Competitive pressure from partner markets

Since the beginning of the year, exports have continued to be a bright spot in the economic picture as they have maintained impressive growth momentum. According to the General Statistics Office, export turnover in May reached 32.81 billion USD, up 15.8% over the same period last year. Of which, fruits and vegetables are one of the items with impressive export growth compared to last year. In May, the export turnover of fruits and vegetables is estimated at 700 million USD, up 7.4% over the same period.

Mr. Vu Ba Phu - Director of the Trade Promotion Department (Ministry of Industry and Trade) said that the export market space is very large for Vietnamese enterprises, however, competition for agricultural products and fruits of the same type among exporting countries is increasingly fierce.

|

| Due to geographical distance, Vietnam's seasonal agricultural exports to Canada are quite limited. Photo: Hieu Minh Vu |

Regarding the Canadian market, Ms. Tran Thu Quynh - Trade Counselor, Vietnam Trade Office in Canada, commented that many seasonal agricultural products that Vietnam has strengths in have been successfully developed by neighboring South American countries and brought to the Canadian market at competitive prices. Not to mention, due to geographical distance, Vietnam's seasonal agricultural product exports to Canada are quite limited.

Specifically, Ms. Tran Thu Quynh said that Canada's fresh vegetable import market has an average size of 3.7 billion USD and has increased steadily over the years. The main exporting countries to Canada besides the United States and Mexico are China, Guatemala, India, Spain, Peru, Honduras, Belgium, and Türkiye.

“ In 2022, Vietnam exported 4.8 million USD worth of vegetables to Canada and had an insignificant market share compared to its competitors. The main Vietnamese vegetable products exported to Canada are spices, chili padi peppers and some seasonal specialty vegetables (malabar spinach, bitter greens, sesbania flowers...) to supply to Vietnamese restaurants and Asian supermarket chains” - Ms. Tran Thu Quynh informed and said that in this segment of products, Vietnam does not have many competitors, although recently, many Asian supermarket chains have started renting farms in Mexico to grow basil and mint on a large scale.

Regarding fruit products, in 2022, Vietnam exported approximately 105 million USD worth of fruit and nut products to Canada, of which cashew nuts accounted for 80% (about 84 million USD). According to the Trade Office, the size of the Canadian fruit import market is quite large, reaching approximately 5.6 billion USD in 2022. In the period from 2018-2022, Vietnam ranked 9th in the top 10 largest exporters of fruit and nut products to Canada. Vietnam's competitors besides the United States and Mexico are Peru, Guatemala, Chile, South Africa, Costa Rica, Morocco and Türkiye.

Frankly assessing Vietnam's fruit export activities to Canada, the Trade Counselor of the Vietnam Trade Office in Canada acknowledged that, looking at the competitive structure, it can be seen that for Asian specialty fruit products, Vietnam currently does not have strong competitors.

Vietnam is still the largest exporter of items such as: dragon fruit, lemon/grapefruit, fresh coconut, and recently guava, mango, longan, durian and fresh lychee. However, in general, guava, mango and coconut items have increased slightly (the strongest increase is lemon/grapefruit at a rate of 483%). The data also shows the growing competition trend for fresh fruit items that Vietnam has strengths in such as dragon fruit, durian, longan, lychee, mangosteen from South American countries. After CPTPP, exports of these items to the area not only did not increase but also decreased steadily over the years.

