|

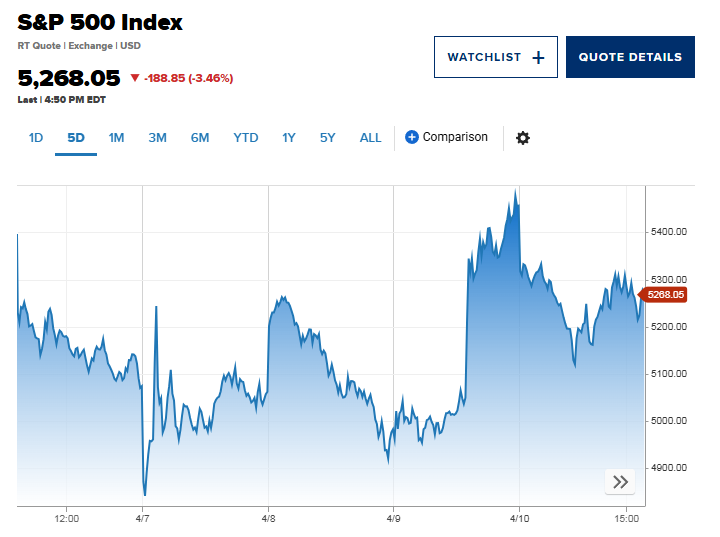

| S&P 500 fell 0.8% on Thursday |

Specifically, S&P 500 futures fell 0.8%; while Nasdaq 100 futures lost 0.9%; futures tied to the Dow Jones Industrial Average fell 277 points, equivalent to 0.7%.

Earlier, the US stock market also turned down again. Accordingly, the S&P 500 closed Thursday's trading session down 3.46%; while the 30-stock Dow fell 1,014.79 points, equivalent to 2.5%; the technology-heavy Nasdaq Composite ended the day down 4.31%.

Thursday’s decline erased some of the gains the major averages made on Wednesday after Trump announced a 90-day delay on some of his reciprocal tariffs. On Wednesday, the S&P 500 jumped 9.52%, its third-largest one-day gain since World War II; while the Dow Jones Industrial Average jumped more than 2,900 points…

According to analysts, concerns about tariffs remain a top concern for investors. Trump has only temporarily suspended reciprocal tariffs, while most goods exported to the US are still subject to a 10% tax. Trump has even sharply increased tariffs on goods from China, deepening trade tensions between the world’s two largest economies.

“Lower tariffs are still a big issue and the three-month deadline does not provide certainty for consumers, businesses and investors,” said Jed Ellerbroek, portfolio manager at Argent Capital Management. “This policy package will lead to higher inflation in the US, lower economic growth and disappointing stock markets,” he said.

Similarly, Thursday's stock market sell-off suggests investors want more clarity on tariffs, according to Evercore ISI strategist Krishna Guha.

“Today’s trading saw a rare, ugly and worrying combination of market moves with the dollar, bonds and equities falling amid heightened volatility and cross-asset market stress – despite a solid 30-year Treasury bond auction,” Guha, Evercore’s head of global policy and central bank strategy, said in a note to clients.

These moves may be “a contraction,” Guha wrote. “But the market is pushing for a larger shift with either a complete end to tariffs on China or negotiations with China or both.”

Despite the volatility this week, the three major U.S. stock indexes are still on track for solid gains this week. The S&P 500 is up 3.8%, its best weekly gain since November. The Nasdaq is up 5.1%, and the Dow Jones is up 3.3%.

Investors are now looking ahead to a slew of earnings reports on Friday from the nation’s largest banks and financial companies that will kick off the first-quarter earnings season and provide clues about the health of the U.S. economy. Morgan Stanley, Wells Fargo, JPMorgan Chase and BlackRock are among the names set to release their financial results.

On the economic front, the March producer price index report and the University of Michigan's preliminary consumer sentiment data for April due out on Friday are also being closely watched by investors.

Source: https://thoibaonganhang.vn/chung-khoan-my-lai-do-lua-vi-cang-thang-thuong-mai-162611.html

![[Photo] President Luong Cuong receives UN Deputy Secretary General Amina J.Mohammed](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/72781800ee294eeb8df59db53e80159f)

![[Photo] Hundred-year-old pine trees – an attractive destination for tourists in Gia Lai](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/25a0b7b629294f3f89350e263863d6a3)

![[Photo] Warm meeting between the two First Ladies of the Prime Ministers of Vietnam and Ethiopia with visually impaired students of Nguyen Dinh Chieu School](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/b1a43ba73eb94fea89034e458154f7ae)

![[Photo] President Luong Cuong receives Lao Prime Minister Sonexay Siphandone](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/337e313bae4b4961890fdf834d3fcdd5)

![[Photo] Prime Minister Pham Minh Chinh and Ethiopian Prime Minister visit Tran Quoc Pagoda](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/18ba6e1e73f94a618f5b5e9c1bd364a8)

![[Photo] President Luong Cuong receives Kenyan Defense Minister Soipan Tuya](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/0e7a5185e8144d73af91e67e03567f41)

![[Infographic] Cross exchange rates of Vietnamese Dong with some foreign currencies to determine tax value from April 17-23](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/aba0ea0ef3fe481684a63c149b7c9921)

![[Video] Viettel officially puts into operation the largest submarine optical cable line in Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/f19008c6010c4a538cc422cb791ca0a1)

Comment (0)