Sacombank, Vietinbank and VPBank increased SMS Banking fees from the beginning of September this year, encouraging customers to switch to receiving free notifications on the application.

The new fee schedule for automatic transaction notification service via text message, also known as SMS Banking, will be applied by Sacombank, VietinBank and VPBank from September 1.

All three banks have adjusted SMS Banking fees based on the actual number of messages generated, instead of applying a fixed monthly fee as before.

At Sacombank, the lowest SMS Banking fee is 16,500 VND per month, for accounts receiving less than 30 messages per month. For accounts receiving more than 30 SMS messages per month, the fee is 550 VND per message.

With VietinBank, the SMS Banking fee remains at 11,000 VND for accounts receiving less than 14 messages per month. If the number of SMS balance changes from 15 messages or more, the SMS Banking fee per message is 880 VND.

At VPBank, instead of the fixed monthly fee of VND12,000 as before, customers will pay a fee ranging from VND11,000 to VND77,000, depending on the number of messages generated. In addition, for transactions with a value of less than VND100,000, VPBank will not send a message notifying of balance changes to the phone but will instead send a notification on the banking application.

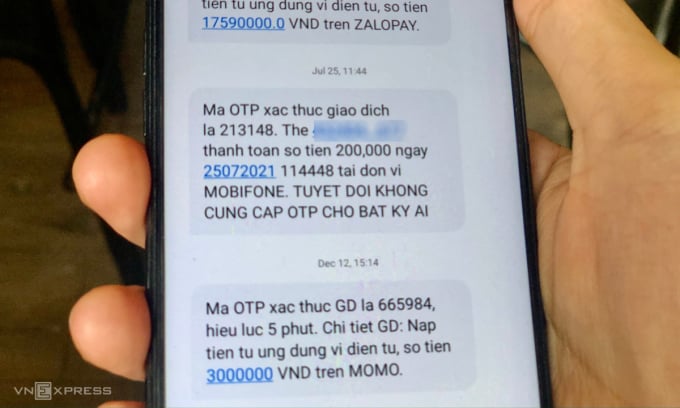

Customers receive OTP code messages. Photo: Quynh Trang

The move, which banks say is aimed at encouraging customers to receive transaction notifications via the app, has become a trend.

Since last year, Vietcombank, BIDV, Techcombank and TPBank have also considered adjusting their SMS Banking fee policies. Vietcombank and BIDV - the two state-owned giants - have temporarily postponed fee increases while they renegotiate with network operators.

For a long time, customers have been accustomed to receiving balance change notifications and one-time authentication codes (OTP) via text messages. However, banks say they are losing money from SMS Banking services because they have to pay SMS fees to network operators at three times the usual price.

Mr. Nguyen Quoc Hung, General Secretary of the Vietnam Banks Association (VNBA), once said that banks collect SMS Banking fees to pay network operators and they do not make a profit from this service.

Many banks previously offset losses from SMS Banking services by charging customers online transaction fees. However, since most online transactions are free, banks, especially those with a large customer base, have no source of revenue to offset the losses, Mr. Hung shared.

To save on SMS costs, banks have adjusted their fee policies to encourage customers to switch to using the feature of receiving notifications via the application. In addition to the free service, the advantage of receiving notifications on the application is safety, limiting the situation of fake bank messages (SMS Brand name).

Quynh Trang

Source link

![[Photo] Prime Minister Pham Minh Chinh receives Mr. Jefferey Perlman, CEO of Warburg Pincus Group (USA)](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/18/c37781eeb50342f09d8fe6841db2426c)

![[UPDATE] April 30th parade rehearsal on Le Duan street in front of Independence Palace](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/18/8f2604c6bc5648d4b918bd6867d08396)

Comment (0)