Which bank currently offers the highest interest rates?

PVcomBank currently offers the highest savings interest rate on the market, up to 10%, applicable to deposits of 12-13 months and requiring a minimum deposit of 2,000 billion VND.

Ranked second is HDBank, offering an interest rate of 8.4%/year for a 13-month term, provided a minimum balance of VND 300 billion is maintained, and 8%/year for a 12-month term.

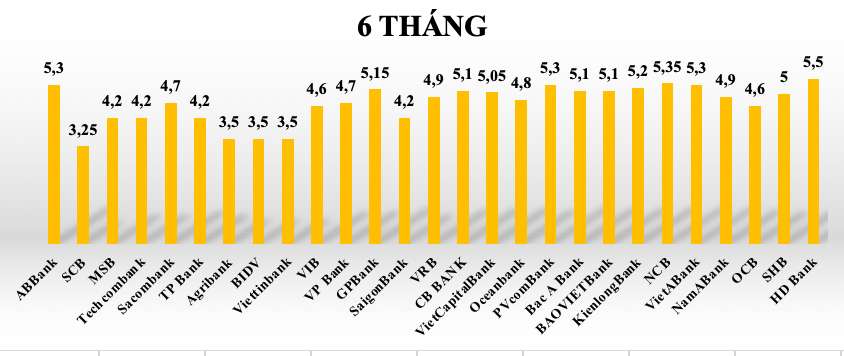

For a 6-month term, savings interest rates at banks in the system range from 3.25% to 5.5% per year.

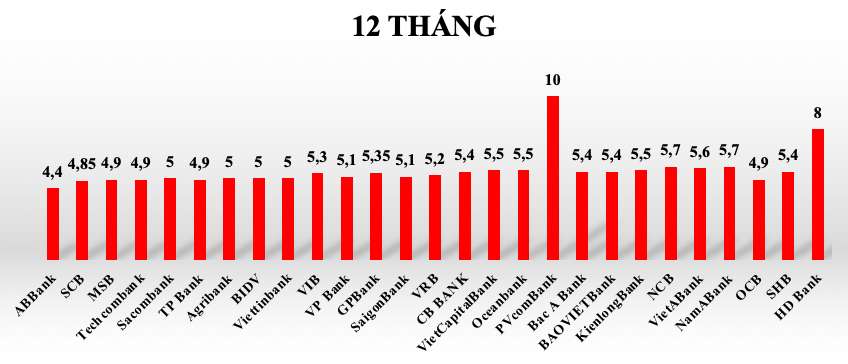

For a 12-month term, savings interest rates at banks within the system range from 4.4% to 10% per year.

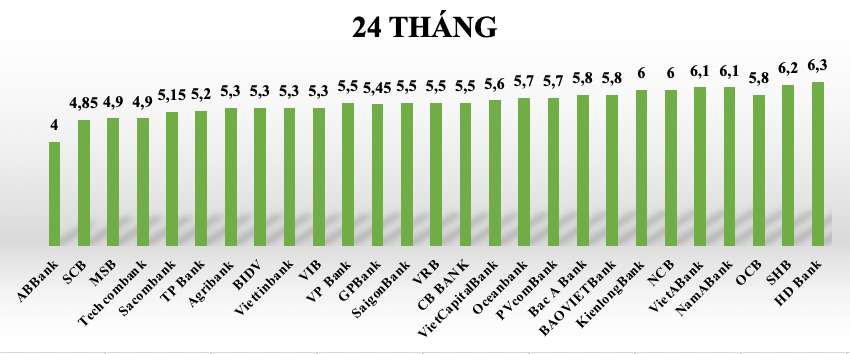

For a 24-month term, savings interest rates at banks in the system range from 4% to 6.3% per year.

