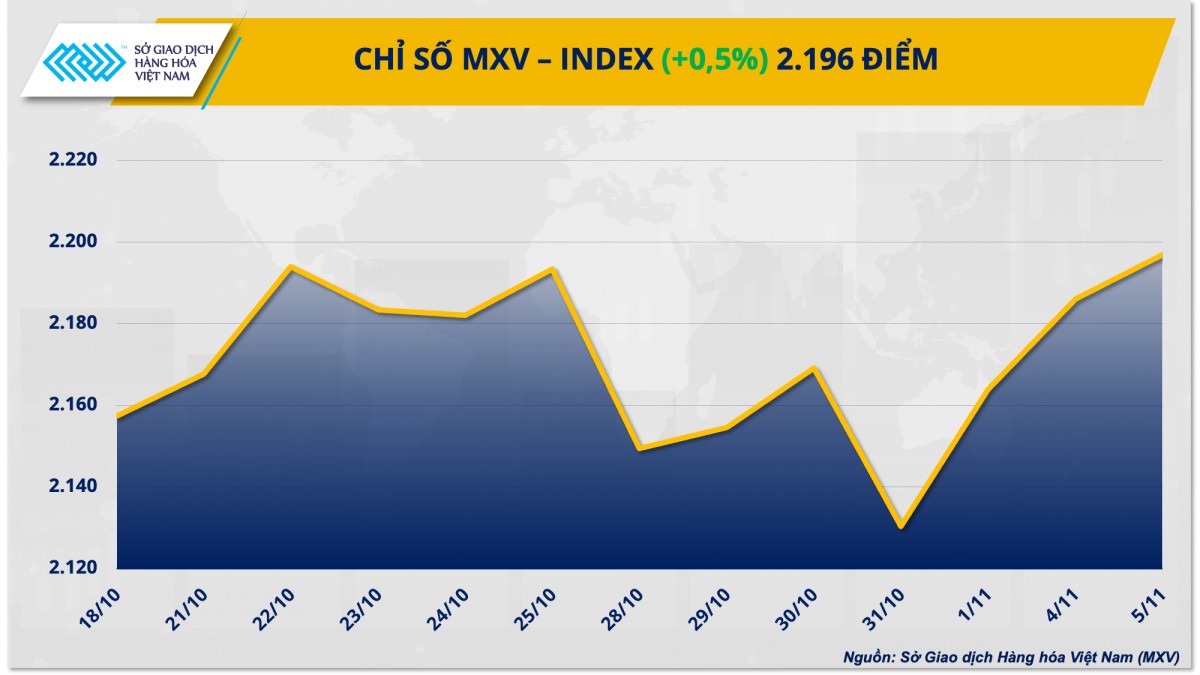

According to the Vietnam Commodity Exchange (MXV), buying power continued to dominate the world raw material market in yesterday's trading day (November 5).

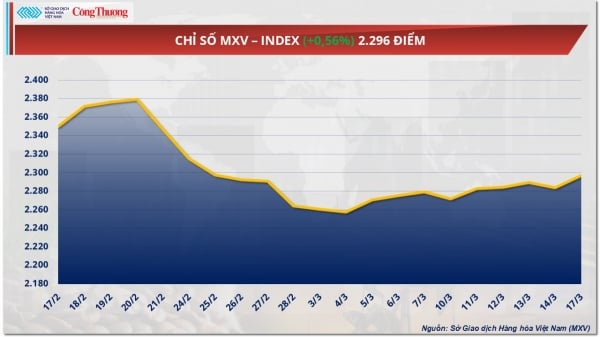

Closing, the MXV-Index increased by 0.5% to 2,196 points. Notably, the metal market recorded a positive session when 9 out of 10 commodities increased in price on the US Presidential election day and the market context expected a large-scale fiscal stimulus package from China. In addition, in the energy market, WTI oil prices recovered due to concerns that Hurricane Rafael could affect production in the Gulf of Mexico.

