On the afternoon of November 5, the Trade Promotion Agency (Ministry of Industry and Trade) organized a workshop on trade promotion to Asian markets.

The Workshop on Trade Promotion to Asian Markets was held to share the potential and advantages of Vietnamese export products in the region as well as take advantage of incentives from free trade agreements (FTAs) to boost exports to Asian markets.

Providing information on the overview of FTAs within the ASEAN framework, Mr. Quyen Anh Ngoc - Head of ASEAN Department, Multilateral Trade Policy Department (Ministry of Industry and Trade) - said that in the Regional Comprehensive Economic Partnership Agreement (RCEP), countries commit to eliminating and reducing import taxes, but do not commit to export taxes. Along with that, the opening of commodity markets is similar to current ASEAN FTAs.

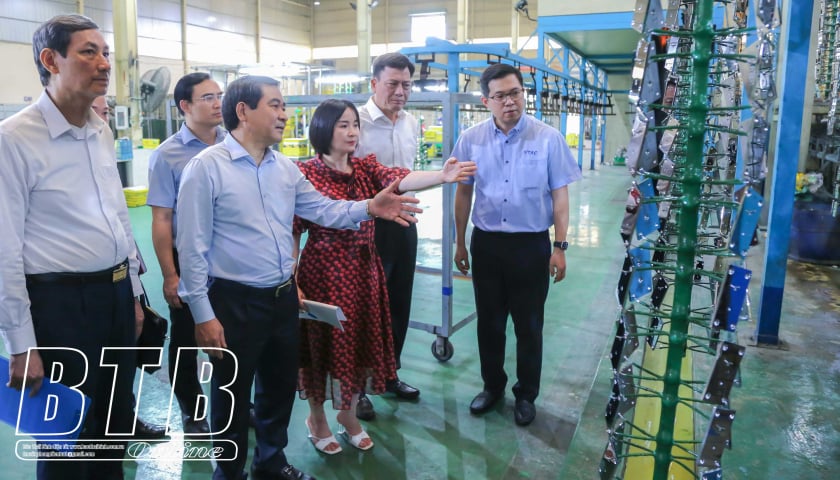

|

| Mr. Quyen Anh Ngoc - Head of ASEAN Department, Multilateral Trade Policy Department (Ministry of Industry and Trade) - provided information on the overview of FTAs within the ASEAN framework. Photo: Phuong Cuc |

ASEAN countries will eliminate tariffs for Vietnam on about 85.9%-100% of tax lines; the longest roadmap is from 15-20 years since the FTA takes effect. In addition, partner countries will eliminate tariffs for Vietnam on about 90.7%-98.3% of tax lines; the longest roadmap is from 15-20 years since the FTA takes effect.

The tax difference with this agreement is that countries apply different tariff commitments with different partners for some goods while other FTAs apply only one tariff commitment schedule.

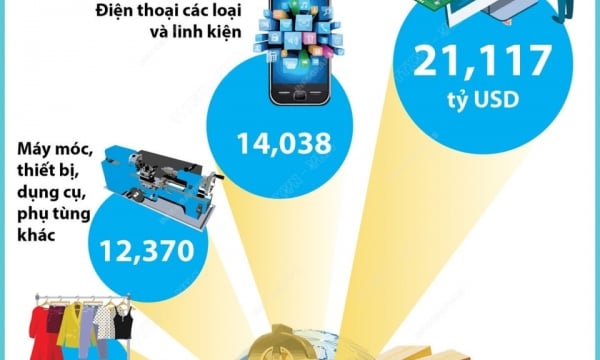

According to Mr. Quyen Anh Ngoc, some Vietnamese export products with export strengths will have their tariffs eliminated by countries immediately after the RCEP Agreement comes into effect, including seafood, meat, vegetables, fruits, and agricultural products. In addition, some types of machinery, mechanical equipment; spare parts, machinery, computers, and electronic components. In addition, there are also some groups of footwear, sandals, and parts and accessories of footwear; textile materials, textiles, clothing, and chemicals.

