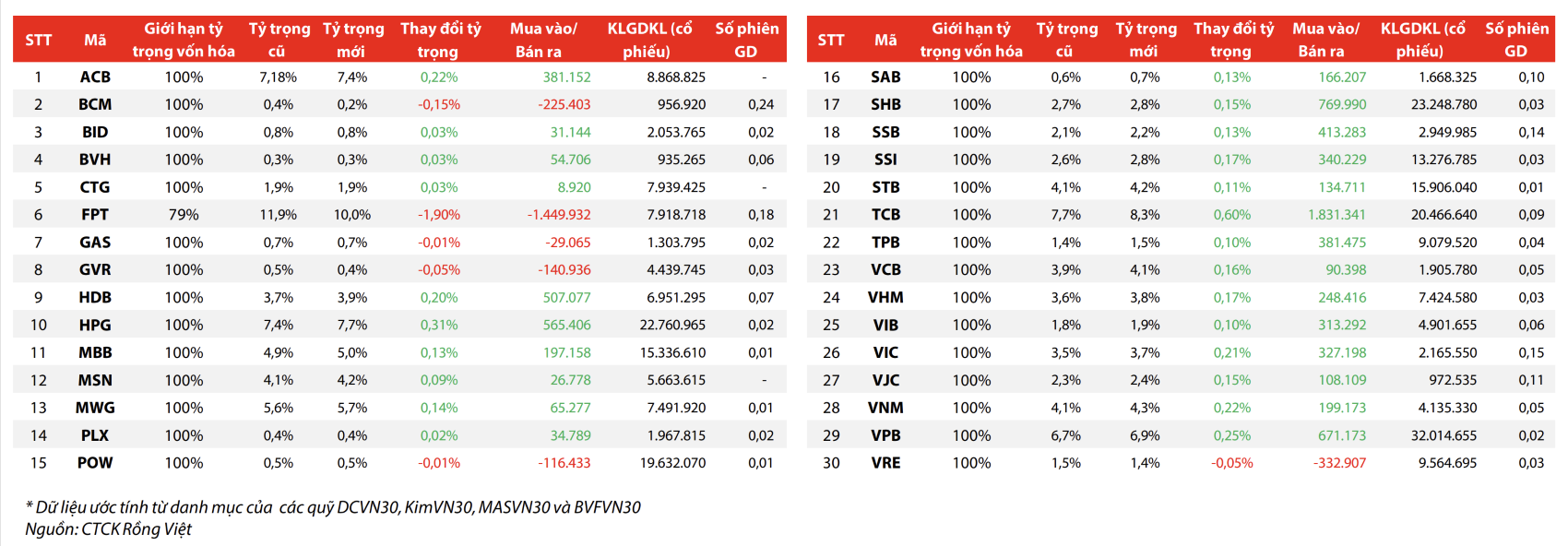

With the VN30 index , based on data closing on June 28, 2024 , Rong Viet Securities Company estimates that the VN30 index will have no change in index composition and only adjustments in the portfolio weight of component stocks.

Currently, there are 4 ETF funds on the market using the VN30 index as a reference, including DCVN30, KimVN30, MASVN30 and BVFVN30 with total assets of more than VND 8,700 billion.

Of which, DCVN30 fund is the fund with the largest total assets, reaching about 7,180 billion VND and has decreased by 4.9% compared to the beginning of the year, in which the fund size was withdrawn by more than 1,600 billion VND and NAV recorded a growth of 16.5% compared to the beginning of the year. Forecasts on stock buying/selling transactions can mention some stocks as follows:

|

| The VN30 Index portfolio is expected to have no changes in composition. Source: Rong Viet Securities Company. |

