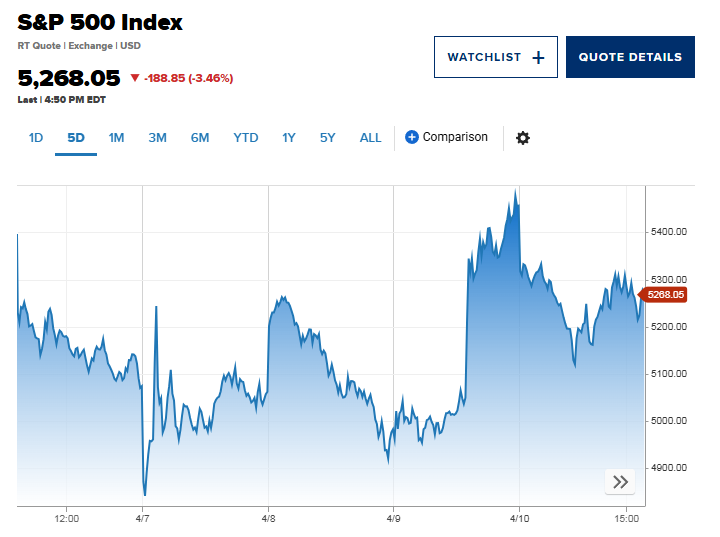

The dollar held steady as investors awaited an announcement this week from US President Donald Trump on reciprocal tariffs that will hit “nearly all countries”.

“The second quarter could continue to bring uncertainty and volatility, and the degree of volatility will depend on who is targeted by tariffs,” said Anthony Saglimbene, chief market strategist at Ameriprise Financial.

The euro rose 0.07% to $1.0824, after rising 4.5% in the first quarter, its strongest since the fourth quarter of 2022, helped by fiscal reforms in Germany. However, some investors doubted the rally would last as trade uncertainty escalated.

The British pound rose 0.11% to $1.2932.

The Japanese yen rose 0.1 percent to 149.81 yen per dollar, posting a gain of nearly 5 percent in the first quarter, on expectations the Bank of Japan (BoJ) will raise interest rates.

New data showed business sentiment among Japan's major manufacturers worsened in the first quarter as trade tensions hit the export-oriented economy, complicating the BoJ's policy decision.

The Australian dollar rose 0.08% to $0.6252, near a four-week low of $0.6219 it hit on Monday, ahead of the Reserve Bank of Australia (RBA) policy meeting. The RBA is expected to keep interest rates unchanged, with investors focused on comments from RBA officials for clues on the central bank’s policy direction.

“Recent economic data may prompt the RBA to be more dovish, especially given the geopolitical uncertainty. This could increase market expectations for a 25 basis point rate cut in May, which could weigh on the Australian dollar,” said Carol Kong, an economist at Commonwealth Bank of Australia.

Elsewhere, the New Zealand dollar fell 0.04% to $0.5676.

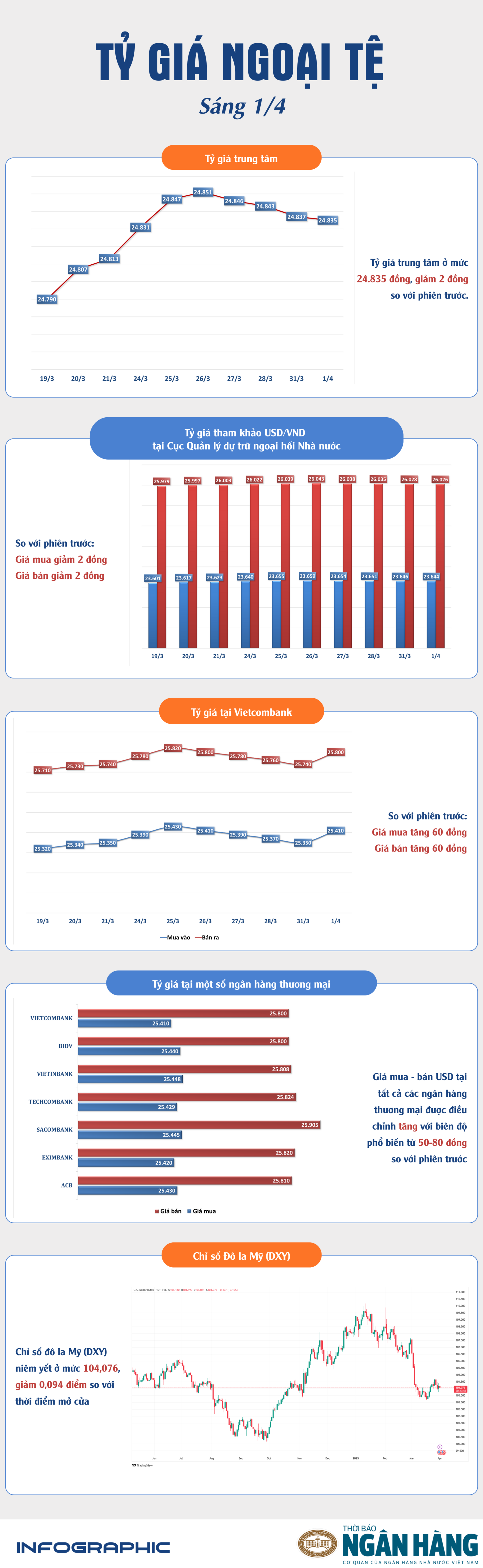

Source: https://thoibaonganhang.vn/sang-14-ty-gia-trung-tam-tiep-tuc-giam-nhe-162104.html

![[Photo] Phuc Tho mulberry season – Sweet fruit from green agriculture](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/1710a51d63c84a5a92de1b9b4caaf3e5)

![[Photo] Summary of parade practice in preparation for the April 30th celebration](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/78cfee0f2cc045b387ff1a4362b5950f)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to discuss tax solutions for Vietnam's import and export goods](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/19b9ed81ca2940b79fb8a0b9ccef539a)

Comment (0)