(Dan Tri) - Ms. Van's mother has only paid compulsory social insurance for 7 years, and is 8 years away from retirement age, but may soon be laid off. She wants to continue paying insurance for her mother to receive a pension.

Ms. Van said that her mother was born in September 1973, is a school worker, and has worked for 7 years (2017-2024). During this time, Ms. Van's mother participated in compulsory social insurance (SI) paid by her workplace.

According to Ms. Van, the unit's plan is to lay off some employees in the near future, including her mother. Ms. Van wants her mother to have a pension in the future to ease her burden and feel secure when she retires, so she intends to pay voluntary social insurance for her mother.

Ms. Van asked: "Will my mother's retirement age be affected when she participates in both compulsory and voluntary social insurance? If it is not affected, will my mother be able to apply for retirement benefits when she turns 59 in September 2032?"

She also wants to know how her mother's pension is calculated. During the past 7 years of participating in the compulsory social insurance regime, her mother's salary for social insurance contribution was 5.5 million VND. She plans to let her mother participate in 8 more years of voluntary social insurance with the income used as the basis for contribution also being 5.5 million VND.

According to Vietnam Social Security, Article 98 of Social Security Law No. 41/2024/QH15 (effective from July 1, 2025) stipulates: "Voluntary social insurance participants are entitled to pension when they reach retirement age as prescribed in Clause 2, Article 169 of the Labor Code and have paid social insurance for 15 years or more".

According to Decree No. 135/2020/ND-CP of the Government, the retirement age of female workers born in September 1973 is 59 years old, the time to receive pension when having 15 years of social insurance contribution or more is from October 2032.

Thus, if she has paid social insurance for 15 years or more, Ms. Van's mother will be eligible for a pension from October 2032.

Regarding the calculation of monthly pension in the case of Ms. Van's mother, Vietnam Social Security said it is stipulated in Article 99 of the 2024 Law on Social Insurance.