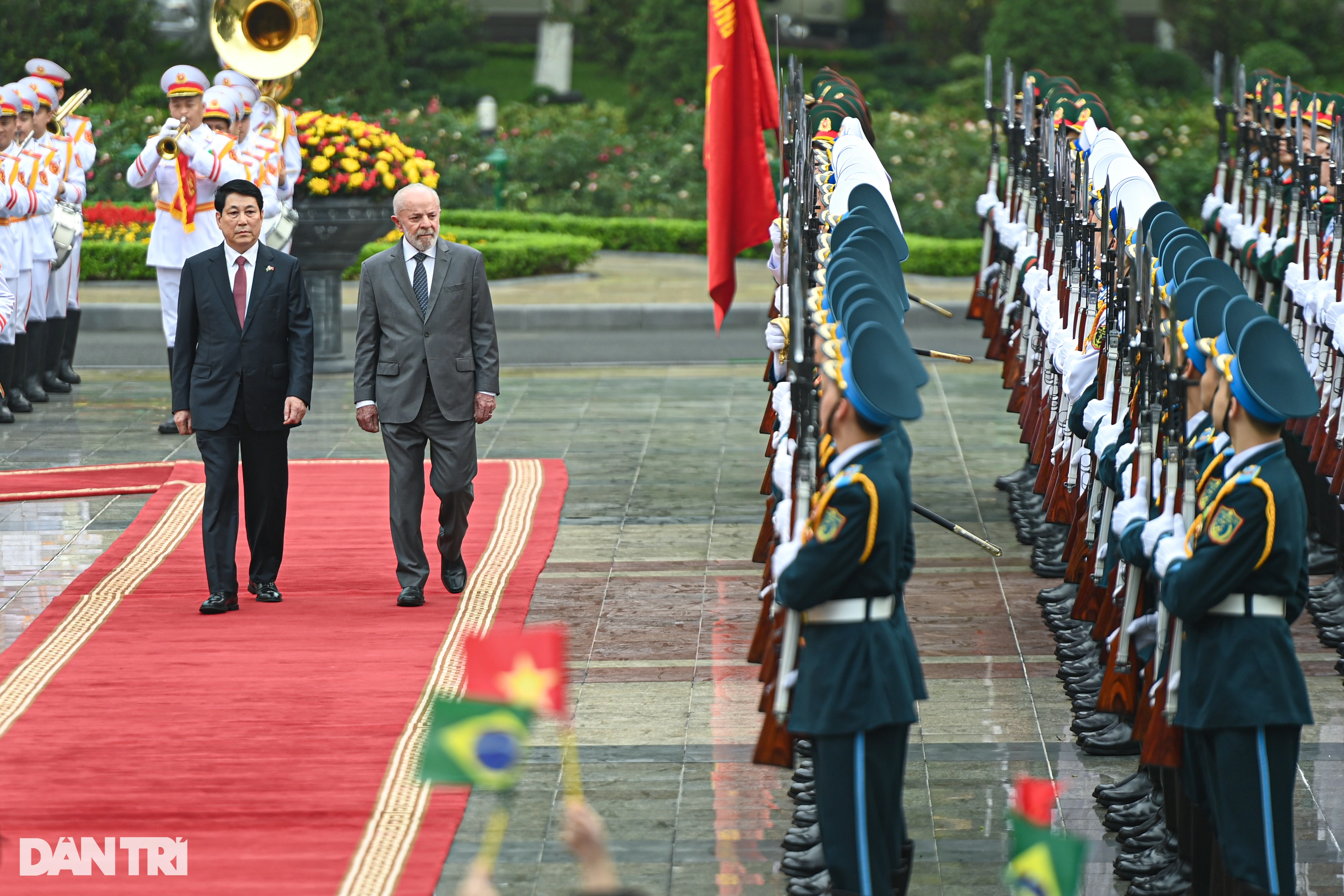

|

| In the Canadian market, Vietnamese dragon fruit, custard apple and passion fruit are under great competitive pressure with the Brazilian market. Photo: Dinh Cong Tam |

Sharing the same opinion with the Trade Office, Mr. Canada Herb - owner of a business specializing in importing Vietnamese fruits and vegetables to the Canadian market, said that currently, the business is still persistent in importing fruits from Vietnam to balance the volume with spices and vegetables, but in reality, the business is almost not profitable.

“In the Canadian market, Brazil is competing strongly with Vietnam in dragon fruit, custard apple and passion fruit. Colombia and Mexico have started to grow durian, lychee and rambutan. Tropical fruit products from South America have much better quality and price than similar products from Vietnam” - the representative of this enterprise informed and assessed that Vietnam's weakness when participating in export is unstable supply, unstable prices and high transportation costs.

In addition, Mr. Canada Herb also analyzed that in the Canadian market, Vietnamese goods are also facing great competition from Chinese traders, who are currently the distributors controlling many supermarket chains and only prioritizing imports from China. In addition, Vietnam has not yet preserved and developed traditional fruit varieties/species (jackfruit) and new fruit varieties that are popular in the market. Another weakness mentioned by this enterprise is that the network of Vietnamese buyers/traders has not yet developed to its full potential; while farmers are still chasing profits and do not care about standards.

The market is "open" but not easy-going

According to Ms. Tran Thu Quynh, the Canadian fruit and vegetable market is relatively easy to penetrate. Canada does not require market access negotiations for each product, does not require a Protocol/license for official export, nor does it require a growing area code... Canada also does not impose taxes on most fruit and vegetable products, except for some products that Canada needs to protect seasonal domestic production, which Vietnam does not have strengths in.

However, to penetrate and go deeper into this market, Vietnamese fruit and vegetable exporters also need to comply with the existing regulations of this market. Because, for fruit and vegetable products in general and seasonal vegetables in particular, Canada fully complies with the world's general regulations on the issue of hygiene and phytosanitary standards of the WTO.

That does not mean that Canada is an easy market. To enter the market, standards are always a top priority, including a variety of aspects: standards for product quality, size/weight/ripeness standards, packaging and labeling standards, hygiene standards (disinfection during harvesting, processing, packaging, storage, transportation, etc.). At the same time, it is necessary to comply with standards related to pesticide residues/additives, preservatives, permitted chemical residues on vegetables, etc. under the jurisdiction of Health Canada.

In addition, to protect the environment, imported products must also have certain certifications according to the Plant Protection Act (plant quarantine certification) and may be regulated by other laws such as the Canadian Environmental Protection Act, the Pesticide Act, etc. If the product is transited through the United States and then enters Canada, it must also comply with the regulations of the United States Department of Agriculture. Some import-controlled products to protect Canadian agriculture also require certification from Canadian-recognized agencies (apples, onions, potatoes, etc.).

The Commercial Counselor of the Vietnam Trade Office in Canada also said that for imported specialty products from other countries, Canada encourages the addition of information on processing methods, recipes, etc. Canada recognizes and encourages businesses with Global GAP, GMP, HACCP certifications, etc. Because the Canadian market is relatively small, Canadian importers often require exclusive import contracts for the items they agree to import.

Source: https://congthuong.vn/nong-san-trai-cay-viet-dang-chiu-canh-tranh-gay-gat-tai-thi-truong-canada-323526.html

![[Photo] Admiring orange cotton flowers on the first "Vietnam heritage tree" in Quang Binh](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/28/7476a484f3394c328be4ac8f9c86278f)

![[Photo] Vietnam and Brazil sign cooperation agreements in many important fields](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/28/a5603b27b5a54c00b9fdfca46720b47e)

![[Photo] General Secretary To Lam receives Brazilian President Luiz Inácio Lula da Silva](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/28/7063dab9a0534269815360df80a9179e)

Comment (0)