Novaland mortgaged many documents of the Aqua City urban area project (Dong Nai) to bondholders - Photo: A.LOC

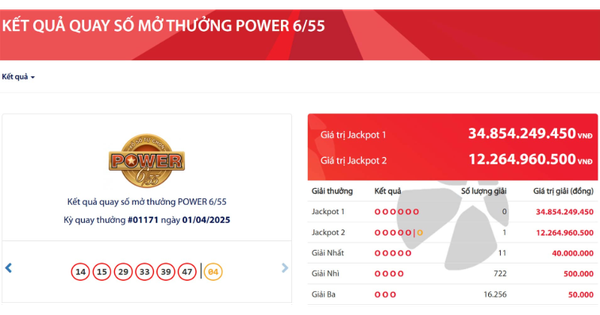

Nova Real Estate Group Joint Stock Company (Novaland) has just sent information to the Hanoi Stock Exchange regarding the NVLH2123010 bond lot worth more than VND860 billion issued by the company three years ago.

Bondholders reject Novaland's offer, forced to add additional collateral

According to Novaland's updated report, due to the sharp drop in stock prices, affecting the value of the collateral of the bonds, bondholders (owners of the bond lot, creditors) did not agree to exempt the mortgage of assets, as previously proposed by the enterprise.

Bondholders request that businesses complete mortgage contract procedures and register secured transactions as soon as they are eligible.

The appendix shows that the additional mortgaged assets include 47 certificates of land use rights, house ownership rights and assets attached to land at the high-end commercial and service urban area project Cu Lao Phuoc Hung (Phoenix Island, part of the Aqua City project, Dong Nai province).

It is known that the above bond lot was issued by Novaland in September 2021, mobilizing more than 860 billion VND. Thanks to the payment period being extended by 21 months, this bond lot will not mature until March 2025. The interest rate during the extension period is fixed at 11.5%/year, an increase of 1% compared to before.

Stock prices hit historic lows

On the stock market, NVL closed the trading session on October 16 at VND10,200/share, hitting a historic low. Over the past year, this stock has fluctuated and decreased by about 30%.

In a related development, NVL shares were recently "fled" and sold off heavily by investors, following the news that Ms. Truong My Lan demanded VND2,500 billion in cash to remedy the consequences of the case related to the Viet Phat Industrial Park and Urban Area project (Suntec City). Responding to the incident, Novaland stated that the above request was completely baseless.

During its heyday, NVL was a shining star when it reached VND 121,000/share (June 29, 2021). It then remained at a high level of around VND 80,000 until the end of 2022.

Amid the general difficulties of the real estate market, especially when investor confidence in the bond market has seriously declined, capital mobilization activities have become more difficult, Novaland and many other real estate businesses are also in trouble.

Novaland records record loss, auditor cautious

Regarding the business picture, the audited consolidated financial report for the first half of 2024 showed that the company suffered a loss after tax of more than VND 7,300 billion, a record loss in the company's operating history, and far from the profit of VND 345 billion in the previous self-prepared report.

Novaland explained that the large difference between pre- and post-audit figures mainly came from the PwC audit firm requesting a provision for the land rent and use fees payable based on the 2017 land price plan of the Lakeview City project (Thu Duc City, Ho Chi Minh City).

The enterprise assessed that the authorities had made a mistake in calculating land prices for this project, so it made a recommendation to the Ho Chi Minh City People's Committee for consideration and handling.

Therefore, the above provision can be revised and reversed when eligible in the future.

Sharing with Tuoi Tre Online , a senior manager working at one of the four leading auditing firms (Big4) commented that requiring Novaland to set aside provisions as above shows the auditor's prudence.

Recently, in the market, not only Novaland but also a number of other businesses have changed from profit to loss, with a large difference between financial statements before and after auditing.

Then the businesses also give explanations about the incident. Investors can monitor and analyze carefully, from there make appropriate decisions.

