Reporting to Nguoi Lao Dong Newspaper, Mr. Gia Khang (living in District 4, Ho Chi Minh City) said that about 2 months ago, a friend who worked in a bank needed to "run" a credit card quota so he begged him to open one for him. Out of respect for his friend, he opened a regular credit card for personal and family expenses.

Credit card cancellation trouble

Last week, the bank staff informed Mr. Khang that he had another credit card linked to the one he was using, and asked him to pay a fee. He was very surprised, not understanding why he had only opened one card but there were two active cards in the system, and they were also linked together.

Recently, many consumers have had trouble with credit cards that require spending first and paying later. Photo: LAM GIANG

"I have complained through the hotline but have not received a response from the bank. This is not the first time because about 2 years ago, when I borrowed money from the bank to buy a house, the condition was to open a credit card, then I also discovered that I had 2 cards. I struggled for a long time to cancel it, now I am facing this situation" - Mr. Khang recalled.

Many people also fall into a "half-crying, half-laughing" situation when they accidentally open a credit card and then struggle to cancel it. Mr. Le Hoang (living in Binh Thanh District, Ho Chi Minh City) said that he just received a phone call from a consultant of a bank headquartered in Hanoi, informing that if he reactivates his credit card, the annual fee will be waived for the next 3 years. Notably, this is a credit card that just 1 month ago, he had to struggle for a whole week to cancel.

According to Mr. Hoang, in early 2024, an acquaintance who worked at V. Bank invited him to open a credit card with a limit of 44 million VND to meet the issuance target. Also out of respect for his friend, he agreed to open the card even though he had no intention of using it. Opening the card was very convenient, only requiring a phone number, ID card and he received it after only 1 week.

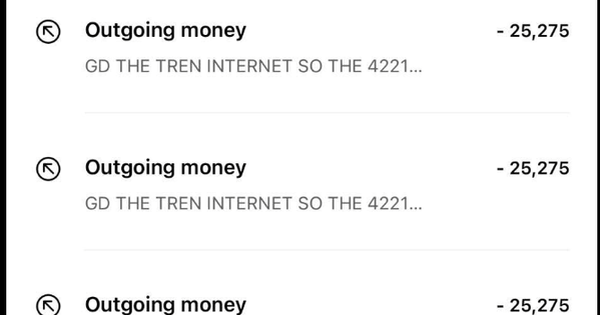

During the process of opening the card, Mr. Hoang was told by the employee V. that he had to deposit 10,000 VND to activate it and that it would be refunded, but he did not say that interest would be charged on this amount. More than 6 months later, his card account had deducted the initial 10,000 VND and incurred additional overdue interest and late payment fees for this amount, totaling nearly 200,000 VND.

"I was very surprised because I thought I didn't spend any money but was still charged a late payment fee. It's worth mentioning that after paying this amount, I went to the bank to close the card, but the staff asked me to... go home and call the hotline to register for cancellation. After I reported canceling the card, the hotline operator told me to wait 3-5 days for someone to confirm... Opening a card is easy, but closing it is too difficult" - Mr. Hoang was upset.

Similarly, Mr. Quoc Ngoc (living in Thu Duc City) also spent 2 weeks going back and forth to the bank several times to close his credit card. According to the bank's regulations, credit card holders who want to cancel their credit card must call the hotline, but the system is often overloaded. When someone answered the phone, the staff said that his account still had 600,000 VND in promotional money, the balance had not yet reached 0, so he could not cancel. To cancel, he had to use up all of this promotional money!

Should be clearly explained to the cardholder

Why is it so easy to open a credit card - banks advertise it only takes a few minutes (if you qualify), but it's so difficult to close it?

Some banks only accept card payments via the call center instead of going to the branch or using the bank application. A commercial bank employee explained that credit card payments via the call center are to reduce the workload and pressure on employees at branches and transaction offices.

Dr. Chau Dinh Linh, Ho Chi Minh City Banking University, commented that the situation of users "racing" to open credit cards and then struggling to close them because they do not need to use them is the result of a period when banks expanded card issuance and employees "ran" for business targets. Many people simultaneously own many types of credit cards (cashback cards, shopping cards, co-branded cards, etc.) with different limits and needs.

"Credit card business often has high profits from interest rates (average credit card interest rates are about 30%-35% - PV), fees, incentives, cash flow from payment accounts... so banks compete to issue them, regardless of the actual needs of users. Meanwhile, many people do not have the need but still open cards because they are considerate of relatives and friends, so they know almost nothing about the interest rates to pay, the types of penalties and use the card very easily. In fact, many cases have bad debts due to uncontrolled spending and inability to pay" - Dr. Chau Dinh Linh analyzed.

According to financial expert Phan Dung Khanh, he used to have up to 7 credit cards, also because he respected friends or acquaintances who asked him to open them for him. Because he works in the financial industry, he realized that credit card opening contracts are very long and detailed, so very few customers read them carefully before signing. Not to mention, the contracts often have very complicated content.

"Once, I read the credit card contract and found the regulations unreasonable, so I suggested an adjustment. The bank staff said that this was a general legal framework and could not be changed. If so, to be fair to the cardholder, in addition to the contract, the bank should summarize specific information for customers about interest rates, penalty fees, and risks that may be encountered if interest is not paid on time," Mr. Phan Dung Khanh suggested.

Source: https://nld.com.vn/the-tin-dung-de-mo-kho-huy-196240827213843362.htm

Comment (0)