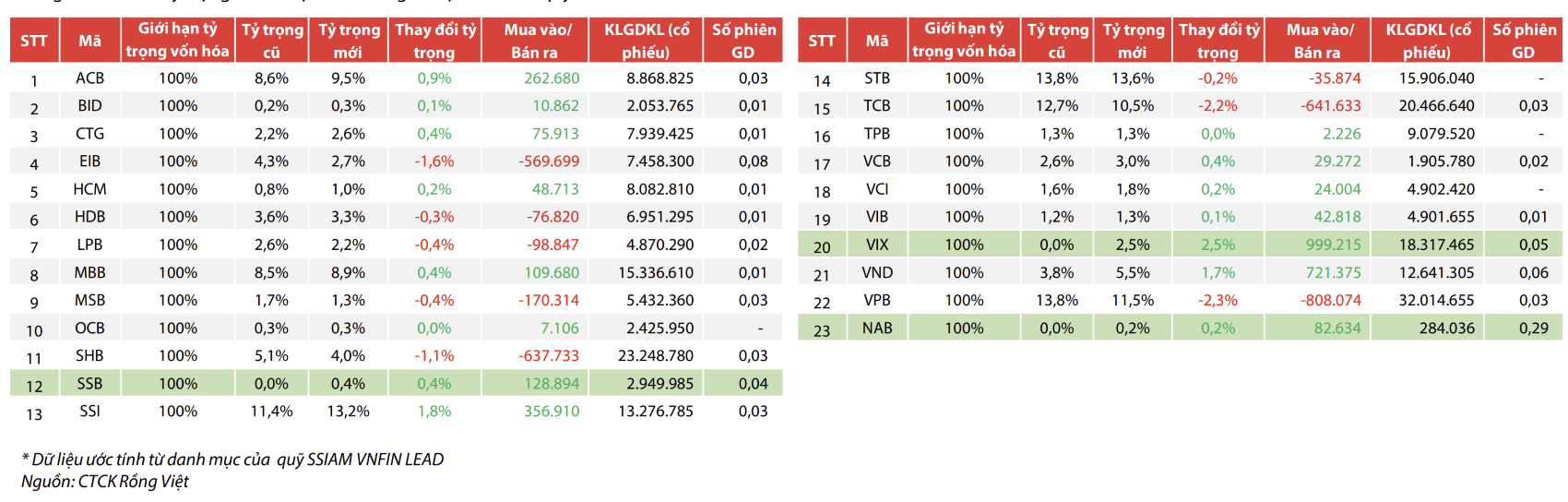

Similar to the VN30 basket, in this restructuring period, the VNFIN LEAD index portfolio will have its component indices recalculated. The calculation results up to June 28, 2024, it is estimated that the VNFIN LEAD index portfolio will have 3 new stocks, namely SSB, VIX and NAB, and there will be no exclusion of any stocks in the current portfolio.

Currently, there is one ETF on the market that is using the VNFIN LEAD index as a reference, SSIAM VNFIN LEAD, with a total asset value of about 673.4 billion VND. Compared to the beginning of this year, the SSIAM VNFIN LEAD fund has suffered a significant net withdrawal with a value of up to more than 1,900 billion VND, causing the total asset value of the fund to decrease sharply by 71%, although NAV increased by 13.4% compared to the beginning of the year.

Accordingly, some notable stock trading adjustments include: Buy: VIX (+1 million shares), ... and Sell: VPB (-808 thousand shares), ...

The new index composition will take effect from August 5, 2024 and investment funds will restructure with a deadline of August 2, 2024. Rong Viet estimates the index portfolio weights and transactions of funds as follows:

|

| VNFINLEAD index is forecast to have changes in component index. Source: Rong Viet Securities Company |

Sharing about investment opportunities in stocks in the mid & small cap group, Mr. Nguyen Dai Hiep, Head of Investment Consulting Department of Individual Clients of Rong Viet Securities Company, recommended "waiting to buy" for 3 stocks SZC, BAF, VLB.

In terms of technical signals, SZC has been supported and recovered recently after falling deep into the short-term oversold zone. SZC will retest the resistance zone 41-42, the convergence zone of MA(20), MA(50), MA(100). This zone is expected to cause strong disputes and fluctuations in the near future. However, it is still possible to expect SZC to overcome this resistance zone to head towards the resistance zone 45-47 thanks to recent support momentum.

The focus of attention for SZC shares is that in the first quarter of 2024, revenue and profit grew strongly compared to the same period, increasing 2.49 times and 4.55 times respectively. This growth came from core business activities such as increased industrial park rental area and increased rental prices.

