USD exchange rate today, March 29, 2025: Early morning of March 29, the State Bank announced the central exchange rate of the Vietnamese Dong to the USD decreased by 3 VND, currently at 24,843 VND.

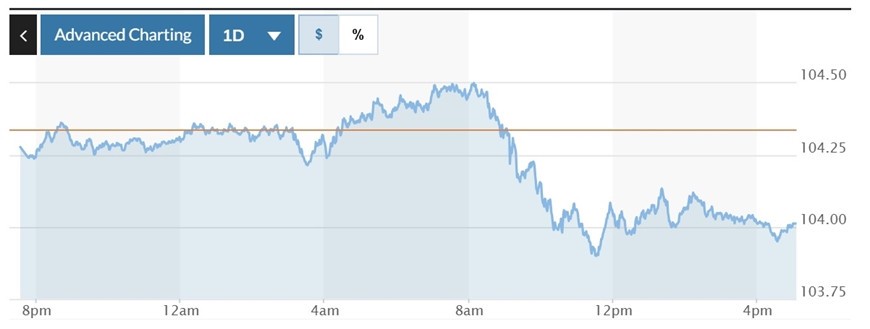

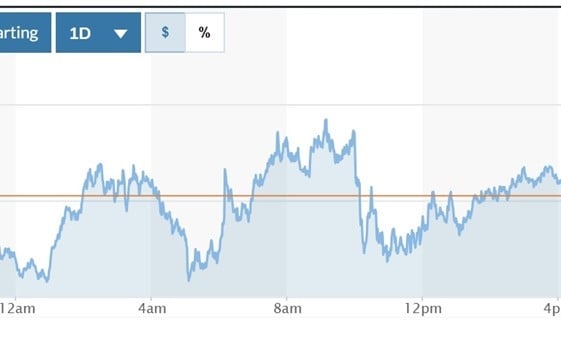

Meanwhile, in the US market, the US Dollar Index (DXY) measuring the greenback's fluctuations against six major currencies (EUR, JPY, GBP, CAD, SEK, CHF) decreased by 0.32% to 104.01.

The dollar weakened on Friday on concerns about US economic growth ahead of next week’s expected announcement by US President Donald Trump on “reciprocal” tariffs on other countries, while the Japanese yen benefited from safe-haven flows as stocks tumbled and Treasury yields fell.

Traders have been optimistic about the impact of trade tariffs at times, but remain concerned that they will dampen economic growth and spark a resurgence of inflation.

On March 28, President Donald Trump announced a 25% tariff on imported cars and light trucks starting April 3.

“We do not expect the dollar to strengthen in this case, as the market remains concerned about the prospect of a slowdown in the US economy. The implementation of new tariffs also takes time, which will allow for future negotiations,” said foreign exchange analysts Athanasios Vamvakidis and Claudio Piron at Bank of America.

The US currency also fell in the last trading session, after data showed core inflation rose 0.4% in February, higher than expected.

Headline inflation rose 0.3%, as expected. US consumer spending also rebounded in the month. Separately, a survey from the University of Michigan showed that consumers' 12-month inflation expectations jumped to their highest level in more than two years in March.

The greenback fell 0.69% against the Japanese yen to 150.01 yen per dollar and was on track for its biggest one-day drop against the Japanese currency since March 3.

Data released on March 28 showed that core consumer inflation in Japan remained above the central bank's target and accelerated in March.

On the other hand, the euro rose 0.2% in the last trading session to $1.0823. The common currency is supported by technical factors after approaching the 200-day moving average of $1.0727.

Earlier data from Europe showed inflation in March came in much lower than forecast in France and Spain, while consumer expectations for price growth remained low, bolstering hopes for another interest rate cut by the European Central Bank.

French consumer spending also fell, while unemployment in Germany rose more than expected and business and consumer morale in Italy fell sharply in March.

Meanwhile, the pound fell 0.09% against the dollar to $1.2935.

USD exchange rate today domestic

In the domestic market, at the beginning of the trading session on March 29, the State Bank announced the central exchange rate of the Vietnamese Dong against the USD decreased by 3 VND, currently at 24,843 VND.

* The reference exchange rate at the State Bank's transaction office has slightly decreased, currently at: 23,651 VND - 26,035 VND.

USD exchange rate at commercial banks buy and sell as follows:

USD exchange rate | Buy | Sell |

Vietcombank | 25,370 VND | 25,760 VND |

Vietinbank | 25,245 VND | 25,825 VND |

BIDV | 25,405 VND | 25,755 VND |

* The EUR exchange rate at the State Bank's buying and selling exchange center increased slightly, currently at: 25,478 VND - 28,160 VND.

EUR exchange rates at commercial banks are as follows:

EUR exchange rate | Buy | Sell |

Vietcombank | 26,888 VND | 28,362 VND |

Vietinbank | 26,866 VND | 28,366 VND |

BIDV | 27,142 VND | 28,338 VND |

* The Japanese Yen exchange rate at the State Bank's exchange office for buying and selling has slightly decreased, currently at: 156 VND - 173 VND.

Japanese Yen Exchange Rate | Buy | Sell |

Vietcombank | 163.30 VND | 173.68 VND |

Vietinbank | 166.06 VND | 175.76 VND |

BIDV | 166.42 VND | 174.09 VND |

Source: https://baolangson.vn/ty-gia-usd-hom-nay-29-3-dong-usd-giam-tiem-can-moc-103-5042472.html

![[Photo] Third meeting of the Organizing Subcommittee serving the 14th National Party Congress](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/3f342a185e714df58aad8c0fc08e4af2)

![[Photo] Relatives of victims of the earthquake in Myanmar were moved and grateful to the rescue team of the Vietnamese Ministry of National Defense.](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/aa6a37e9b59543dfb0ddc7f44162a7a7)

Comment (0)