While there are big companies waiting for the market to be upgraded, the stock market wants to move up and stay in the emerging market, the important thing is to have good "goods".

Shorten the IPO time associated with listing

Earlier this week, more than 300 million DSE shares of DNSE Securities officially traded on the Ho Chi Minh City Stock Exchange (HoSE). As promised by the company's leaders, DNSE went public 5 months after completing its public offering. Although it was not the strongest capital increase in its history, this offering recorded the highest issuance price (VND30,000/share), thereby helping this securities company earn VND900 billion.

For the stock market, DNSE's initial public offering (IPO) is also a positive start to 2024, after the previous year saw a record low mobilization level for this channel.

In the first half of this year, while the credit growth rate was quite low compared to the same period in recent years, the securities channel was somewhat better than the same period, playing a good role in mobilizing capital for many organizations. Many businesses have successfully raised thousands of billions of dong in “new money” through offering shares to existing shareholders and issuing shares privately.

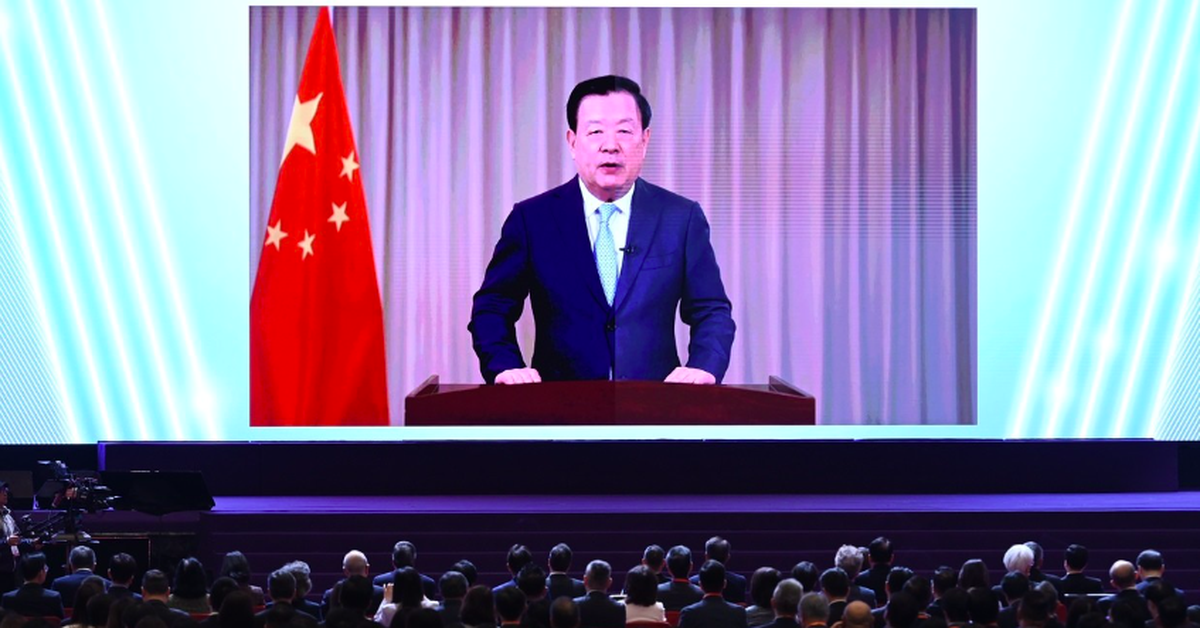

|

| Securities are playing a good role in raising capital for many organizations. Photo: D.T |

In addition to DNSE, a major dairy brand has also become a new member of HoSE in June. However, unlike DNSE, MCM shares of Moc Chau Dairy Cattle Breeding Joint Stock Company have been traded on UPCoM for 4 years. A fact that has been pointed out many times is that in the past 10 years, the Top 10 largest stocks have mainly changed their rankings, and there have not been many new products; businesses with a capitalization of over 1 billion USD still only hover around 50 businesses.

Speaking at a recent conference, Mr. Bui Hoang Hai, Vice Chairman of the State Securities Commission, said that the agency is proposing solutions to integrate IPO and listing. “Enterprises that want to attract investors to participate in IPOs face difficulties because the time for shares to be on the market is not long. In recent times, the State Securities Commission has proposed solutions to shorten the time between these two processes. This will help large enterprises attract investors and large capital sources. The State Securities Commission is researching and has initial solutions, which will be included in drafts, circulars and decrees in the coming time,” Mr. Hai said.

