The digital growth strategy has helped OPES, a young insurance company, break through in terms of revenue, market share and reputation in 2023. In 2024, the company aims to increase profits 5.5 times compared to the previous year.

Transforming through digitalization

After breakthroughs and serious investments in technology, in 2023, OPES - a member company of VPBank successfully issued more than 109.3 million non-life insurance contracts, with an accumulated customer base of up to 11 million people.

It is known that during peak times, OPES can issue up to more than 500,000 insurance policies/day and the number is expected to continue to increase in 2024.

At the end of fiscal year 2023, OPES recorded pre-tax profit (PBT) of more than VND 156 billion, an increase of nearly 140% compared to 2022. Notably, the company's total insurance business operating expenses recorded a decrease of approximately 44% compared to the previous year, thanks to optimizing the digital sales platform, increasing cross-selling in the ecosystem, helping to reduce exploitation and operating costs.

“Last year was considered a pivotal year marking major changes for OPES in terms of technology infrastructure - management and multi-channel sales, multi-partners. Upgrading technology helps OPES increase operational efficiency, shortening the contract processing process. In addition, OPES also focuses on diversifying products and sales channels to reach a wide range of customers in many segments, classes, and needs,” Mr. Dang Hoang Tung, CEO of OPES, explained the company's outstanding performance.

|

OPES invests heavily in technology with the goal of becoming a pioneering and innovative digital insurer , bringing new experiences to customers. |

Unlike the “old” insurance companies in the market, OPES aims to become a digital insurance company right from the start. Accordingly, the company has invested heavily in technology infrastructure and digital transformation activities from the inside out. This is considered a strategy to create a competitive advantage for OPES in the medium-long term by helping to optimize operating costs, improve revenue and profit.

In an effort to meet the diverse and practical needs of customers, OPES has expanded its range of insurance products, ranging from home insurance to broken screen insurance, mobile device insurance and many other products, forming a shield of maximum protection and convenience for customers' life experiences. OPES products are also contributing to complementing and enriching VPBank's ecosystem of comprehensive financial products, services and solutions.

Not only taking advantage of the existing ecosystem of parent bank VPBank to promote cross-selling on digital channels such as VPBank NEO, OPES is also cooperating to provide services to major partners inside and outside the ecosystem to expand market share in Vietnam.

Along with that, in 2023, OPES joined hands with two famous insurance brands in the market, Military Insurance (MIC) and Petrolimex Insurance (PJICO), to introduce O•CAR auto physical damage insurance products for VPBank's individual and small and medium-sized enterprise customers through the VPBank O•CARCARE program. The large-scale cooperation program brings together more than 200 branches and transaction offices, along with 132 business units nationwide, 7,370 sales staff, 460 professional appraisers, and 2,639 affiliated garages.

Based on the results achieved in 2023, OPES targets a 5.5-fold increase in pre-tax profit in 2024, equivalent to VND 873 billion. The target for original insurance premium revenue is to grow by more than 100% to enter the top 10 largest non-life insurance companies in Vietnam.

These are not small challenges in the recent period when the insurance market has been quite quiet, but they are also a great opportunity for OPES to assert itself on the big sea.

To realize these goals, OPES said it will continue to promote business, maximize the potential of insurance products in the ecosystem, and optimize operating costs.

The company is actively upgrading its D2C platform and implementing digital marketing activities to enhance its digital insurance brand. OPES will move towards digitizing the entire journey and enhancing the customer experience, becoming a pioneering and innovative digital insurance company in Vietnam in the coming years.

|

| OPES strongly develops multi-channel, multi-partner and multi-touchpoint based on advanced technology to better meet customers' needs for non-life insurance. |

In addition to its internal strength, the support from the parent corporation in terms of capital and the privilege of exploiting a customer base of up to 30 million people, nearly 1/3 of Vietnam's population, of the ecosystem is also one of the springboards that helps OPES realize its ambitious business goals in 2024 and the following years - especially in the context of the potential of the insurance industry in general and non-life insurance in particular, which still has a lot of room for development.

Data from the General Statistics Office shows that in the first quarter of 2024, total insurance premium revenue is estimated at nearly VND 53.3 trillion, down 4.3% over the same period in 2023. However, the non-life insurance sector emerged as a bright spot with growth reaching 9.8%, equivalent to nearly VND 19.6 trillion.

According to market research firm Statista, Vietnam's non-life insurance market could grow with the original premium size reaching 5.75 billion USD (equivalent to about 144 trillion VND) in 2024. On average, the level of spending on non-life insurance per capita could reach approximately 58 USD, equivalent to 1.45 million/person. However, this level of spending is still quite modest compared to developed countries like the US (3,371 USD, equivalent to approximately 84.3 million VND).

