| Businesses face many opportunities for digital exports in 2023 Many opportunities for Vietnam in attracting foreign capital and growth targets |

2023 is an extremely difficult and challenging year, but economic growth for the whole year still reached 5.05% and is among the highest in the region and the world... What is your assessment of these results?  |

| Associate Professor, Dr. Hoang Van Cuong, National Assembly delegate, member of the National Assembly's Finance and Budget Committee |

First of all, it must be said that 2023 is the year when the whole world has to face many "headwinds", so the global economy grows slowly and much lower than the expected target. The "headwind" that the world has to face is the wave of high inflation, causing many countries and large markets to implement policies to increase interest rates to fight inflation. When interest rates increase, it will reduce investment and increase capital costs. High inflation also causes the world's total demand in 2023 to decline sharply, so the purchasing index of manufacturers in most regions is very low, showing that the manufacturing sectors do not grow because there is no output market. Vietnam's economy is very open, so when the world economy encounters difficulties, it will greatly affect our economic growth. However, the results that Vietnam has achieved are the result of us going against that "headwind". As a country that depends heavily on imports and exports, when global inflation increases, especially in export markets that account for a large proportion, it will directly affect domestic inflation, which is called imported inflation. In that context, we must devote resources to fighting inflation, even sacrificing growth to control and fight inflation. We all know that implementing such measures will limit and discourage investment, and then growth will be impossible.

|

But in such a difficult context, we still achieved a growth rate of 5.05%. Compared to the target of 6.5%, although not yet achieved, this is a great effort. While most countries in the world have very low growth rates, such as the US at about 2.4%, Europe at more than 1%... the growth rate of 5.05% is the highest in the region and the world. But more importantly, the figure of 5.05% increased on the basis of the growth of 8% in 2022, it is much more difficult than countries with low growth rates in 2022. Besides, we have also succeeded in the true sense of the word in going against the "headwind" of the world's inflation trend. While most countries and regions with large economies such as the US and Europe have quite high inflation rates, and monetary policy agencies (MPOs) have had to continuously increase interest rates, Vietnam has gone against this trend, being one of the pioneers in reducing interest rates four times... helping the inflation rate in 2023 to be very low, increasing only 3.25% compared to the allowed target of 4.5%. Another success is that in the trend of public debt and corporate debt in the world increasing rapidly, in Vietnam, public debt has decreased very low. In 2023, the public debt index was below 40% of GDP, very low compared to the safe limit of 60%. It is worth noting that public debt has continuously decreased over the years, demonstrating great success in controlling national financial safety. In addition, in 2023, we will also actively and flexibly manage the exchange rate, so the value of the currency will be stable, creating confidence for investors, especially foreign investors, to confidently invest in Vietnam. This is also one of the reasons why, despite the world's difficulties in 2023, foreign investment flows into Vietnam will still increase, other indicators will grow well; macroeconomic indicators will continue to be stable. Vietnam's credit rating in 2023 will increase to a stable outlook while some countries will be downgraded. To achieve this success, we have effectively implemented fiscal and monetary policies to stabilize the macro economy. It is thanks to stable fiscal and flexible monetary policies that have created macroeconomic stability, which is a premise for creating momentum for other regions to grow.

In addition to the achievements, in your opinion, what shortcomings and limitations are creating "bottlenecks" that are holding back growth in the past year? What solutions do we need to remove in the coming year? It is true that we have achieved successes, but looking back at the economy, we still see many shortcomings and weaknesses that need to be focused on removing. The most typical and obvious weakness today is that the capacity and potential of enterprises have declined sharply. Enterprises no longer have resources or enough reserves to invest, and even though credit capital is now quite available and quite cheap, enterprises still do not have the ability to absorb it to invest in business activities because there is no direction for business development, no market... This requires us in 2024 to design policies to continue supporting enterprises. Because the economy wants to grow and develop, it must rely on whether enterprises can recover and break through or not. Another weakness is that the Vietnamese economy depends heavily on FDI investment, most domestic enterprises only stop at participating in stages and stages with low added value, making the productivity of Vietnamese enterprises not high... We need to restructure business sectors, restructure the attraction of foreign investment. FDI attraction must be based on science and technology, innovation. Our opportunities for 2024 are very open to set foot in high-tech industries such as semiconductors and artificial intelligence... If we have the right strategy, approach and seize the opportunity of the new wave of investment for this industry, it is expected to create opportunities for economic restructuring in depth. Another problem is that market demand is still very difficult. To stimulate demand, we need to go in two directions. One is to continue to increase public investment, promote investment in transport infrastructure to reduce connection costs, reduce logistics costs, and increase domestic and foreign investment attraction. But at the same time, it is necessary to expand to new public investment areas, especially public investment in technology infrastructure, digital transformation, science and technology infrastructure, etc. to create new momentum for innovation and the digital economy. Second, continue to implement policies to stimulate consumption through tax support programs, VAT reduction, promote conditions for business recovery, create jobs, implement new salary reform policies, increase income for the public sector, etc., thereby spreading to other areas. At the same time, it is necessary to implement social security policies to increase income for the subjects, create additional sources of revenue to increase consumer demand. Another weakness in 2023 is the situation of officials avoiding, pushing away work, and fearing responsibility. This is one of the bottlenecks not only in the public sector but also creating negative impacts and influences, hindering the development of the private sector. Therefore, in 2024, we must promote institutional reform and remove bottlenecks to overcome this situation. I think this will be one of the focuses in institutional reform, but it is also a solution to create a breakthrough to encourage cadres to dare to think, dare to do, be proactive and creative... as concluded in Conclusion No. 14 of the Politburo, creating new momentum for development.