|

| MXV-Index |

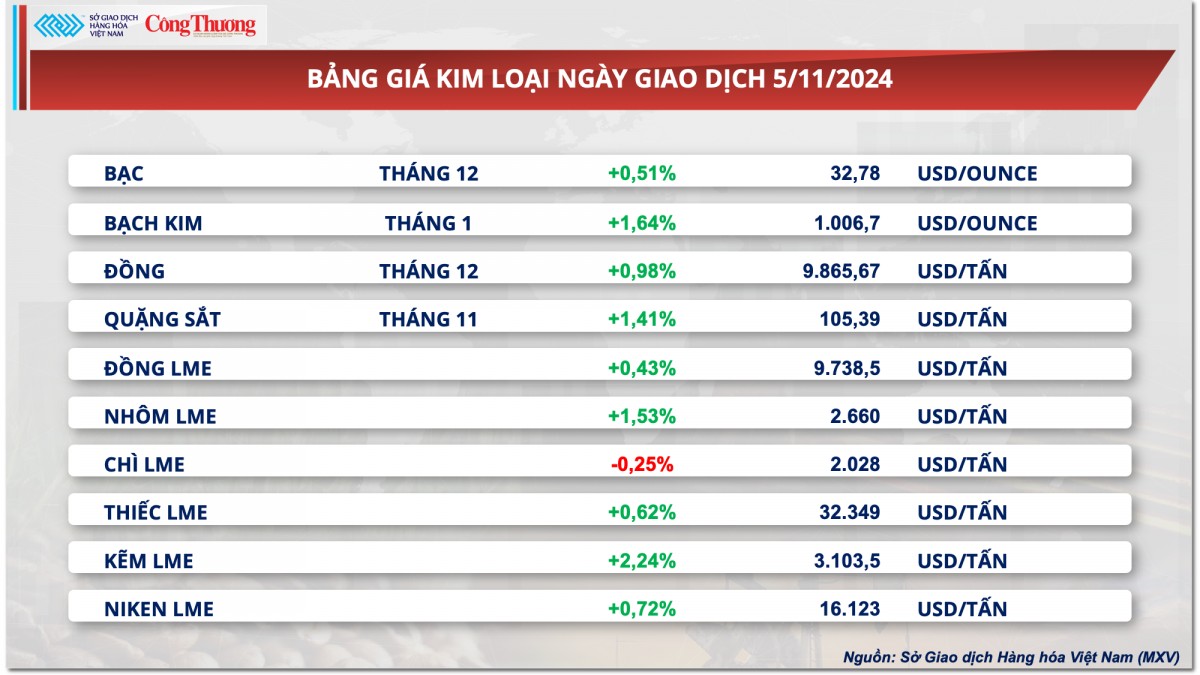

Green color almost covers the metal price list

At the end of yesterday's trading day, the metal price chart was almost entirely green as most commodities increased in price, except for LME lead. As for precious metals, thanks to their good role as safe havens, silver and platinum prices both recovered in yesterday's session. At the close, silver prices recovered from a two-week low by increasing 0.51% to $32.78/ounce. Platinum prices regained the $1,000/ounce mark after increasing 1.64%, closing at $1,006.7/ounce.

|

| Metal price list |

The highly anticipated US presidential election officially took place yesterday afternoon Vietnam time, and current polls are showing a tight race between Republican candidate Donald Trump and Democratic candidate Kamala Harris. The uncertainty that has engulfed the market has supported the price of precious metals, a hedge against economic and political risks.

In base metals, COMEX copper rose 0.98% to $9,865 a tonne. Iron ore also rose more than 1% to nearly $105.40 a tonne. Both copper and iron ore benefited from growing optimism about further stimulus from top consumer China, although demand remained weak.

Markets are now focused on the ongoing National People's Congress (NPC) Standing Committee meeting, which is scheduled to conclude on November 8. The meeting is expected to discuss details of fiscal stimulus measures. Reuters reported last week that China is considering approving a new bond issuance worth more than 10 trillion yuan to address local government debt risks, support local governments in buying up vacant real estate and clearing large unsold apartment inventories.

Data released yesterday also showed that China's economy continued to improve, reinforcing market confidence that the country's recent economic stimulus packages are helping to improve business conditions. Specifically, according to the results of a private survey released by Caixin and S&P Global yesterday, China's services purchasing managers' index (PMI) rose to 52 points in October. This figure surpassed the market forecast of 50.5 points and was the highest level in the past three months.

