Gold futures for August rose to a session high of $2,487.40 an ounce overnight. Chris Weston, head of research at Pepperstone, said in a note late Tuesday that gold’s fundamentals have clearly changed.

According to this expert, $2,500/ounce is the next test threshold for the precious metal in the future, followed by a potential target of $2,600/ounce.

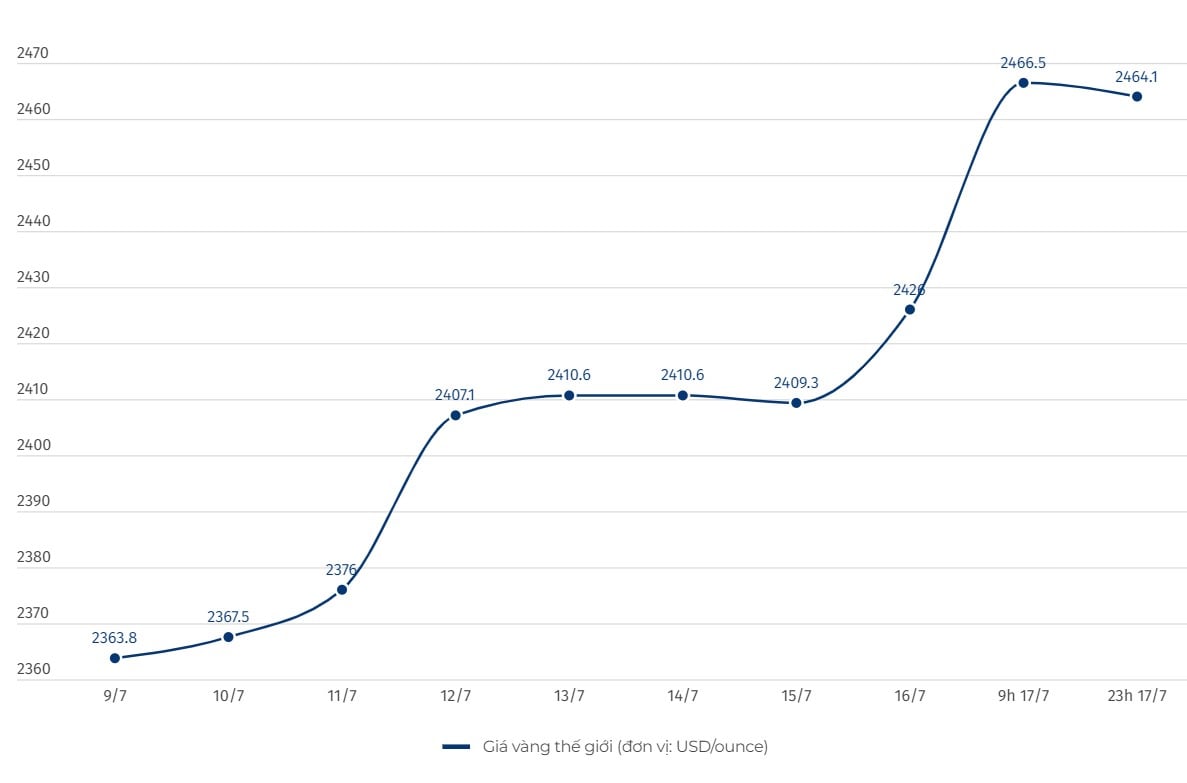

Gold prices received a positive signal to rise last week as the market began to increase expectations of a US Federal Reserve (FED) interest rate cut in September. According to the CME FedWatch Tool, the market sees a 98% chance of easing at the September meeting.

“The market has a strong belief that the Fed is about to start its easing cycle from September. As expectations of a Fed rate cut increase, gold has maintained a tight relationship,” Weston said in his note.

“Traders have seen that in three of the last four Fed easing cycles, gold rallied sharply about six months later. This is enough for some to be bullish on a potential gold rally,” he said.

Along with expectations of lower interest rates, Weston said gold is also gaining renewed attention as a safe haven after the Republican Party formally nominated former US President Donald Trump as its 2024 presidential candidate following a roll call vote at the party's national convention.

According to senior market analyst Jim Wyckoff of Kitco Metals, the market's growing expectations that the US Federal Reserve (FED) will cut interest rates this fall are pushing gold prices up.

Joe Cavatoni of the World Gold Council (WGC) commented that monetary policy factors, especially interest rate cuts from central banks like the FED, are the main factors affecting gold prices in the long term.

Cavatoni predicts that when the Fed starts cutting interest rates, this will be the main driver to attract Western investors back to the gold market.

In overnight news, the eurozone consumer price index rose 0.2% month-on-month in June and 2.5% year-on-year. The figures were in line with market expectations and showed that inflation in the eurozone has eased.

Important foreign markets today saw the US dollar index fall sharply. Recorded at 1:30 a.m. on July 18 (Vietnam time), the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 103.447 points (down 0.49%).

Nymex crude oil prices edged up and traded around $81.00 a barrel. The benchmark 10-year U.S. Treasury yield is currently at 4.175%.

Source: https://laodong.vn/tien-te-dau-tu/gia-vang-the-gioi-tang-phi-ma-huong-toi-muc-cao-nhat-moi-thoi-dai-1367982.ldo

![[Photo] Prime Minister Pham Minh Chinh chairs the regular Government meeting in April 2025](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/6/48eb0c5318914cc49ff858e81c924e65)

![[Photo] Prime Minister Pham Minh Chinh receives Mr. Tomas Heidar, Chief Justice of the International Tribunal for the Law of the Sea (ITLOS)](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/6/58ba7a6773444e17bd987187397e4a1b)

![[Photo] Sparkling lanterns to celebrate Vesak 2025](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/7/a6c8ff3bef964a2f90c6fab80ae197c3)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to review preparations for trade negotiations with the United States](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/6/1edc3a9bab5e48db95318758f019b99b)

Comment (0)