Gold is facing challenging headwinds, raising concerns that the decline could continue.

The gold market ended the first half of this year significantly lower than at the end of last year and weak investor sentiment suggests further price declines are likely ahead as the precious metal faces challenging headwinds.

Christopher Vecchio, head of futures and forex at Tastytrade.com , said it was no surprise that investors were moving away from gold amid a solid economic backdrop that continues to support risk assets.

There are a lot of concerns in the market, but so far none of those fears have materialized. So investors feel more comfortable taking on more risk, he said.

While gold appears to be holding support around $1,900 an ounce, any rebound is likely to be more of a profit-taking opportunity than a sustained rally, the expert said. “Gold is facing a difficult environment with rising real yields and will remain so for a long time,” Vecchio said.

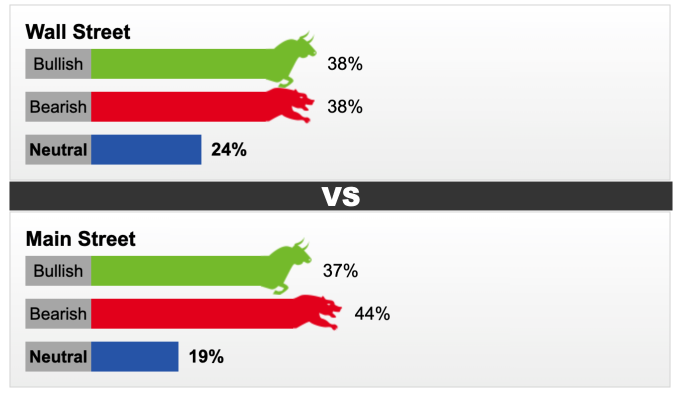

This week, 21 Wall Street analysts participated in Kitco’s survey, with only 38% of respondents predicting that the market will rise. Five analysts (24%) forecast flat prices, while the rest forecast lower.

While Wall Street analysts are evenly split between bullish and bearish, retail investors remain bearish. Of the 845 respondents to the online poll, only 37% expect gold to rise next week, 44% see the precious metal falling and 19% see the market moving sideways.

Kitco's gold price forecast for the week of July 3-7. Photo: Kitco News

Marc Chandler, managing director at Bannockburn Global Forex, said he is bullish on gold due to recent short-term moves in the currency market. “I look for a stronger dollar and higher US interest rates. However, gold’s momentum indicators appear to be bottoming out and technical indicators suggest a possible rebound in the near term,” he said.

However, Chandler said he prefers to hold a short position and could do so if gold recovers to around $1,920-$1,930.

Adrian Day, chairman of Adrian Day Asset Management, is cautious on the upside, explaining that while gold prices could see a modest rise next week, the precious metal remains caught in a tug-of-war between multiple market factors.

“There are still risks in the short term as the gold market does not appear to have fully priced in future interest rate hikes in the US and elsewhere, while the large financing needs of the US government will drain liquidity and hurt gold,” he said.

Gary Wagner, editor of TheGoldForecast.com , also said that improving economic conditions will continue to put pressure on gold prices. "A strong economy, low unemployment and rising yields will confirm to the Fed that the US economy can absorb further rate hikes," the expert said. "This will put pressure on gold prices," he added.

On the flip side, however, a factor supporting gold prices is rising geopolitical uncertainty. Most analysts bullish on gold have noted that increased uncertainty and risk will support gold as a safe-haven asset.

Minh Son ( according to Kitco )

Source link

![[Photo] National Assembly Chairman Tran Thanh Man attends the summary of the organization of the Conference of the Executive Committee of the Francophone Parliamentary Union](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/fe022fef73d0431ab6cfc1570af598ac)

![[Photo] General Secretary To Lam receives Ethiopian Prime Minister Abiy Ahmed Ali](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/086fa862ad6d4c8ca337d57208555715)

![[Photo] Welcoming ceremony for Prime Minister of the Federal Democratic Republic of Ethiopia Abiy Ahmed Ali and his wife](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/77c08dcbe52c42e2ac01c322fe86e78b)

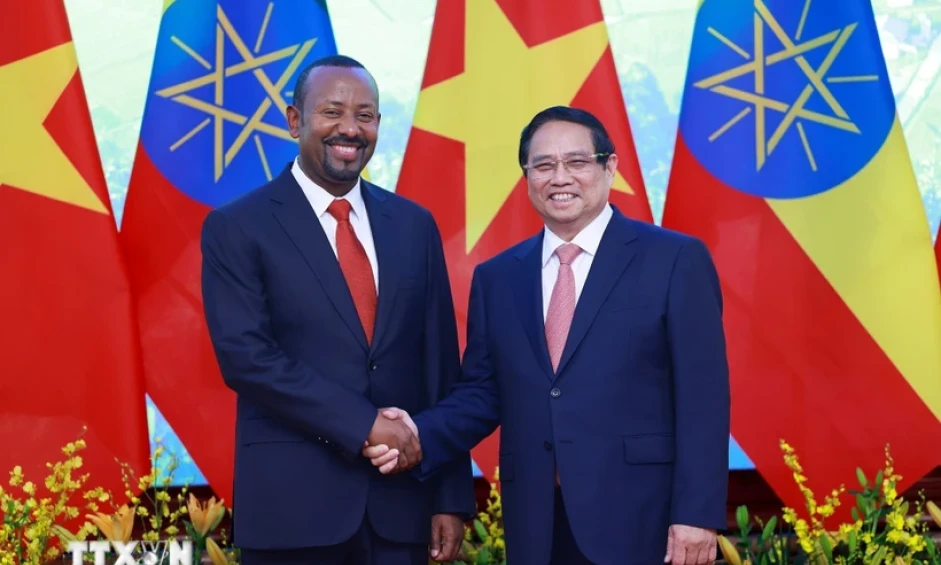

![[Photo] Prime Minister Pham Minh Chinh holds talks with Ethiopian Prime Minister Abiy Ahmed Ali](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/4f7ba52301694c32aac39eab11cf70a4)

![[Photo] The two Prime Ministers witnessed the signing ceremony of cooperation documents between Vietnam and Ethiopia.](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/16e350289aec4a6ea74b93ee396ada21)

![[Photo] General Secretary To Lam meets with veteran revolutionary cadres, meritorious people, and exemplary policy families](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/7363ba75eb3c4a9e8241b65163176f63)

Comment (0)