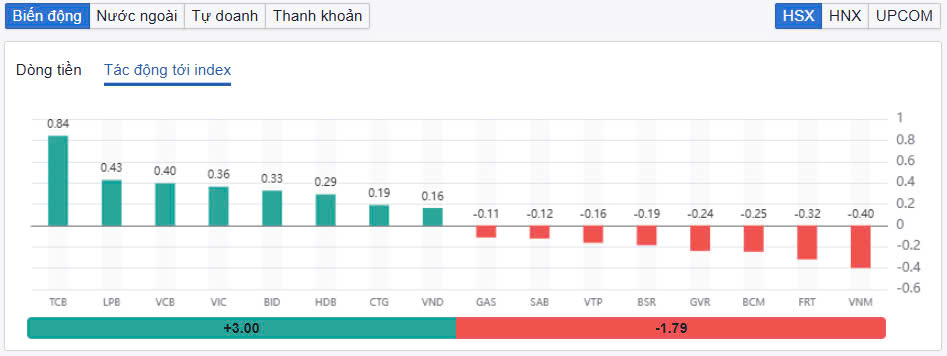

Divergence was stronger in many stock sectors. In particular, the banking sector became the main support. Techcombank was the bright spot in the session with market capitalization increasing by more than VND3,500 billion.

Divergence was stronger in many stock sectors. In particular, the banking sector became the main support. Techcombank was the bright spot in the session with market capitalization increasing by more than VND3,500 billion.

|

| Techcombank shares increased sharply in the session of February 6 |

The upward momentum of Vietnamese stocks continued to extend. The VN-Index ended the previous session at 1,269.61 points, up 0.39%, despite a 9% decrease in trading volume and at an average level. Entering the trading session on February 6, the upward momentum of the indices continued. However, the general market gradually recorded differentiation between stock groups. Although there were times when the index increased thanks to the bustling cash flow, the increasing selling pressure when approaching the peak of December last year restrained the upward momentum. The number of stocks decreasing in price tended to gradually dominate over time and brought the VN-Index closer to the reference point at the end of the morning session. The group of large-cap stocks, especially banks, played a role in keeping the rhythm, helping the VN-Index maintain green, although there was no strong breakthrough. Meanwhile, the group of mid- and small-cap stocks continued to record clear differentiation, with some codes attracting strong cash flow and increasing in price well, but most were under pressure to correct.

Trading in the afternoon session was more volatile and at times the VN-Index was pulled below the reference level. However, the support force in today's session was still quite good and this helped the index quickly bounce back. Although the support force was good, the cash flow was still relatively cautious and this only helped the VN-Index fluctuate narrowly above the reference level. The cash flow was not enough to help maintain the rhythm of the market's stock groups, instead focusing heavily on stocks with low liquidity.

At the end of the trading session, VN-Index increased by 1.87 points (0.15%) to 1,271.48 points. HNX-Index increased by 1.15 points (0.5%) to 229.13 points. UPCoM-Index increased by 0.84 points (0.88%) to 96.74 points.

The entire market today had 404 stocks increasing while 297 stocks decreasing and 851 stocks remaining unchanged (no trading). The market still recorded 51 stocks hitting the ceiling while only 4 stocks hitting the floor.

Banking stocks contributed the most to maintaining green in today's session, although the excitement was not as good as at the beginning of the session. TCB increased sharply by 2% to VND25,200/share and matched orders of more than 37 million units. TCB was the largest contributor to the VN-Index with 0.84 points. LPB also increased sharply by 1.67% and contributed 0.43 points. Other banking stocks such as VCB, BID, HDB, CTG... also maintained green quite well.

|

| Photo caption |

On the contrary, the differentiation in the large-cap group was strong, in which stocks such as BCM, VNM, VRE, SAB... were all in red and put significant pressure on the VN-Index. Of which, VNM decreased by 1.3% and took away 0.4 points from the VN-Index. FRT continued to fall sharply by 5% to VND188,000/share and ranked second in terms of negative impact on the VN-Index when taking away 0.32 points.

After yesterday's breakout session, the real estate stock group has shaken up again, in which, CEO decreased by 2.2%, DXG decreased by 1.6%, NLG decreased by 1.3%, NHA decreased by more than 1%...