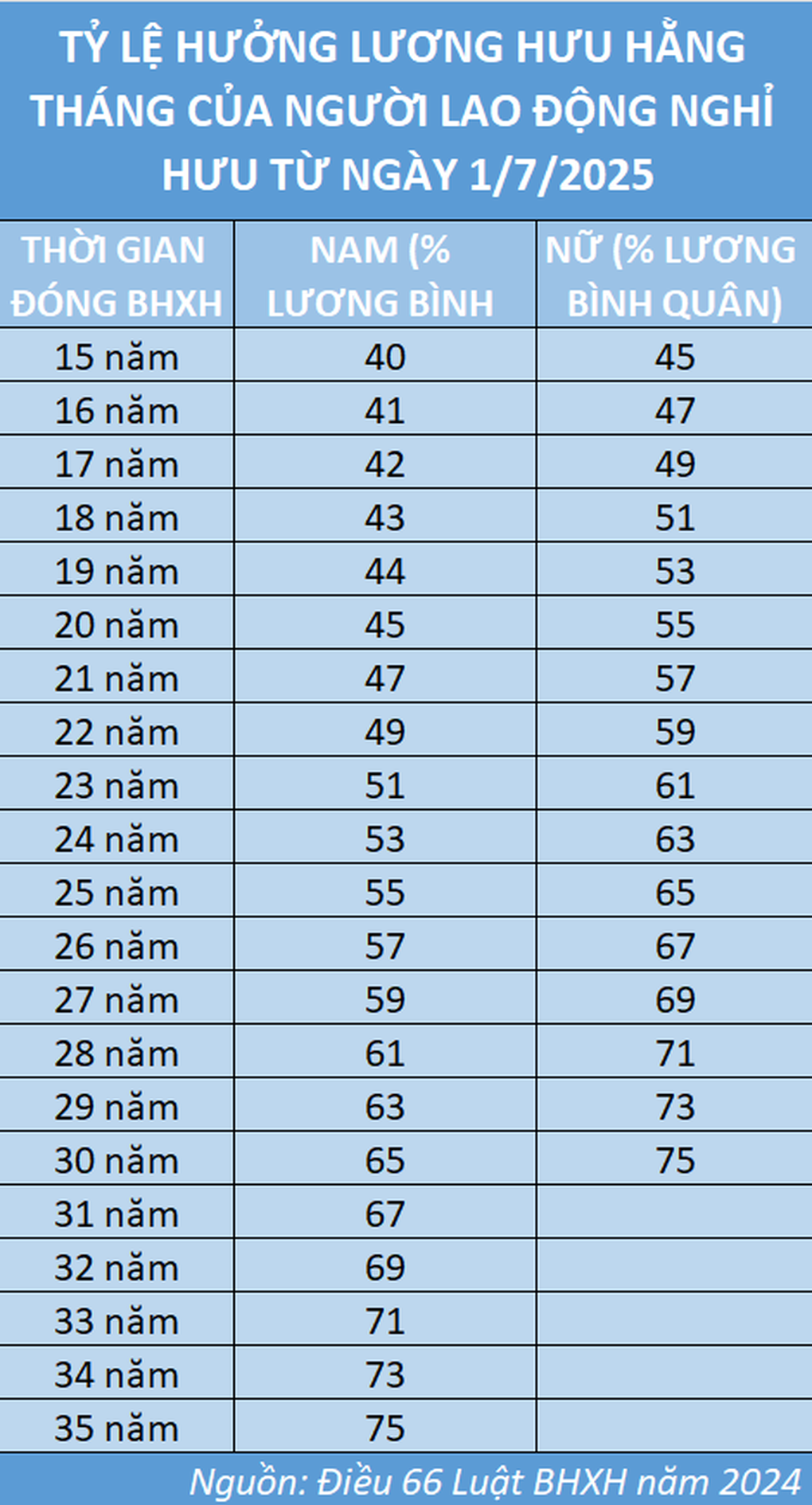

Accordingly, the monthly pension of female workers is equal to 45% of the average income used as the basis for social insurance contributions corresponding to 15 years of social insurance contributions, then for each additional year of contributions, an additional 2% is calculated, with a maximum of 75%.

Monthly pension level from July 1, 2025 (Graphic: Tung Nguyen).

The basis for paying social insurance in the case of Ms. Van's mother is stipulated in Article 104 of the Social Insurance Law 2024.

Accordingly, the average income level used as the basis for voluntary social insurance contributions is calculated by the average of the income levels used as the basis for social insurance contributions for the entire contribution period.

Monthly income for which social insurance has been paid to be used as the basis for calculating the average income for which social insurance has been paid for employees is adjusted based on the consumer price index of each period according to Government regulations.

Vietnam Social Security said: "According to the provisions of the 2024 Social Security Law, to be eligible for a pension, your mother must have paid social insurance for 15 years and be 59 years old."

According to this agency, if Ms. Van's mother continues to pay voluntary social insurance for 15 years, when calculating the average monthly salary paid for social insurance, it will include the salary of 7 years of compulsory social insurance participation and the monthly income paid for social insurance of 8 years of voluntary social insurance participation as the basis for calculating pension.

However, the calculation of pension benefits for employees is based on the development of salary and monthly income used as the basis for social insurance contributions of the entire social insurance contribution process recorded in the social insurance book, the total actual social insurance contribution period until reaching retirement age, the adjustment level of salary and monthly income for which social insurance has been paid at the time of eligibility for pension benefits...

Source: https://dantri.com.vn/an-sinh/nhan-vien-bi-tinh-gian-moi-dong-bhxh-duoc-7-nam-lam-sao-de-co-luong-huu-20250109102756775.htm

![[Photo] Close-up of Vietnam's sniffer dog team searching for earthquake victims in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/d4949a0510ba40af93a15359b5450df2)

![[Photo] Prime Minister Pham Minh Chinh meets with King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/be2f9ad3b17843b9b8f8dee6f2d227e7)

![[Photo] General Secretary To Lam receives King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/e5963137a0c9428dabb93bdb34b86d7c)

![[Photo] President Luong Cuong and King Philippe of Belgium visit Thang Long Imperial Citadel](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/cb080a6652f84a1291edc3d2ee50f631)

![[Photo] Myanmar's capital in disarray after the great earthquake](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/7719e43b61ba40f3ac17f5c3c1f03720)

Comment (0)