With annual GDP growth among the highest in the region and the world (2023: 5.05% - higher than global economic growth of 2.9%), along with increasing awareness and demand for physical insurance, Vietnam's non-life insurance sector is expected to grow rapidly and strongly in the coming time.

Also according to Statista, the annual growth in the period 2024-2028 of Vietnam's non-life insurance could reach about 4.55%/year.

Source: https://baodautu.vn/opes-va-hanh-trinh-chuyen-minh-nho-so-hoa-d216138.html

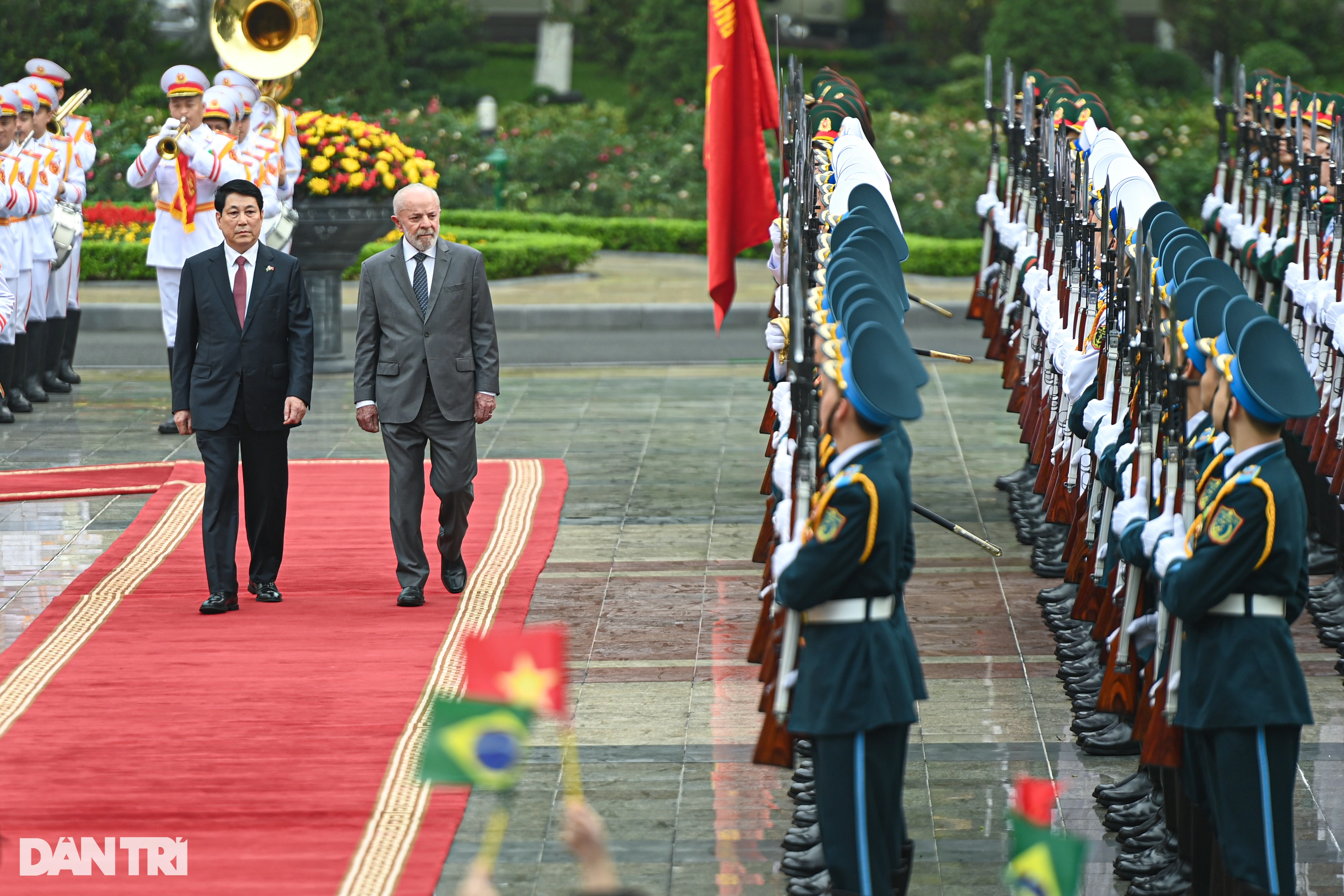

![[Photo] General Secretary To Lam receives Brazilian President Luiz Inácio Lula da Silva](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/28/7063dab9a0534269815360df80a9179e)

![[Photo] Admiring orange cotton flowers on the first "Vietnam heritage tree" in Quang Binh](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/28/7476a484f3394c328be4ac8f9c86278f)

Comment (0)