A series of violations in 14 loan applications

As reported by Lao Dong, in early 2022, VietABank had 3 credit transactions with HSTC Investment, Construction and Trading Joint Stock Company (HSTC Company).

Of which, 2 transactions were registered on January 26, 2022 and 1 transaction was registered on February 7, 2022 on the system of the National Registration Office for Secured Transactions (Ministry of Justice).

However, the collateral for these credit transactions is the La Phu Urban Functional Area Project in La Phu Commune, Hoai Duc District, Hanoi City. Confirming with Lao Dong Newspaper reporters, the leader of La Phu Commune People's Committee said that by the end of November 2023, this project still did not have enough legal conditions.

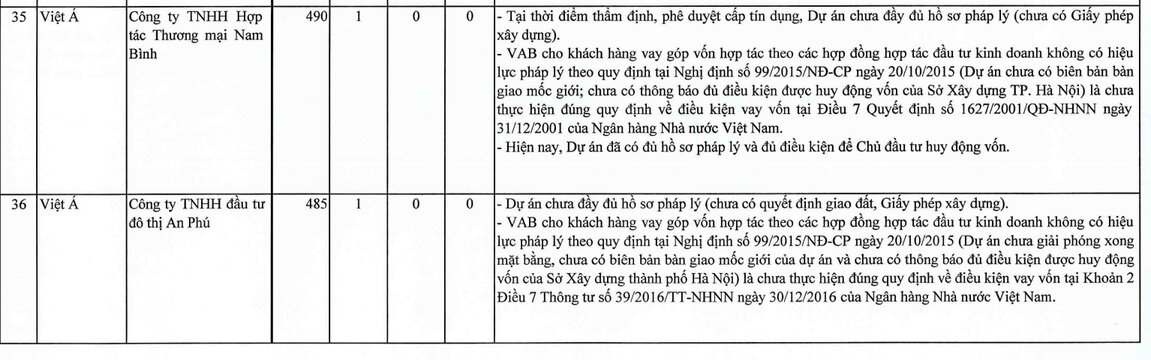

It is worth mentioning that previously, in mid-2023, the Government Inspectorate pointed out many violations when inspecting 14 credit granting files in the period 2013 - 2017 of Viet A Commercial Joint Stock Bank (VietABank).

The Government Inspectorate's inspection results showed that VietABank appraised and approved loans when the project did not have complete legal documents and the investor did not meet the conditions to implement the project (with the loan of HSTC Construction Investment and Trading Joint Stock Company).

Appraisal and determination of revenue and costs for implementing investment projects are not accurate (including 2 customers: Hung Thinh Vietnam Investment and Development Joint Stock Company, PHD Investment Joint Stock Company).

Incomplete collection of documents proving the purpose of loan use (for loans of HSTC Investment, Construction and Trading Joint Stock Company).

This bank was also found to have classified its debt incorrectly according to Resolution No. 42/2017/QH14 of the National Assembly on piloting the handling of bad debts of credit institutions, which stipulates bad debts and risk provisions (including 2 customers: Vicoland Construction and Housing Development Corporation, Binh Thuy Lam Dong Electricity Joint Stock Company); and its debt structure was not in accordance with the State Bank's regulations (Global Investment Joint Stock Company).

In addition, VietABank also lent capital to customers under investment cooperation contracts with project investors, essentially disbursing capital to investors to implement projects, while the projects did not have complete legal documents and did not meet the conditions for capital mobilization; the investment cooperation contracts were not legally valid according to Government regulations and violated the State Bank's regulations on loan conditions.

1,087 billion VND at risk of disappearing

VietABank was established on July 4, 2003 on the basis of merging two credit institutions, Saigon Finance Joint Stock Company and Da Nang Rural Commercial Joint Stock Bank. Updated to the end of June 2023, VietABank's charter capital reached VND 5,399 billion.

In the financial report for the third quarter of 2023, VietABank recorded net interest income of VND 1,020 billion in the first 9 months of 2023, down 4% over the same period. At the same time, the company reported a profit after tax of approximately VND 484 billion, down 26% over the first 9 months of 2022.

As of September 30, 2023, VietABank's total assets reached VND 104,023 billion, down slightly by 1% after 9 months. Of which, deposits at other credit institutions reached VND 11,834 billion, down 46%; deposits at other credit institutions decreased sharply by 77%, to VND 4,923 billion.

On the other hand, customer deposits at VietABank increased by 25% compared to the beginning of the year, to VND87,658 billion; customer loans reached VND66,736 billion, an increase of 7%.

What is worrying is that VietABank's loan quality is showing signs of deterioration, with total bad debt as of the end of September 2023 reaching nearly VND 1,130 billion, an increase of 18% after 9 months.

Notably, more than 96% of VietABank's bad debt is debt with the potential to lose capital (group 5 debt), accounting for VND1,087 billion. Compared to total outstanding debt, the ratio of bad debt to outstanding loans at the bank increased from 1.53% at the beginning of the year to 1.69%.

Violations in lending activities, rising bad debt ratio and the risk of losing thousands of billions of VND in capital at VietABank are raising many questions about the capacity, quality of appraisal and credit process at this bank.

Source

Comment (0)