At the 6th session, the National Assembly passed a resolution with a GDP growth target of 6 to 6.5% in 2024, while controlling inflation at around 4-4.5%. Do you think we can achieve this target? International organizations all predict that in 2024, the world economy will continue to face difficulties and growth will be lower than in 2023. Accordingly, the global economic growth rate is forecast to be only 2-3% in 2024. Other major economies are also forecast to decrease, such as the US in 2023 reaching 2.4%, 2024 forecasting only 1.5%; Japan in 2023 reaching 2%, 2024 forecasting only about 1%; China in 2023 reaching 5.2%, 2024 forecasting only 4%... China is the second largest economy in the world, and is also an economy that has a very strong direct impact on Vietnam's economic growth, so it is clear that the world economic context is not favorable, Vietnam's economy will face many challenges. Therefore, to achieve the target of 6 - 6.5%, we must make great efforts and can still achieve it because of a number of premises. Firstly, if 2023 is a year when the whole world faces difficulties such as inflation, political conflicts... it will have a very strong impact on our country. Domestically, we are also in a difficult period after fighting the Covid epidemic, which has had a strong impact on businesses in the early stages of 2023. The bond debt situation has put many businesses at risk of bankruptcy or the SCB Bank incident has greatly affected the economy... then in 2024, the unfavorable factors of the world and domestic context will decrease. World economic forecasts show that inflation in most major markets will decrease and interest rates will also decrease... This will help us no longer worry about imported inflation, so we can allocate more resources to prioritize investment and growth.

|

Second, domestically, although businesses are facing difficulties, threats such as corporate debt/bankruptcy or financial system instability have improved and are in a fairly good state. The investment growth environment for the economy in 2024 is forecast to be stable and better than in 2023. In fact, our country's economic growth rate in 2023 is currently on the rise, with 3.41% in the first quarter, 4.25% in the second quarter, 4.57% in the third quarter and 6.72% in the fourth quarter. Thus, the domestic and global context in 2024 is trending better than in 2023, creating expectations that growth in 2024 will continue on the basis of 2023 and we will achieve the set target. In addition, we also see new development opportunities for Vietnam such as high-tech investment flows, attracting large corporations in semiconductors, artificial intelligence and application of science and technology, innovation... If we seize this opportunity in 2024, we will not only create a change in position for the future, for expectations, but especially open up qualitative development for the economy in the coming time.