According to Mr. Hai, the number of enterprises with market capitalization of over 1 billion USD is currently "not small" compared to other countries in the region. Through actual discussions, there are enterprises with large market capitalization sharing that they are waiting for the stock market to upgrade before listing.

Upgrading - A matter of consensus

While there are big companies waiting for the market to be upgraded to join the playing field, to upgrade the stock market and then stand firm in the emerging market category, the important thing is to have good “goods”.

One of the solutions to upgrade the Vietnamese stock market is the transparency of information of listed companies. According to Mr. Bui Hoang Hai, in the stock market, information is very important. The reason for the stock market to exist is to effectively allocate capital to the best address. Without transparency, this initial function cannot be performed.

To have quality information that meets high requirements, Mr. Hai emphasized, it takes a long time, starting from changing the awareness of businesses, not forced by management agencies, but stemming from the interests of businesses themselves.

In the first half of this year, many businesses have successfully raised thousands of billions of dong in "new money" through offering shares to existing shareholders and private placement.

In the first half of this year, many businesses have successfully raised thousands of billions of dong in "new money" through offering shares to existing shareholders and private placement.

The second solution from the business side is the story of corporate governance. The management agency sets out minimum requirements to improve corporate governance. Businesses that have only stopped at the level of complying with regulations can move beyond compliance, strengthen supervision, and protect investor rights.

Agreeing with the above view, Ms. Ha Thi Thu Thanh, Chairwoman of the Board of Directors of the Vietnam Institute of Directors (VIOD), also assessed that corporate governance is the most important factor, besides social responsibility, to strengthen market confidence in a listed enterprise.

Not only listed companies, member securities companies are also important factors in the upgrading journey. According to Mr. Nguyen Khac Hai, Director of Legal and Compliance Control at SSI Securities Company, regarding the change when applying the central clearing partner (CCP) model or payment support services for foreign institutional investors, the responsibility for payment of transactions for investors belongs to the securities company, therefore, it is inevitable that securities companies must prepare large capital resources to limit payment risks.

The strong capital increase wave of securities companies in recent times, according to Mr. Nguyen Khac Hai, is partly to anticipate capital requirements.

Tien Phong Securities Joint Stock Company distributed all 100% of the ORS shares offered for sale, earning VND1,000 billion. With a lower successful distribution rate (77.94%), Ho Chi Minh City Securities Joint Stock Company (HSC) also earned a net of VND1,780 billion from the share offering to existing shareholders at a ratio of 2:1.

Currently, many organizations are taking steps and preparing for capital increase. VNDirect Securities has just closed the right to receive 2022 dividends in shares and exercised the right to buy shares offered to existing shareholders on May 30. The time to pay for the purchase just ended on July 3.

SSI Securities recently updated its registration documents to prepare for a maximum capital increase of 453 million shares with an issuance price of VND15,000/share.

Meanwhile, SHS Securities has just built an issuance profile at the end of June, aiming to mobilize VND 8,130 billion.

To achieve the upgrading goal, according to Mr. Nguyen Duc Chi, Deputy Minister of Finance, the management agency is ready to take the lead in implementing this process. However, he also emphasized that the state management agency takes the lead, but does not go alone. The entire stock market needs to be united, no one goes alone, but needs to go together, including the State Securities Commission, listed enterprises, media units, etc.

Source: https://baodautu.vn/som-co-them-co-che-thuc-doanh-nghiep-lon-len-san-d219289.html

![[Photo] President Luong Cuong receives Kenyan Defense Minister Soipan Tuya](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/0e7a5185e8144d73af91e67e03567f41)

![[Photo] General Secretary To Lam attends conference to meet voters in Hanoi city](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/889ce3da77e04ccdb753878da71ded24)

![[Photo] President Luong Cuong receives UN Deputy Secretary General Amina J.Mohammed](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/72781800ee294eeb8df59db53e80159f)

![[Photo] President Luong Cuong receives Lao Prime Minister Sonexay Siphandone](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/337e313bae4b4961890fdf834d3fcdd5)

![[Photo] Hundred-year-old pine trees – an attractive destination for tourists in Gia Lai](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/25a0b7b629294f3f89350e263863d6a3)

![[Photo] Prime Minister Pham Minh Chinh and Ethiopian Prime Minister visit Tran Quoc Pagoda](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/18ba6e1e73f94a618f5b5e9c1bd364a8)

![[Video] Viettel officially puts into operation the largest submarine optical cable line in Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/f19008c6010c4a538cc422cb791ca0a1)

Comment (0)