Savills Vietnam said that in the second quarter of 2023, retail space in Ho Chi Minh City saw a decrease of 7,000 square meters, the lowest since the fourth quarter of 2022. In the context of many tenants returning their premises, project owners have converted the function from shopping malls to office buildings for lease.

Ms. Giang Huynh, Deputy Director, Head of Research & S22M, Savills HCMC

Convert into office for rent

Recently, after the Miniso brand returned the premises, the Thao Dien Pearl project (Thao Dien, Thu Duc City) recorded a decrease of 3,000 m2 of consumed floor area and the landlord decided to convert the retail rental area to office rental.

Not only Thao Dien Pearl, Savills also noted a number of small-scale projects under 10,000m2 in suburban areas that had to convert their functions from modern retail space to office or co-working space. Ms. Giang Huynh, Deputy Director, Head of Research & S22M, Savills Ho Chi Minh City, assessed that this trend has pointed out a reality that many retail projects for lease are facing today.

“Small-scale projects often struggle to attract diverse tenants and maintain their tenant base. Most of these projects are located in new residential areas far from the city center with business models limited to a few services such as F&B, convenience stores, hair care, etc. These are tenants who are often unable to pay high rents.

Therefore, these models are mostly financially ineffective for investors. Therefore, they tend to convert the functions of these projects to more commercially effective types," the Savills expert analyzed.

Challenges in development models

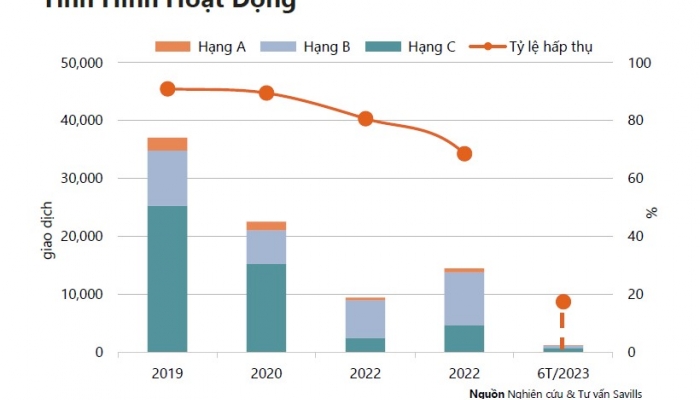

According to Savills, new supply in the first 6 months of 2023 is quite limited. The total modern retail supply in Ho Chi Minh City reached more than 1.5 million square meters of floor space, unchanged from the previous quarter. Rental prices reached nearly VND 3.5 million/square meter/month for the central area and about VND 1 million/square meter/month for the non-central area. Occupancy remained at 91%, unchanged from the previous quarter.

Ms. Tran Pham Phuong Quyen, Retail Leasing Manager, Savills HCMC

“In the first 6 months of the year, despite the difficult economic situation, we still recorded stable occupancy rates and prices. This shows a good demand in the market,” Ms. Giang Huynh assessed.

In the second quarter, there were 3 new projects, most of which were in suburban areas. A typical example is Thiso Mall Sala with a moderate scale and convenient location that can attract a variety of tenants from F&B, fashion, accessories brands to supermarkets, thereby attracting good traffic and achieving good occupancy rates.

“The occupancy rate of over 90% is partly due to the fact that the modern retail supply in Ho Chi Minh City is still small compared to the total population of 13 million people. If compared to Bangkok or other cities in the region, their total modern retail area is around 8-9 million square meters of floor space. It can be seen that the modern retail area in Ho Chi Minh City is very small compared to the great potential in terms of consumption of the city,” Ms. Giang Huynh analyzed.

Agreeing with this view, Ms. Tran Pham Phuong Quyen, Retail Leasing Manager of Savills HCMC, also said that the biggest problem of the Vietnamese retail market in the eyes of foreign tenants is the scarcity of quality premises. Vietnam is often compared to neighboring markets that have developed for many years such as Thailand and Malaysia, where there are many large, spacious premises and a series of quality commercial center projects.

Typically in Ho Chi Minh City, retail space in the central district is always sought after by large international brands that have just entered the Vietnamese market. These brands often have strict requirements on location to ensure access to many customers, the ability to have an impressive brand presence on the street or in a famous shopping center.

“However, the high occupancy rate in shopping malls requires brands to patiently wait for contracts to expire before they have a chance to take over. Meanwhile, townhouses have other obstacles including: multi-storey buildings that reduce design efficiency and space utilization, security, parking space, legal procedures for leasing... making international brands feel hesitant during the business establishment phase,” said Ms. Quyen.

Looking to the last 6 months of the year, the market will have 3 new projects located in the non-central area, with a total area of about 70,000 m2. However, because most of this supply is located in the non-central area and in new residential areas, the story of the problem of occupancy may repeat itself.

“We hope that the new retail models will be able to attract potential tenants as well as those with good financial capacity, providing interesting shopping experiences to attract consumer traffic,” added Savills experts.

Source

![[Photo] Nhan Dan Newspaper announces the project "Love Vietnam so much"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/362f882012d3432783fc92fab1b3e980)

![[Photo] Closing of the 4th Summit of the Partnership for Green Growth and the Global Goals](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/c0a0df9852c84e58be0a8b939189c85a)

![[Photo] National Assembly Chairman Tran Thanh Man meets with outstanding workers in the oil and gas industry](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/1d0de4026b75434ab34279624db7ee4a)

![[Photo] General Secretary To Lam receives French Ambassador to Vietnam Olivier Brochet](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/49224f0f12e84b66a73b17eb251f7278)

![[Photo] Promoting friendship, solidarity and cooperation between the armies and people of the two countries](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/0c4d087864f14092aed77252590b6bae)

![[Photo] Welcoming ceremony for Chinese Defense Minister and delegation for friendship exchange](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/fadd533046594e5cacbb28de4c4d5655)

![[Video] Viettel officially puts into operation the largest submarine optical cable line in Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/f19008c6010c4a538cc422cb791ca0a1)

Comment (0)