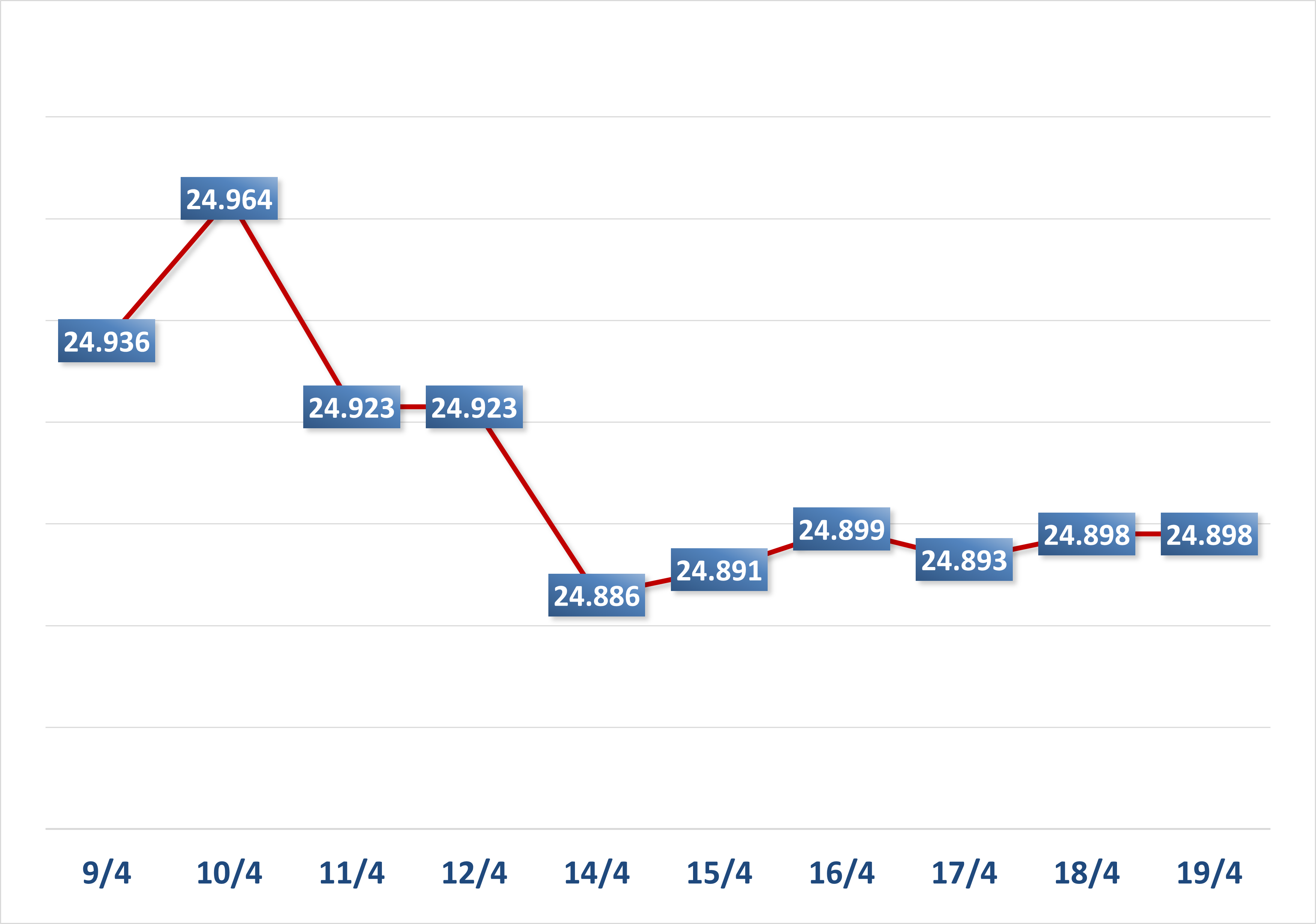

In such a context, what recommendations do you have for monetary policy management to achieve the growth target in 2024? In 2024, there will be many premises for us to be able to implement monetary policy more firmly than in 2023. Because the pressures on inflation and exchange rates in 2024 will be reduced, the current lending interest rate is also low. On the premise of low interest rates, we can also expect that in 2024, interest rates will continue to be maintained at a reasonable level, not too high to affect the goal of supporting businesses. Therefore, the monetary policy in 2024 needs to move towards an open, flexible but cautious monetary policy... In the context that businesses still do not have enough resources and potential to create stable growth, many businesses are currently in a state of old debt, even bad debt and no longer have collateral... banks in providing and financing credit need to switch to a new management and supervision method, which is to monitor cash flow according to programs and projects that need funding, not according to the historical factors of the business. Regarding exchange rates, 2024 will be more challenging than 2023 because when we expect an economic recovery, the trade balance between exports and imports will also change. Especially in the period of strong economic recovery, import demand is quite high and thus the trade deficit may not have a large positive balance. At that time, foreign exchange reserves may be a factor that needs to be considered so that we can operate monetary policy flexibly; exchange rates are flexible but stable, not to affect the psychology of investors, especially when we are promoting foreign investment attraction.

Thank you! Source link

![[Photo] Prime Minister Pham Minh Chinh receives Mr. Jefferey Perlman, CEO of Warburg Pincus Group (USA)](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/18/c37781eeb50342f09d8fe6841db2426c)

![[UPDATE] April 30th parade rehearsal on Le Duan street in front of Independence Palace](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/18/8f2604c6bc5648d4b918bd6867d08396)

Comment (0)