VietinBank - Trusted Partner

As a prestigious state-owned bank with a long history, VietinBank has been and is a brand chosen by multinational enterprises from Europe, Singapore, Korea, China, Japan, etc. to cooperate and develop. Through many years of companionship, with diverse products and services, VietinBank has owned a customer portfolio of foreign enterprises with large brand value in the market.

For example, VietUnion - a company with investment capital from NTT DATA, Japan's leading telecommunications and IT group, has chosen VietinBank as a partner to provide comprehensive, secure payment solutions according to leading international standards in Vietnam. The payment solutions of VietinBank and VietUnion not only optimize the process for retail businesses and B2C businesses but also bring convenience to consumers. Mr. Ngo Trung Linh, General Director of VietUnion said: " VietinBank is one of the strategic partners with whom Payoo has built a deep and diverse cooperative relationship. As a payment intermediary, Payoo and VietinBank have deployed many outstanding services such as: Online payment gateway, Payoo POS payment device, QR payment, providing bill payment services..."

Customers make quick cashless payments via the Payoo platform - This is the result of cooperation between VietinBank and VietUnion

Customers make quick cashless payments via the Payoo platform - This is the result of cooperation between VietinBank and VietUnion

In the coming time, VietinBank will continue to expand its cooperation with Payoo with key projects such as: Providing comprehensive payment solutions (card payment, QR) for a chain of pharmaceutical and fast-moving consumer goods manufacturers and suppliers of Japanese investors; Connecting the three-party POS system at thousands of stores nationwide, helping customers easily pay at the Bach Hoa Xanh chain; Providing card payment solutions and QR codes exclusively for delivery services at Traphaco Pharmaceuticals.

By optimizing the payment process and bringing convenience to consumers, VietinBank and VietUnion have been contributing to the development of a modern payment ecosystem, creating sustainable values for the community and the economy.

Leading position with many typical marks

In the context of increasing FDI inflows into Vietnam, VietinBank, as a pillar bank of the economy and with a good understanding of the market, has pioneered the FDI wave, continuing to affirm its leading role in attracting foreign capital. A representative of VietinBank said that the bank had a successful 2024 with strong growth in capital, outstanding loans, CASA ratio and was ranked in the group of banks with the largest scale and market share of FDI customer transactions in Vietnam. Notably, VietinBank has proactively deployed its funding portfolio in the field of industrial infrastructure development with a credit scale of up to more than 2 billion USD for industrial and logistics real estate projects. This demonstrates VietinBank's pioneering step in attracting FDI, because the industrial real estate segment is forecast by experts to have strong growth and is an important driving force in attracting FDI capital in Vietnam in the coming time.

VietinBank received the award "Best Local Bank for FDI in Vietnam"

VietinBank received the award "Best Local Bank for FDI in Vietnam"

In 2024, VietinBank received two major awards: “Best Domestic Bank for FDI Enterprises in Vietnam” and “Infrastructure Project Finance Deal of the Year” at the Corporate and Investment Banking Awards of Asian Banking & Finance.

The prestigious awards demonstrate VietinBank's commitment to accompany and develop sustainably with FDI enterprises and are a testament to VietinBank's efforts to bring the most perfect experiences to customers. In 2025, VietinBank aims to expand its FDI customer portfolio and increase its scale by over 20%. To achieve this, in addition to promoting technology and digital transformation, VietinBank will also focus on other core activities such as: Focusing on customers; seeking opportunities in new fields and potential markets; and promoting strategic cooperation with major partners.

Source: https://daibieunhandan.vn/vietinbank-lua-chon-hang-dau-cua-doanh-nghiep-fdi-post405003.html

![[Photo] Official welcoming ceremony for the King and Queen of the Kingdom of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/9e1e23e54fad482aa7680fa5d11a1480)

![[Photo] Queen of the Kingdom of Belgium and the wife of President Luong Cuong visit Uncle Ho's Stilt House](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/9752eee556e54ac481c172c1130520cd)

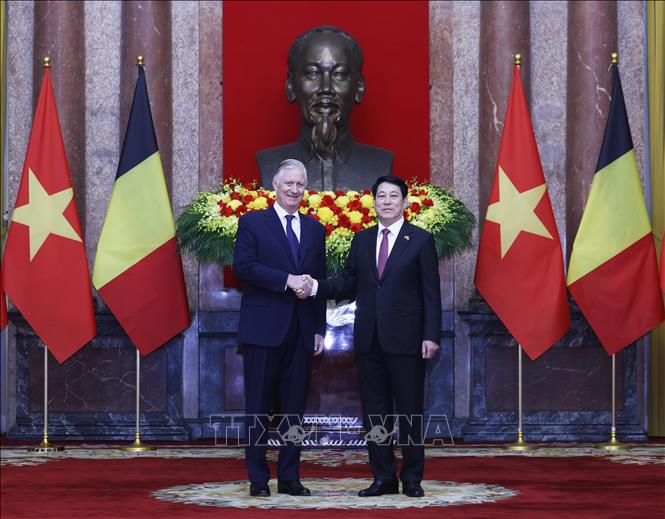

![[Photo] President Luong Cuong meets with King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/1ce6351a31734a1a833f595a89648faf)

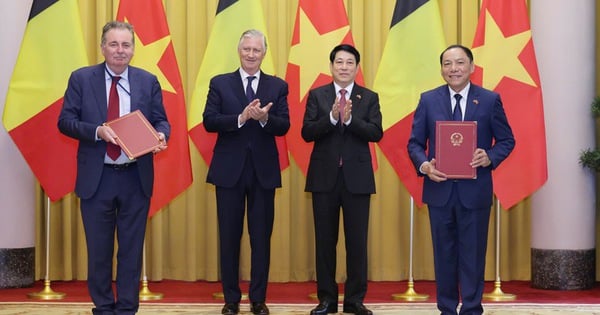

![[Photo] President Luong Cuong and the King of Belgium witness the Vietnam-Belgium document exchange ceremony](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/df43237b0d2d4f1997892fe485bd05a2)

![[Photo] National Assembly Chairman Tran Thanh Man meets with King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/c6fb3ef1d4504726a738406fb7e6273f)

Comment (0)