Source: https://tuoitre.vn/rui-ro-tang-chu-no-doi-novaland-the-chap-them-tai-san-20241016224100544.htm

![[Photo] Close-up of Vietnam's sniffer dog team searching for earthquake victims in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/d4949a0510ba40af93a15359b5450df2)

![[Photo] General Secretary To Lam receives King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/e5963137a0c9428dabb93bdb34b86d7c)

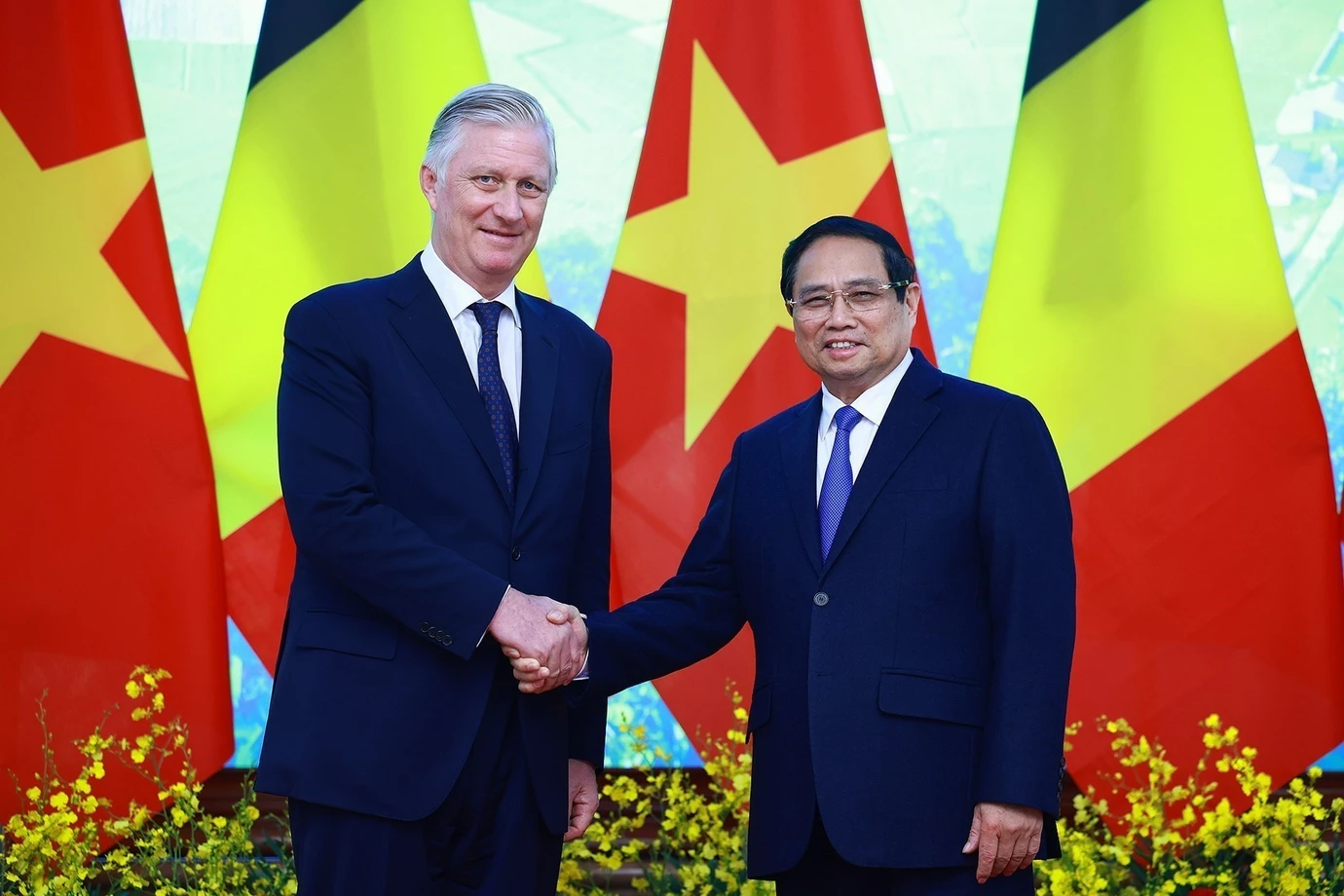

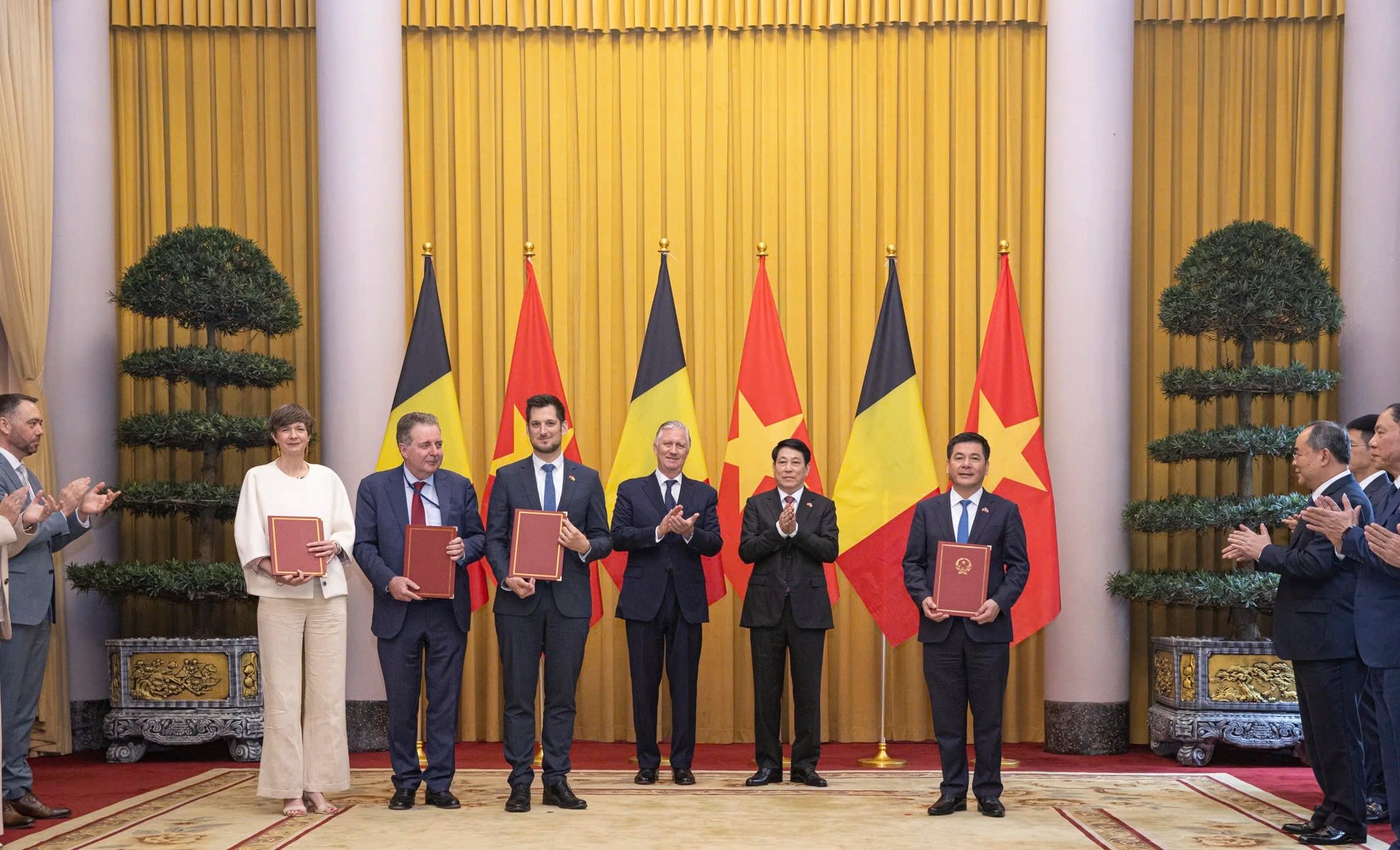

![[Photo] Prime Minister Pham Minh Chinh meets with King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/be2f9ad3b17843b9b8f8dee6f2d227e7)

![[Photo] President Luong Cuong and King Philippe of Belgium visit Thang Long Imperial Citadel](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/cb080a6652f84a1291edc3d2ee50f631)

![[Photo] Myanmar's capital in disarray after the great earthquake](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/7719e43b61ba40f3ac17f5c3c1f03720)

Comment (0)