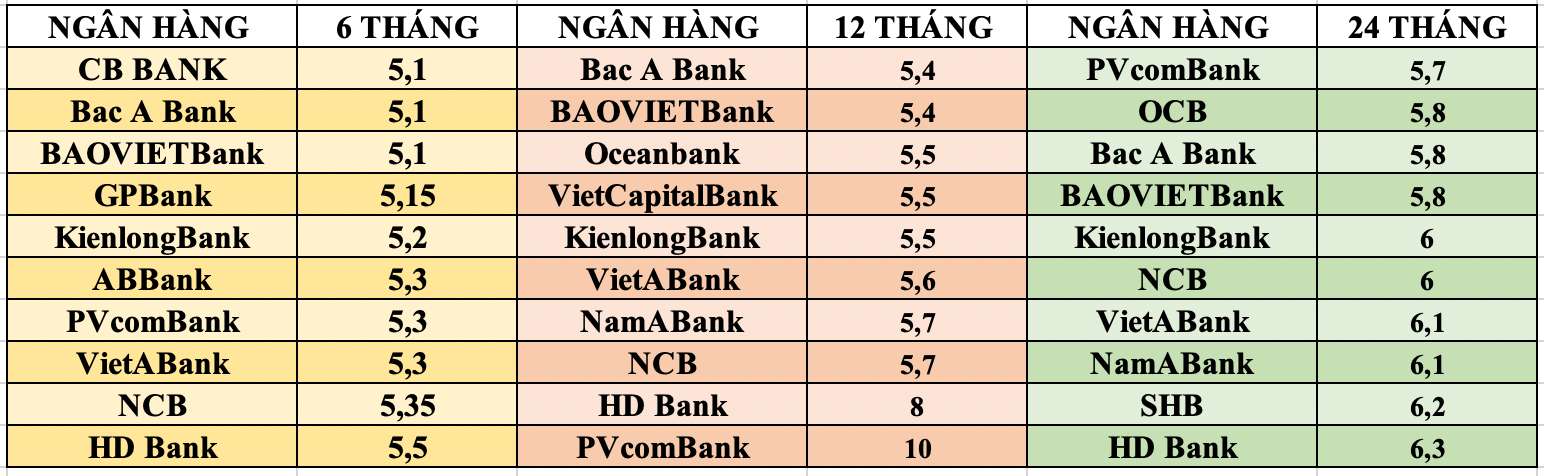

Here is a list of banks currently offering the highest savings interest rates:

Compare the highest bank interest rates for a 6-month term.

Compare the highest bank interest rates for a 12-month term.

Compare the highest bank interest rates for a 24-month term.

It can be seen that, although deposit interest rates have continuously fallen to record lows, this has not caused a strong shift of money out of the banking system to flow into other investment channels such as real estate and stocks.

According to data from the State Bank of Vietnam, the amount of money deposited in banks by individuals and businesses at the end of 2023 reached its highest level ever at over 13.5 million billion VND, an increase of 14% compared to 2022.

Thus, in 2023, deposits from residents and economic organizations increased by 1.68 million billion VND, the highest increase in decades, with over 800,000 billion VND increasing in the fourth quarter of 2023 alone. Compared to 2022, the increase in deposits in 2023 was almost double.

In its 2024 strategic report, PetroVietnam Securities Corporation (PSI) noted that deposit interest rates at commercial banks have fallen even lower than during the pandemic.

The State Bank of Vietnam's management efforts and improvements in banking system liquidity have led to deposit interest rates at commercial banks falling even lower than during the "cheap money" period of the pandemic years. The 12-month deposit interest rate at state-owned commercial banks has dropped to just 5.3% per year.

Interest rate information is for reference only and may change from time to time. Please contact your nearest bank branch or hotline for specific advice.

Readers can find more articles about the highest bank interest rates HERE.

Source

![[Photo] Two flights successfully landed and took off at Long Thanh Airport.](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F15%2F1765808718882_ndo_br_img-8897-resize-5807-jpg.webp&w=3840&q=75)

Comment (0)