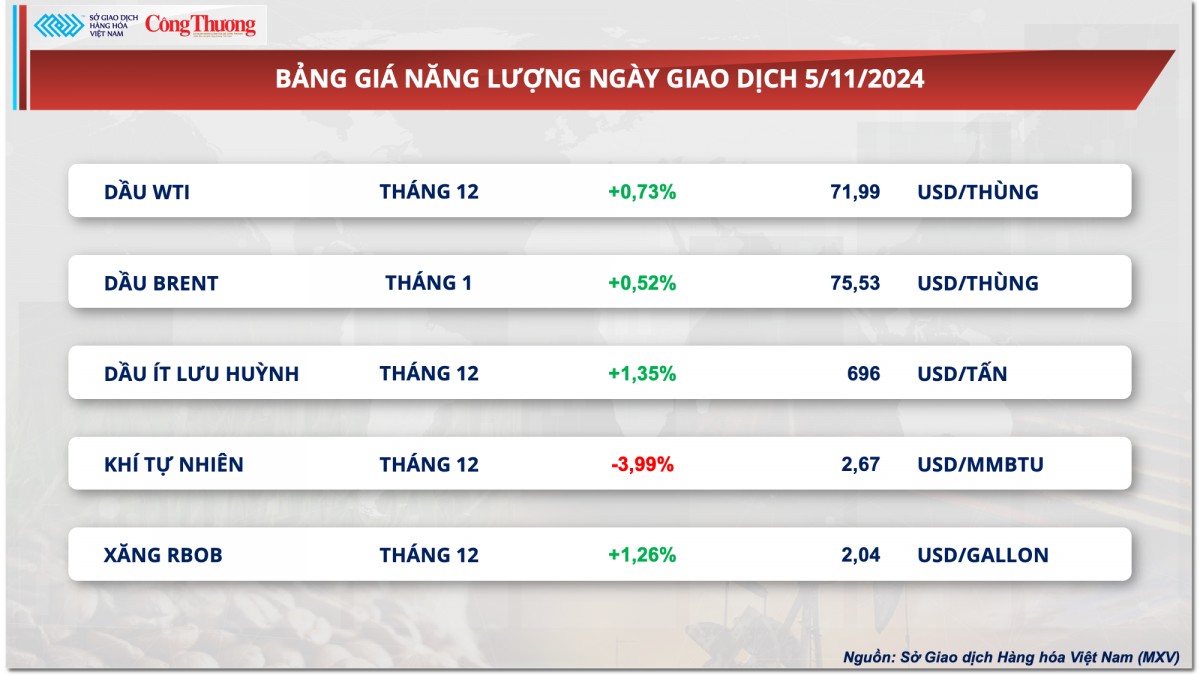

Crude oil prices rise as Hurricane Rafael threatens US supplies

According to MXV, crude oil prices were relatively gloomy for most of yesterday's trading session, in the context of a more cautious market ahead of the announcement of the US presidential election results. However, oil prices still maintained green at the close as investors worried about short-term disruptions in US supplies due to storms.

WTI crude oil for December delivery closed yesterday's session up 0.73% to $71.99 a barrel. Meanwhile, Brent crude oil for January delivery also rose 0.52% to $75.53 a barrel.

|

| Energy Price List |

A tropical cyclone in the US Gulf of Mexico is expected to strengthen into a Category 2 storm called Rafael and disrupt oil production in the region, researchers said. Hurricane Rafael has been in the Caribbean since yesterday and will move into the Gulf of Mexico, passing through major US oil-producing regions. The storm could reduce US crude oil production by 3.1-4.9 million barrels. Concerns about a short-term supply shortage have had a positive impact on crude oil prices.

The weakness of the US dollar continued to support crude oil prices yesterday and boosted buying interest in the commodity. The Dollar Index - a measure of the greenback's strength against a basket of major currencies - fell 0.41% yesterday to its lowest level in more than two weeks.

On the other hand, the stronger-than-expected increase in US crude oil inventories last week put pressure on and limited the rise in oil prices. According to the weekly report of the American Petroleum Institute (API), the US commercial crude oil inventories in the week ending November 1 increased by 3.132 million barrels, recovering after a decrease of 0.573 million barrels in the previous week and surpassing analysts' expectations for an increase of 1.8 million barrels.

