(NLDO) - The cash flow of the December 23 session showed signs of spreading to small and medium-cap stocks, and this trend may not stop in the next session.

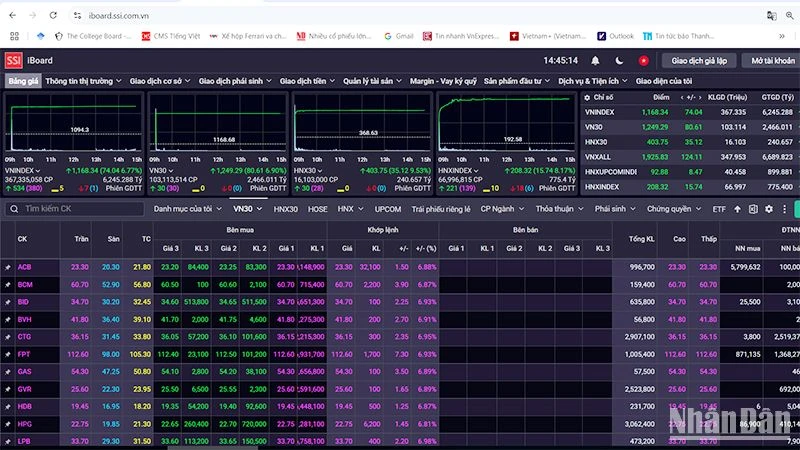

At the end of the session on December 23, the VN-Index closed at 1,262 points, up 5 points, equivalent to 0.42%.

Vietnamese stocks opened on December 23 with an increase thanks to demand from blue-chip stocks and small and medium-sized stocks, typically in codes such as CSV, NVL, HDG, DRC...

The movement of the general index in the afternoon session was similar to the morning session. Cash flow still showed signs of differentiation into small and medium-sized stocks while blue-chips played a role in keeping the pace of the market.

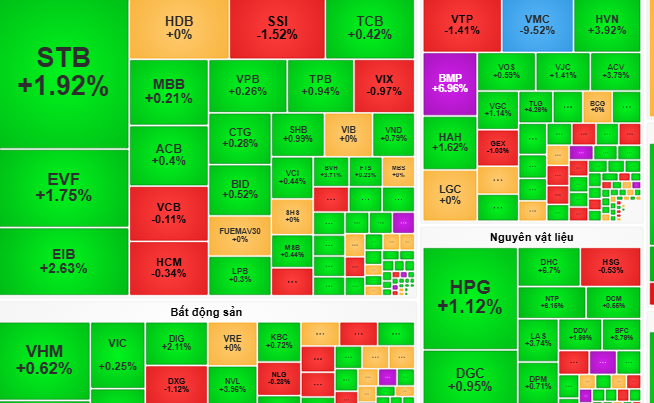

During the session, demand focused on some stocks in the aviation, steel, insurance industries... supporting the increase in points for VN-Index. Accordingly, the stocks that increased points and had an impact on the market included: HVN (+3.92%), HPG (+1.12%), BVH (+3.71%), ... On the other hand, VNM (-0.92%), SSI (-1.52%), VCB (-0.11%)... were the prominent stocks that decreased points in this session.

At the end of the session, the VN-Index closed at 1,262 points, up 5 points, equivalent to 0.42%. Liquidity decreased when only 384.7 million shares were matched on the HOSE floor.

Although the market has increased, Vietcombank Securities Company (VCBS) said that the group of blue-chip stocks has not shown its strength as the recovery amplitude is very small. Therefore, the market still needs time to verify the momentum of the increase, so the risk of correction still exists.

"Investors should limit buying stocks at high prices. Instead, they can disburse stocks that have adjusted to low prices and have the participation of demand. Some notable stock groups at this stage include fertilizer, transportation, seaports, etc." - VCBS recommends

Meanwhile, Rong Viet Securities Company commented that the liquidity of the December 23 session decreased, showing that the supply of stocks is not much but the cash flow is still limited. It is expected that the market will continue to challenge the 1,265 point area and if it overcomes this resistance area, stock trading will be active. Therefore, investors can expect the market to recover and consider taking short-term profits on stocks that have increased rapidly to the resistance area.

Source: https://nld.com.vn/chung-khoan-ngay-mai-24-12-nhom-co-phieu-nao-hut-manh-dong-tien-196241223175958821.htm

![[Photo] Unique folk games at Chuong Village Festival](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/cff805a06fdd443b9474c017f98075a4)

![[Photo] April Festival in Can Tho City](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/bf5ae82870e648fabfbcc93a25b481ea)

![[Photo] Opening of the 11th Conference of the 13th Party Central Committee](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/f9e717b67de343d7b687cb419c0829a2)

Comment (0)