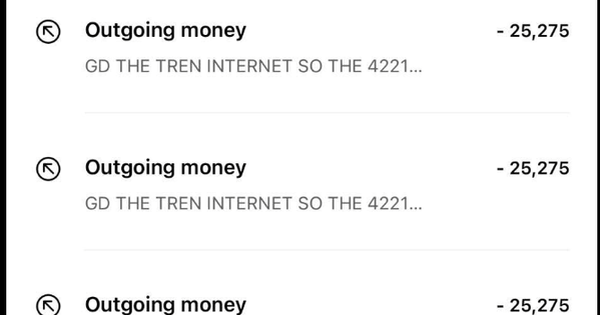

Even though you have taken measures to protect your credit card such as using a strong password and controlling card activity, what should you do if your credit card is hacked?

As soon as you suspect that your credit card information is being used and there are strange activities, you need to take timely actions below to avoid losing money unjustly.

Contact the bank to block the card

If you are sure that your credit card information has been stolen, you need to contact the bank immediately to report the situation and block the card as soon as possible. The bank will then ask you for details about the cardholder's information, the time when the unusual transactions were detected, the name of the transaction company... to verify the information before blocking the card.

In case you receive a call from the bank about the debt, stop the call and contact the bank again to verify whether it is true or not, avoid being tricked by people impersonating bank employees. The contact phone number must be displayed on the bank's official website.

If your credit card is hacked, you need to notify the bank immediately. (Illustration photo).

Cancel strange transactions immediately

All transactions will have a confirmation code or information of the purchasing company. When you see those strange transactions, please send an email or call the company to notify them of transactions that were not made by you. In the response content, clearly state that your credit card was hacked and request to cancel the order. If in the email, please include a photo to prove that the credit card information was stolen.

Update card lock information from the bank

Once you have contacted the bank to block your card, you should also monitor the progress of the blocking process. You can also ask the bank if anyone has used your account or made any strange transactions.

Notes when using bank cards

Responding to VTC News , a cybersecurity expert said that the loss of money in an account even though the account owner did not make any transactions is an act of account hacking by a bad guy.

This expert pointed out some of the main tricks that criminals use to hack credit card accounts: installing malware on victims' devices to collect card information, by having victims click on strange links on emails, chats, e-commerce websites... In addition, criminals buy and sell bank account information from cybercriminal organizations.

Criminals can also attack and steal bank account information using skimming techniques - stealing credit card information using other devices. Examples include using a voice recorder to record sounds at ATMs to analyze the entered PIN code, and installing cameras at ATM withdrawal points to capture information related to the victim's keystrokes to get the PIN code.

"Recently, criminals have forged citizen identification cards or identity cards of bank account owners, and hired people to go to bank agents to request a change in the phone number associated with the victim's bank account. If successful, the criminals will be able to take the victim's bank card account," the expert said.

Another common way this expert pointed out is that criminals take control of phone SIM cards, from there upgrading to take over other accounts such as social networks, e-wallets and bank card accounts.

Therefore, users need to be careful in protecting their bank card information when participating in transactions or exchanges on the internet.

Therefore, it is necessary to set up 2-layer bank account security and at the same time protect OTP codes, use biometric information to improve the safety and security of bank account information.

Customers also need to avoid being scammed into taking control of their phone SIM cards through strange calls asking for support in upgrading their 3G SIM cards to 4G.

Also, do not click on strange links online and avoid participating in unsafe transactions, do not provide bank account information to anyone if you feel unsafe on different platforms.

" It is necessary to ensure safety at card payment locations such as ATMs or POS card swiping counters ," this expert suggested.

If money has been lost, according to cybersecurity experts, customers should immediately contact the bank to request to block the bank card, and at the same time, update information about new transactions from the bank after blocking the card. After that, they should proactively cancel strange transactions that the account owner did not make.

"If you lose money in your account, you can report it to the nearest police station for assistance ," said the expert.

PHAM DUY

Useful

Emotion

Creative

Unique

Wrath

Source

![[UPDATE] April 30th parade rehearsal on Le Duan street in front of Independence Palace](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/18/8f2604c6bc5648d4b918bd6867d08396)

![[Photo] Prime Minister Pham Minh Chinh receives Mr. Jefferey Perlman, CEO of Warburg Pincus Group (USA)](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/18/c37781eeb50342f09d8fe6841db2426c)

Comment (0)