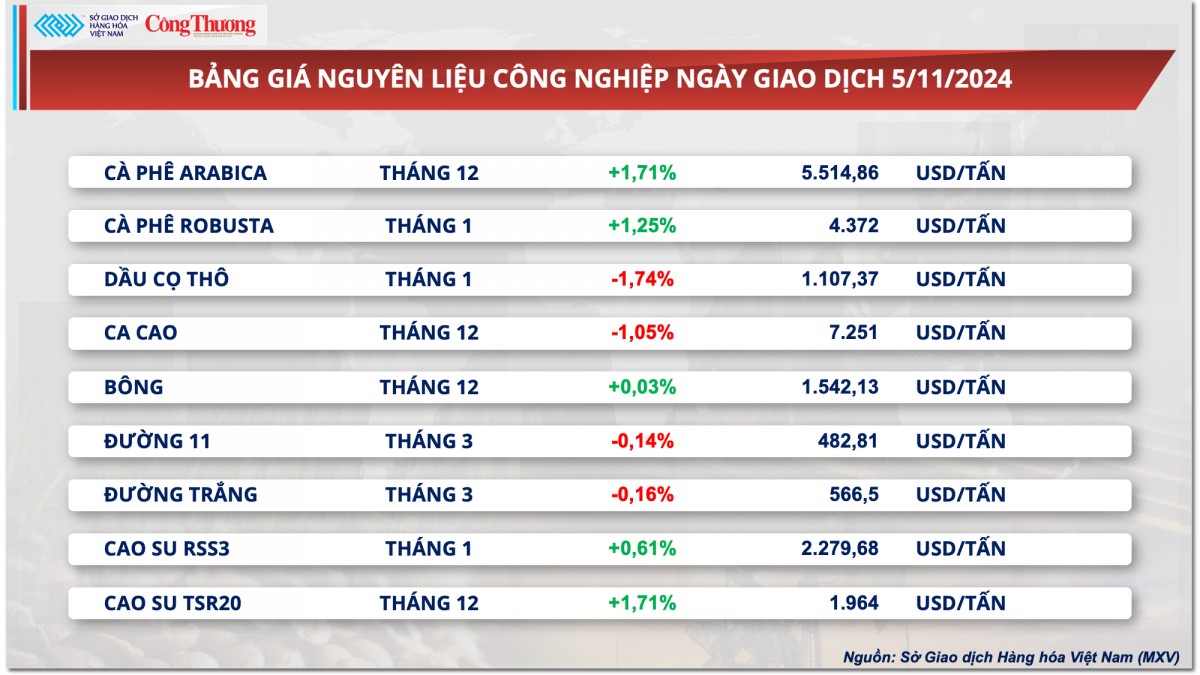

Prices of some other goods

|

| Industrial raw material price list |

|

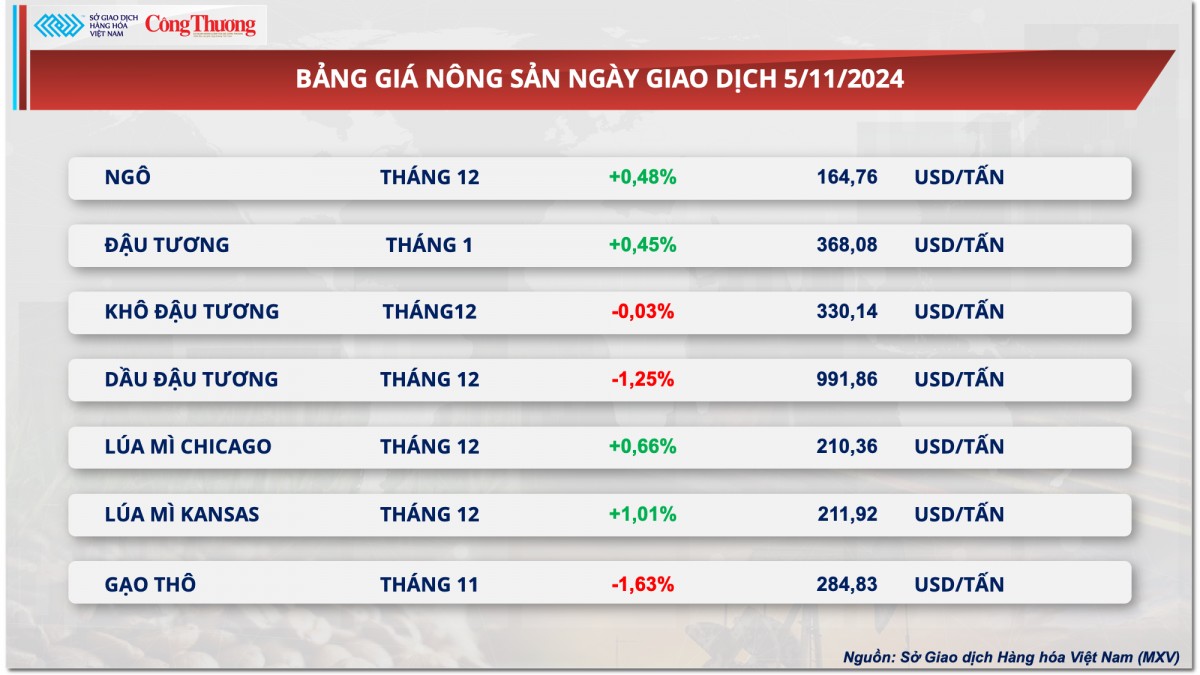

| Agricultural product price list |

Source: https://congthuong.vn/thi-truong-hang-hoa-hom-nay-6112024-sac-xanh-ap-dao-tren-thi-truong-hang-hoa-the-gioi-357085.html

![[Photo] General Secretary To Lam receives King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/e5963137a0c9428dabb93bdb34b86d7c)

![[Photo] Close-up of Vietnam's sniffer dog team searching for earthquake victims in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/d4949a0510ba40af93a15359b5450df2)

![[Photo] Prime Minister Pham Minh Chinh meets with King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/be2f9ad3b17843b9b8f8dee6f2d227e7)

![[Photo] President Luong Cuong and King Philippe of Belgium visit Thang Long Imperial Citadel](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/cb080a6652f84a1291edc3d2ee50f631)

![[Photo] Myanmar's capital in disarray after the great earthquake](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/7719e43b61ba40f3ac17f5c3c1f03720)

Comment (0)