Regarding Vietnam's commitment to open the service market in the World Trade Organization (WTO), it commits to all 11 product lines with about 110/115 service sub-sectors (according to WTO classification) from telecommunications, finance, transportation to other services such as production-related services, audio-visual services... On the other hand, it opens all hotels, restaurants, warehouses, freight forwarding agencies, express delivery and some specialized service sub-sectors such as accounting, auditing, architecture, natural science research and development, and unmanned aircraft leasing.

In the context of a potential export market, Vietnamese goods possess many significant advantages. According to Mr. Quyen Anh Ngoc, diversifying raw material sources solves the problem of input scarcity, while preferential import taxes in the destination market create a clear competitive advantage. A transparent and favorable business environment promotes investment and business, and flexible rules of origin meet diverse market needs. In particular, simplifying transactions, customs clearance and invoice issuance significantly saves time and costs. In addition, the opportunity to participate in regional value chains expands market access.

However, to make the most of these advantages, businesses need to proactively innovate, improve their competitiveness and participate in new supply chains. Close cooperation with the Government and associations, careful study of international commitments and development of appropriate business strategies are key factors to maximize opportunities. By seizing advantages and proactively adapting, Vietnamese goods can affirm their position in the export market, contributing positively to the country's economic development.

With the goal of taking advantage of incentives from FTAs to promote exports to the Indonesian market, Mr. Pham The Cuong - Commercial Counselor in Indonesia - gave specific analysis.

|

| The workshop helps businesses take advantage of incentives from FTAs to boost exports to Asian markets. Photo: Phuong Cuc |

Firstly , Indonesia possesses favorable characteristics for Vietnamese goods such as close Asian culture, easier market than big markets such as the US, EU, Japan. The close geographical distance helps Vietnamese enterprises save on transportation costs, increasing the competitiveness of goods.

Second , Vietnamese goods have gradually asserted their position in Indonesia with increasing export turnover value and comparative advantages in many agricultural and aquatic product groups. Connecting direct flights between the two countries through Vietnam Airlines and Vietjet Air is also an advantage for Vietnamese enterprises to penetrate deeper into this market.

However, in addition to the advantages, according to Mr. Cuong, the Indonesian market also poses some challenges for Vietnamese enterprises. Enterprises need to pay attention to Indonesia's high protection measures such as quotas, import licenses, Halal certification, national standards (SNI) and import port regulations. Indonesia also frequently applies trade defense measures, and has a fragmented terrain with many islands, leading to increased logistics costs.

Realizing these challenges, Vietnamese enterprises need to proactively develop appropriate strategies to penetrate the Indonesian market, take advantage of the FTA, thoroughly understand the market's regulations and standards, and at the same time improve quality and diversify products to increase competitiveness.

Therefore, to boost exports to this market, businesses need to proactively apply for Indonesian Halal certification and SNI national standard certification. At the same time, proactively contact and closely coordinate with relevant Vietnamese agencies in case Indonesia initiates trade defense measures related to the business's products to protect their interests.

To avoid being scammed or having commercial disputes, Mr. Pham The Cuong recommends that businesses should be vigilant when they see that price and contract negotiations are taking place quickly, with little bargaining, accepting high prices; not providing or providing legal documents of the business under many different legal entities. Therefore, before signing a contract, businesses need to require their Indonesian partners to provide a certificate/business registration book (NIB) and tax identification number (TIN).

On the other hand, conduct partner due diligence through the Trade Office, the Indonesian Chamber of Commerce and Industry, Indonesian associations, and the Vietnam National Credit Information Center (CIC). In particular, businesses should note not to transfer deposits to personal accounts. Contract terms should be strict, and note the terms that protect the interests of your business; including provisions on disputes and complaints.

Source: https://congthuong.vn/nhung-luu-y-khi-doanh-nghiep-xuat-khau-sang-thi-truong-chau-a-357002.html

![[Photo] Prime Minister Pham Minh Chinh receives Mr. Jefferey Perlman, CEO of Warburg Pincus Group (USA)](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/18/c37781eeb50342f09d8fe6841db2426c)

![[UPDATE] April 30th parade rehearsal on Le Duan street in front of Independence Palace](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/18/8f2604c6bc5648d4b918bd6867d08396)

Comment (0)