Trade restrictions imposed by Washington on Beijing have skyrocketed demand for less advanced chip foundry equipment.

Japanese trade data shows China accounts for half of Japan's shipments of semiconductor manufacturing equipment, components for these machines, as well as flat-panel display manufacturing equipment.

The value of these exports to China increased 82% year-on-year in the third quarter of 2024 to 521.2 billion yen ($3.32 billion), the highest figure according to data going back to 2007.

Last July, Japan's trade ministry began requiring a licensing process for exports of advanced semiconductor manufacturing equipment, such as 14-nanometer (nm) logic chips and more advanced microprocessors.

Exports to China have increased, partly due to a scramble to buy chip foundry equipment amid increased US curbs on mainland technology.

China imported $5.2 billion worth of chipmaking equipment in September last year, up about 50% from a year earlier, according to Chinese customs data, with purchases from Japan and the Netherlands both increasing. The mainland’s imports of these items continued to rise in the first four months of 2024, hovering around $4 billion.

“Chinese manufacturers without access to advanced semiconductor manufacturing equipment are turning to other, less specialized tools,” said Kazuma Kishikawa of the Daiwa Research Institute.

The change is believed to have fueled a surge in exports of chip manufacturing equipment that are not on the restricted list.

The semiconductor industry typically has a boom-bust cycle that lasts three to four years. The global market entered a recession in the second half of 2022 amid the post-pandemic turmoil, but there are signs it has bottomed out. Japan's global chipmaking equipment exports rose 13% from the previous quarter, ending five consecutive quarters of negative growth.

Source: https://vietnamnet.vn/trung-quoc-day-manh-nhap-khau-may-duc-chip-kem-tien-tien-2290760.html

![[Photo] Prime Minister Pham Minh Chinh meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/893f1141468a49e29fb42607a670b174)

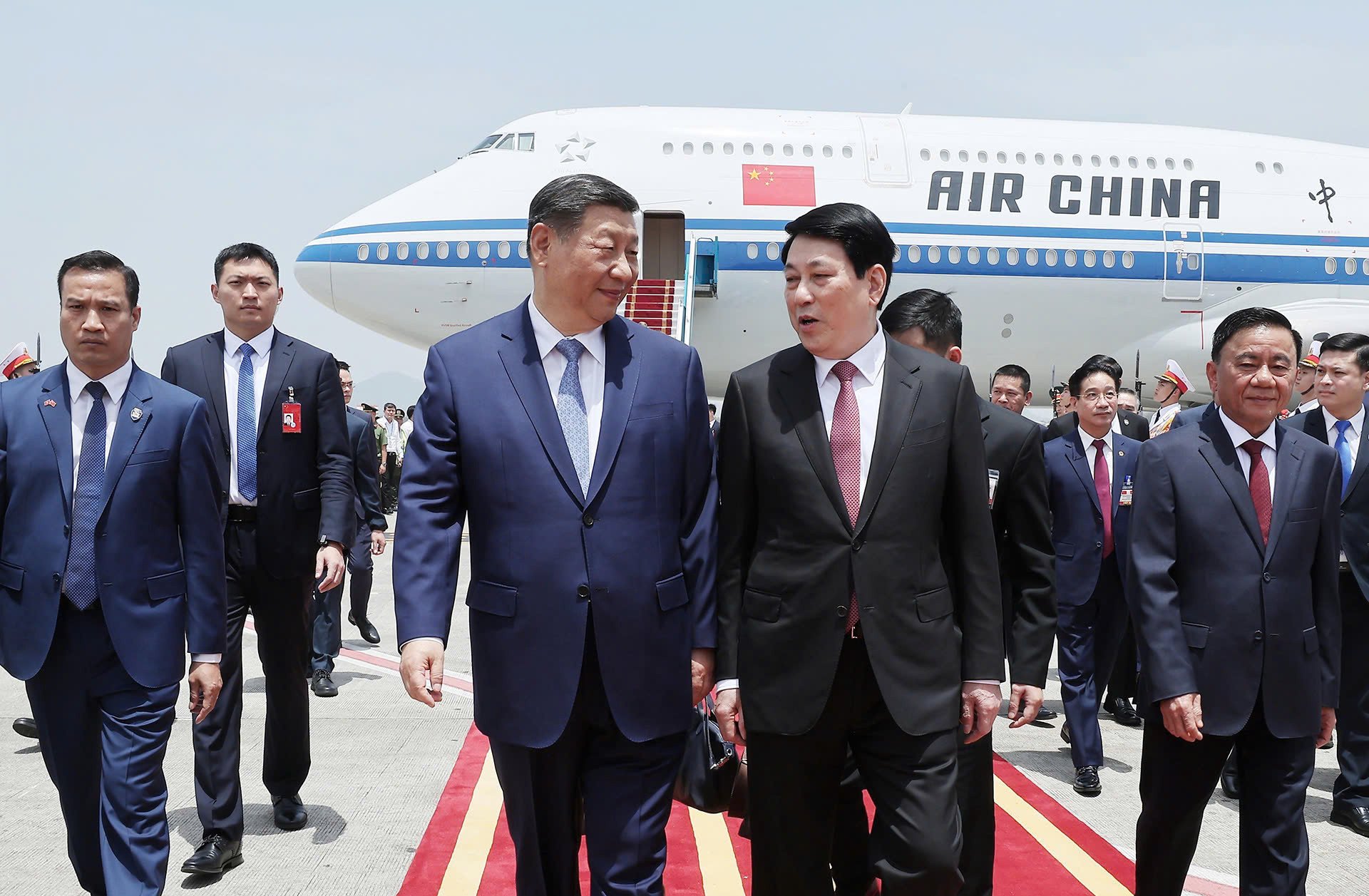

![[Photo] Reception to welcome General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/9afa04a20e6441ca971f6f6b0c904ec2)

![[Photo] General Secretary To Lam holds talks with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/b3d07714dc6b4831833b48e0385d75c1)

![[Photo] National Assembly Chairman Tran Thanh Man meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/4e8fab54da744230b54598eff0070485)

Comment (0)