VN-Index decreased slightly in the session on November 7, losing the 1,260 point mark due to selling pressure appearing in many pillar stocks such as banks, fertilizers and securities.

VN-Index decreased slightly in the session on November 7, losing the 1,260 point mark due to selling pressure appearing in many pillar stocks such as banks, fertilizers and securities.

After a strong increase thanks to cash flow into industrial real estate, many experts said that investors should consider taking profits because the market may soon face correction pressure when many stocks fluctuate at the peak.

The actual trading session on November 7 also proved this statement when the index increased at the beginning of the session but closed in red. Specifically, the VN-Index at one point increased by more than 6 points compared to the reference after the opening hour, exceeding 1,267 points. However, the selling pressure increased sharply in the last minutes, causing the index representing the Ho Chi Minh City Stock Exchange to reverse below the reference and lose nearly 2 points at the closing, down to 1,259.75 points.

Market breadth was skewed to the downside with 193 stocks closing in the red, while the number of stocks increasing was only 165. VN30 fell into a similar state when stocks decreased by up to 20 stocks, 4 times more than stocks increasing.

Most banking stocks closed the session in negative territory. BID was the code that weighed down the VN-Index the most, falling 0.94% to VND47,600. Next, CTG fell 0.84% to VND35,600, VPB fell 0.76% to VND19,700, EIB fell 1.29% to VND19,200, HDB fell 0.57% to VND26,250 and TPB fell 0.88% to VND16,800.

After yesterday's tumultuous session, industrial real estate stocks showed signs of cooling down as most of them turned down below the reference price. Specifically, VGC decreased by 1.1% to VND42,350, while KBC decreased by 0.2% to VND28,800.

Fertilizer group was under fierce selling pressure when DCM decreased 1.2% to VND36,750, DPM decreased 0.7% to VND33,700 and BFC decreased 0.5% to VND37,350.

Similarly, the securities group also put great pressure on the index when pillar stocks VDS decreased 1.2% to VND19,900, BSI decreased 1% to VND47,900, VCI decreased 0.9% to VND34,650 and AGR decreased 0.8% to VND18,200.

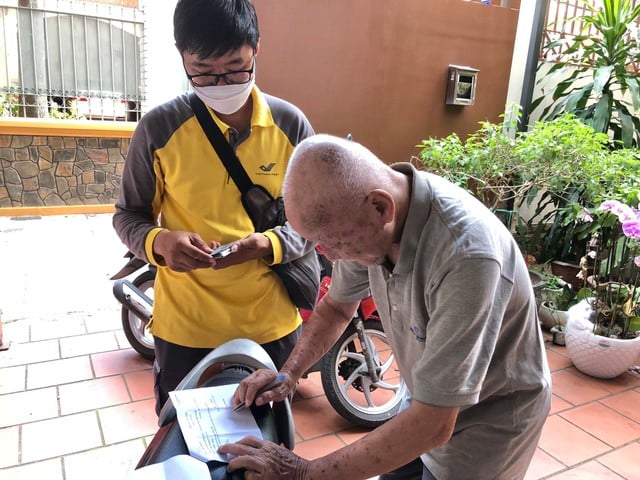

On the other hand, VCB reversed the trend when it increased by 0.32% to VND93,200 and became the market's pillar in today's session. Notably, VTP was the only code that increased to the ceiling in the list of stocks that had the most impact on the VN-Index, reaching the historical price of VND102,100 and closing the session with no sellers.

The real estate group contributed significantly to helping the VN-Index avoid a deep decline when most stocks closed in the green. Specifically, DXS increased to the full range of 6,220 VND and closed today's session in a blank state. Next, NVL increased 3.8% to 10,800 VND, HPX increased 2.9% to 5,050 VND and NBB increased 2.5% to 25,000 VND.

HoSE recorded more than 499 million shares successfully transferred, down 68 million units compared to yesterday's session. The transaction value accordingly reached VND12,481 billion, down VND1,705 billion compared to the previous session and extending the 25th session with a transaction value below VND20,000 billion. The large-cap basket contributed about VND5,339 billion to liquidity, equivalent to nearly 158 million shares successfully matched.

VHM leads in liquidity with a value of over VND664 billion (equivalent to 16 million shares). This figure far exceeds the following stocks, FPT with approximately VND485 billion (equivalent to 3.6 million shares) and HPG with over VND433 billion (equivalent to 16 million shares).

Foreign investors continued to be net sellers in today's session. Specifically, this group sold nearly 57 million shares, equivalent to a transaction value of VND1,884 billion , while only disbursing VND1,493 billion to buy about 49 million shares. The net selling value was therefore nearly VND391 billion.

Foreign investors dumped VHM shares with a net selling value of nearly VND104 billion, followed by MSN with nearly VND86 billion and CMG with more than VND67 billion. On the other hand, foreign investors bought MWG shares with a net value of VND48 billion. STB ranked next with a net absorption of about VND43 billion, followed by TCB with VND41 billion.

Source: https://baodautu.vn/vn-index-giam-nhe-sau-2-phien-tang-lien-tiep-d229468.html

![[Photo] "Beauties" participate in the parade rehearsal at Bien Hoa airport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/155502af3384431e918de0e2e585d13a)

![[Photo] Looking back at the impressive moments of the Vietnamese rescue team in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/5623ca902a934e19b604c718265249d0)

![[Photo] Summary of parade practice in preparation for the April 30th celebration](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/78cfee0f2cc045b387ff1a4362b5950f)

Comment (0)