Staff of the Social Policy Bank branch in Mo Cay Bac district, Ben Tre province, coordinate with organizations to create conditions for disadvantaged students to borrow capital to cover their study expenses... (Photo: Chuong Dai/VNA)

Staff of the Social Policy Bank branch in Mo Cay Bac district, Ben Tre province, coordinate with organizations to create conditions for disadvantaged students to borrow capital to cover their study expenses... (Photo: Chuong Dai/VNA)In Ben Tre, social policy credit continues to be affirmed as an effective economic tool of the State in implementing the goal of rapid and sustainable multidimensional poverty reduction.

Thereby, actively contributing to the successful implementation of national target programs on poverty reduction, new rural construction and socio-economic development in the area.

Deputy Director of the Ben Tre Province Social Policy Bank Branch Nguyen Manh Hoai said that in order to meet the capital needs of poor households and policy beneficiaries in the area, every year, in addition to the balanced capital transferred from the Central Government, the Party Committees and authorities at all levels in the province have allocated a part of the local budget entrusted through the Social Policy Bank to supplement the loan capital.

In addition, the provincial branch of the Social Policy Bank also promotes capital mobilization from residents and, together with the annual additional capital, actively collects debts for revolving loans to basically meet the loan needs of poor households and policy beneficiaries.

By the end of June, preferential loans for poor households and other policy beneficiaries in Ben Tre province reached VND3,664 billion (an increase of VND280 billion compared to the beginning of this year); of which, central capital was VND3,500 billion, an increase of VND231.4 billion; local entrusted capital was VND163.6 billion, accounting for 4.51% of total capital, an increase of VND49 billion.

[Ben Tre: Collective economy plays a role in building prosperous farmers]

The provincial branch of the Social Policy Bank has effectively implemented policy credit programs, focusing on lending to the right beneficiaries, actively supporting communes striving to meet new rural standards and households with livelihood models, production and business and expected to escape poverty this year.

According to statistics, loan turnover in the first 6 months of this year reached 657.4 billion VND; debt collection turnover reached 415.3 billion; total outstanding debt reached 3,623.5 billion VND, an increase of 241.9 billion VND, credit growth rate of 7.15%, with 108,814 customers with outstanding debt.

In the first six months of this year, policy credit capital has helped 3,886 poor households, near-poor households, and households that have just escaped poverty borrow 194.4 billion VND; 3,883 self-employed workers in the locality received loans of 158.9 billion VND; 193 workers working abroad for a limited period borrowed 16.2 billion VND; more than 10,000 households built clean water and sanitation works in rural areas borrowed 190.2 billion VND; created conditions for 714 students in difficult circumstances to cover their study expenses...

According to Ms. Tran Lam Thuy Duong, Director of the Ben Tre Province Branch of the Bank for Social Policies, the special operating model of the Bank for Social Policies has mobilized the strength of the political system, of all levels and sectors to effectively implement preferential credit policies, ensuring publicity, democracy and transparency in operations, in management, supervision and use of State capital; linking the responsibilities and tasks of relevant levels and sectors in sustainable poverty reduction, social stability and promoting local economic development.

"Social policy credit capital helps people stay attached to their land and villages; at the same time, it helps local authorities plan and orient economic development for the locality, have more opportunities to interact with people, grasp their thoughts and aspirations, promptly resolve their difficulties and problems, and contribute to maintaining stability, security, order and social safety at the grassroots level," Ms. Tran Lam Thuy Duong emphasized.

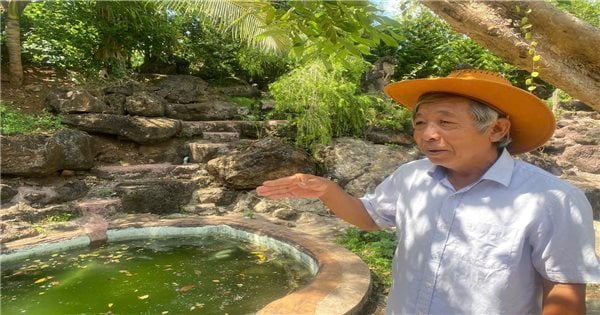

Near-poor households and households that have just escaped poverty in Mo Cay Bac district, Ben Tre province, have been supported with livestock loans to gradually change their lives. (Photo: Chuong Dai/VNA)

Near-poor households and households that have just escaped poverty in Mo Cay Bac district, Ben Tre province, have been supported with livestock loans to gradually change their lives. (Photo: Chuong Dai/VNA)In particular, with the lending method mainly entrusted through socio-political organizations (accounting for 99%), the entrusted unions have the conditions to gather, consolidate and develop union members; connect the community through the activities of Savings and Loan Groups; at the same time, with the deployment to 100% of hamlets, villages and residential groups in the province, poor households and policy beneficiaries have access to government capital to practice doing business, create jobs, gradually improve their production and business management skills, and get rich in their homeland. From there, creating people's trust in the Party and the State, contributing to gradually repelling black credit, maintaining national defense, security and social order.

In the coming time, Ben Tre social policy credit will continue to develop in a stable and sustainable direction, creating the best support conditions for poor households and policy beneficiaries. The unit also aims to ensure that 100% of poor households, near-poor households, newly escaped poverty households and other policy beneficiaries who have the need and are eligible for loans can borrow from credit programs and access services provided by the Social Policy Bank. The average annual growth of outstanding loans is about 10%. The overdue debt ratio is equal to the national average.

To do this, the Ben Tre Provincial Branch of the Bank for Social Policies will focus on directing the synchronous implementation of solutions to improve the quality of social policy credit activities; including enhancing the role, responsibility and operational efficiency of local Party committees and authorities at all levels and of socio-political organizations in implementing social policy credit; increasing the provision of local capital to entrust loans to the poor and other policy beneficiaries in the area.

Along with that, the Branch attaches special importance to credit quality, the entrustment work of socio-political organizations receiving entrustment, the quality of operations of Savings and Loan Groups, operations at transaction points in communes, and publicizes information and policies related to policy credit activities at commune transaction points to create the best conditions for the poor and other policy beneficiaries to access capital sources of policy credit programs, while promoting the supervisory role of the community in organizing the implementation of Party and State policies in the area.

In addition, the Branch will promote communication on policy credit, especially new credit policies to all levels, sectors, and people to know and supervise implementation in the area; take advantage of exploiting resources and technical funding sources from organizations to supplement loan capital and train and improve management capacity for staff of the Social Policy Bank, staff of socio-political organizations receiving entrusted services, Management Board of Savings and Loan Groups.../.

Source: https://www.vietnamplus.vn/trien-khai-hieu-qua-nguon-von-tin-dung-chinh-sach-xa-hoi-o-ben-tre-post878661.vnp

Comment (0)