Nationwide, there are 471 people receiving pensions of more than 20 million VND per month, of which the highest is 124.7 million VND, according to statistics from Vietnam Social Security.

The highest pensioner resides in Ho Chi Minh City, was Chairman of the Board of Members and General Director of a company, retired in April 2015 with a pension of VND87.3 million. By June 2023, his pension will be VND124.7 million per month after the state adjusted his pension five times.

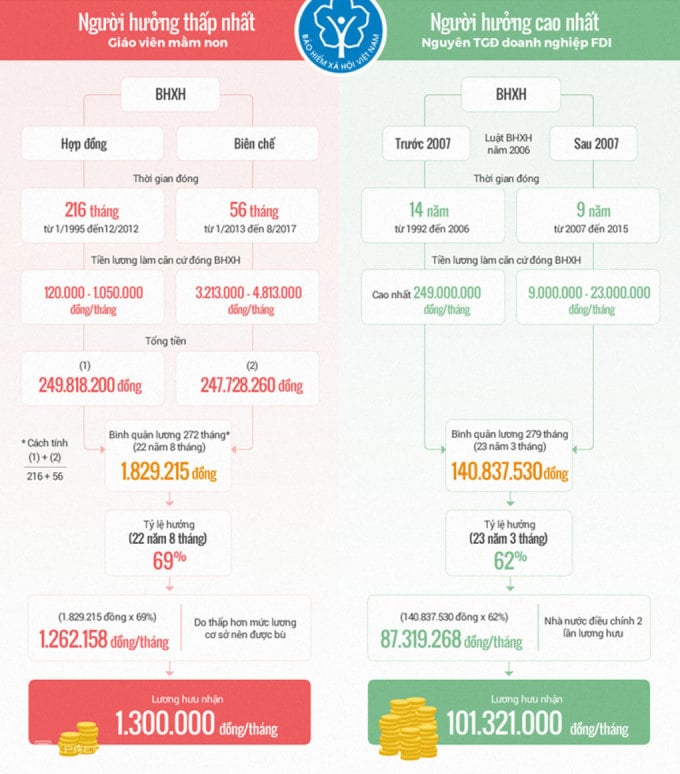

The difference in social insurance contributions and pensions of a kindergarten teacher and a leader of an FDI enterprise according to statistics in 2017. Graphics: Tien Thanh

This man has 23 years of social insurance (SI) participation, always paying at a high level, so his pension is also high according to the contribution-receipt principle. Specifically, before 2007, there was a time when his salary was more than 200 million VND per month because at that time there was no regulation on the ceiling for SI contributions.

Since 2008, the Social Insurance Law 2006 has limited the maximum compulsory social insurance contribution to 20 months of the general minimum wage. From January 2007 to March 2015, this person always paid social insurance from 15.4 to 23 million VND per month.

Vietnam Social Security said that there are 382 people receiving pensions of 20-30 million VND; 80 people receiving 30-50 million and 9 people receiving over 50 million VND per month. These people all work in private companies, joint ventures, and foreign enterprises in Vietnam. They pay social insurance according to their actual salary in foreign currency or Vietnamese currency at the highest level.

About 1.9 million people, accounting for 70% of the total number of pensioners nationwide, are receiving 3-7 million VND per month from the Social Insurance Fund. More than 67,300 people receive pensions below the poverty line (the urban poverty line is 2 million VND). In addition to pensions, the elderly after retirement age have a free health insurance card with a benefit rate of 95% when examining and treating patients.

Hanoians exercise at Thanh Cong flower garden (Hanoi). Photo: Ngoc Thanh

The pension is high or low depending on the number of years of contribution and the salary used as the basis for social insurance contribution. To reduce the pension gap between high and low contributors, the current law stipulates that the highest salary for contribution is 20 times the basic salary, or 29.8 million VND, and will increase to 36 million when the basic salary increases from July 1.

According to statistics in 2022, the average salary for social insurance contributions in the whole system is 5.73 million VND, equal to 76% of the average income of salaried workers. FDI enterprises have the highest and lowest salary for social insurance contributions in the private sector.

The management agency has noted the situation where businesses separate or transfer allowances to other benefits to avoid paying social insurance. Therefore, the salary for social insurance is currently only slightly higher than the minimum wage, plus 5-7% allowance for heavy work, hazardous work, or labor with vocational training.

This contribution level makes the pension very low. For example, a company pays an employee 20 million VND but pays social insurance based on a salary of 5 million VND. If the employee pays for the full year and retires at the right age, he or she will only receive a minimum of 45% and a maximum of 75% of the average of the entire contribution period.

To overcome the above situation, the revised Law on Social Insurance provides two salary options as the basis for calculating monthly social insurance contributions, applicable to employees in the business sector paying regional minimum wages.

Option 1 maintains the current regulations. The salary used as the basis for social insurance contributions includes salary, salary allowances and other additional amounts determined by specific amounts stated in the labor contract. This causes harm to workers because during the working process, the above amounts all change.

Option two is that the monthly salary includes the salary, salary allowances and additional amounts as prescribed by the Labor Code. In this way, the amount calculated for social insurance contributions includes both predetermined amounts and fluctuations during the employee's working process. Thus, the employee's social insurance contribution salary will be increased to receive a higher pension.

Hong Chieu

Source link

![[Photo] Prime Minister Pham Minh Chinh and Ethiopian Prime Minister visit Tran Quoc Pagoda](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/18ba6e1e73f94a618f5b5e9c1bd364a8)

![[Photo] President Luong Cuong receives UN Deputy Secretary General Amina J.Mohammed](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/72781800ee294eeb8df59db53e80159f)

![[Photo] Warm meeting between the two First Ladies of the Prime Ministers of Vietnam and Ethiopia with visually impaired students of Nguyen Dinh Chieu School](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/b1a43ba73eb94fea89034e458154f7ae)

![[Photo] President Luong Cuong receives Lao Prime Minister Sonexay Siphandone](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/337e313bae4b4961890fdf834d3fcdd5)

![[Photo] Hundred-year-old pine trees – an attractive destination for tourists in Gia Lai](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/25a0b7b629294f3f89350e263863d6a3)

![[Photo] President Luong Cuong receives Kenyan Defense Minister Soipan Tuya](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/0e7a5185e8144d73af91e67e03567f41)

![[Video] Viettel officially puts into operation the largest submarine optical cable line in Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/f19008c6010c4a538cc422cb791ca0a1)

Comment (0)