Cash flow in the market tends to focus on small and medium-cap stocks with low liquidity. In the seaport - shipping group, TCL was pulled up to the ceiling price, besides, SGP increased by more than 6%, CLL increased by 4.8%, PHP increased by 4.8%... While stocks with high market factors (good liquidity) such as HAH or VSC were all in red but the decrease was not too strong.

|

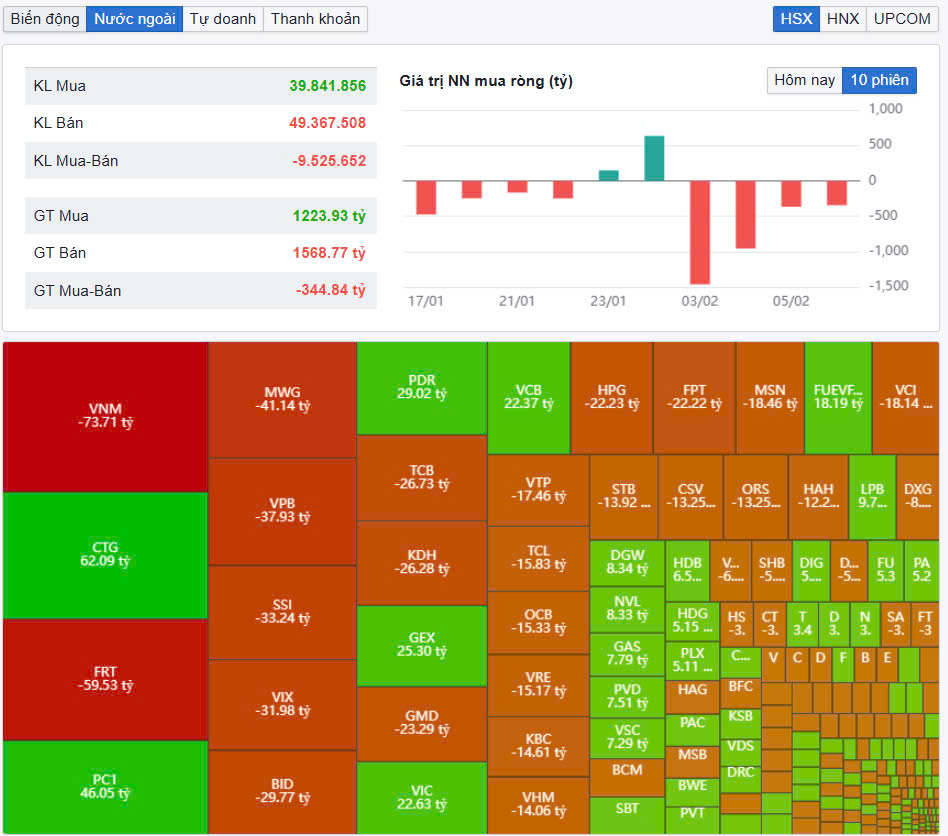

| Foreign investors continue to extend their net selling streak. |

Market liquidity did not fluctuate much compared to the previous session. The total transaction value on HoSE reached VND12,922 billion, down 3% compared to the previous session, of which negotiated transactions contributed VND978 billion. The transaction value on HNX and UPCoM reached VND730 billion and VND722 billion, respectively.

TCB ranked first in terms of total market transactions with a value of VND950 billion. FPT and HPG followed with values of VND501 billion and VND363 billion, respectively. Foreign investors continued to net sell with a value of VND350 billion on the whole market, in which foreign investors net sold the most VNM code with VND74 billion. FRT and MWG were net sold with VND60 billion and VND41 billion, respectively. Meanwhile, foreign investors net bought the most CTG code with VND62 billion. PC1 was also net bought with VND46 billion.

Source: https://baodautu.vn/vn-index-tiep-tuc-giu-sac-xanh-co-phieu-techcombank-tang-toi-2-d244610.html

![[Photo] Promoting friendship, solidarity and cooperation between the armies and people of the two countries](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/0c4d087864f14092aed77252590b6bae)

![[Photo] General Secretary To Lam receives French Ambassador to Vietnam Olivier Brochet](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/49224f0f12e84b66a73b17eb251f7278)

![[Photo] National Assembly Chairman Tran Thanh Man meets with outstanding workers in the oil and gas industry](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/1d0de4026b75434ab34279624db7ee4a)

![[Photo] Nhan Dan Newspaper announces the project "Love Vietnam so much"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/362f882012d3432783fc92fab1b3e980)

![[Photo] Closing of the 4th Summit of the Partnership for Green Growth and the Global Goals](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/c0a0df9852c84e58be0a8b939189c85a)

![[Photo] Welcoming ceremony for Chinese Defense Minister and delegation for friendship exchange](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/fadd533046594e5cacbb28de4c4d5655)

![[Video] Viettel officially puts into operation the largest submarine optical cable line in Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/f19008c6010c4a538cc422cb791ca0a1)

Comment (0)