Recently, on May 13, 2024, SZC signed an MOU with Electronic Tripod Vietnam Co., Ltd. on an area of 18 hectares, bringing the total signed area with other small investors to 45 hectares (an increase of 12% compared to the previous year) - higher than the company's leasing plan of 40 hectares.

According to Mr. Hiep, SZC's 2024 business results are expected to continue to be positive based on: (1) The remaining area available for lease is more than 400 hectares; (2) The prospect of higher rental price increases compared to other industrial parks in Ba Ria - Vung Tau - Chau Duc Industrial Park currently has a rental price 20-35% lower than other industrial parks and infrastructure connectivity is significantly improved from the Bien Hoa - Vung Tau expressway (3) The situation of attracting FDI continues to be positive in Ba Ria - Vung Tau when in the first 5 months of 2024, registered FDI led the country with 1.52 billion USD (12 times higher than the same period).

In addition, SZC is also included in the divestment plan of Sonadezi Corporation (SZN), the ownership ratio reduced from 46.84% to 36% is also a positive driving force for stock prices in the short term.

For VLB , Rong Viet recommends taking profits on VLB shares when the stock price reaches its highest level of VND 42,100/share on June 20, 2024, exceeding the profit-taking price zone. The profit rate achieved according to the recommended price zone is 15.4%.

At the same time, Rong Viet continues to recommend a new buy for VLB shares based on the business outlook for Q2/2024 continuing to improve well with a recommended purchase price of VND 34,000/share.

In the second quarter of 2024, it is expected that consumption output will improve by 10-15% compared to the first quarter of 2024 thanks to good disbursement of infrastructure projects in the Southeast region, especially Long Thanh Airport. At the same time, the number of real estate projects continuing to be implemented has improved compared to the first quarter of 2024. Based on the assumption that selling prices do not improve or may decrease slightly, business results in the second quarter of 2024 can still maintain growth compared to the low base of the same period and growth compared to the entire first quarter of 2024.

With BAF shares , the epidemic (African swine fever and foot-and-mouth disease) broke out strongly in both the South and the North from mid-June 2024, which caused the number of pigs to sell out of the epidemic to increase, while consumption demand was low due to hot weather and students being off school. Therefore, the price of live pigs nationwide has been adjusted down by 8% - 10% from around 70,000 - 71,000 VND/kg to 63,000 - 66,000 VND during this time. The price of livestock stocks in general and BAF shares in particular have been under pressure to adjust when the price of live pigs decreased and the market's downward trend in mid-June.

The disease is still spreading strongly in both regions, especially in the South. According to a survey at the Tan Xuan wholesale market in the South by Agromonitor, in the first days of August, the number of pigs traded at this market fluctuated from 5,200 - 5,500/day, of which 1,000 - 2,000 small pigs/pigs that accidentally ran the disease (a record level) were brought to the market for consumption.

Thus, Rong Viet believes that in the short term, the price of live pigs nationwide will still be affected by the decline due to the strong increase in epidemic sales in the short term. However, in the long term, it is expected that the price of live pigs will soon increase again to around 70,000 VND/kg when the epidemic sales decrease.

Mr. Hiep said that in June, BAF’s position reached the stop-loss threshold when the stock price adjusted down. However, Rong Viet continued to recommend a new position for BAF as it believes that the company’s business prospects for the second half of the year are still very positive.

In addition, Rong Viet also recommends continuing to hold 5 stocks THG, DHC, CTD, IJC, and CNG.

Source: https://baodautu.vn/3-stocks-duoc-chuyen-gia-rong-viet-khuyen-nghi-cho-mua-trong-thang-7-d219872.html

![[Photo] Ministry of Defense sees off relief forces to the airport to Myanmar for mission](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/30/245629fab9d644fd909ecd67f1749123)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to remove difficulties for projects](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/30/7d354a396d4e4699adc2ccc0d44fbd4f)

![[REVIEW OCOP] An Lanh Huong Vet Yen Cat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/c25032328e9a47be9991d5be7c0cad8c)

Comment (0)