According to the resolution of the 2024 Annual General Meeting of Shareholders, Nam Mekong Group Corporation (code VC3) plans to do business this year with a revenue target of VND 1,159 billion and pre-tax profit of VND 253 billion, up 42% and 43% respectively compared to 2023. However, these are the lowest planned targets in the past 3 years of this real estate enterprise.

Is the Mekong Delta (VC3) at risk of 'breaking the plan' for 3 consecutive years? Source: TL

VC3 plans to be more cautious in the context that the enterprise has failed to meet its targets for two consecutive years. Especially in 2023, when the real estate enterprise reported record profits but only achieved 43% of the revenue plan and 33% of the profit plan (revenue plan of VND 1,873 billion, pre-tax profit of VND 546 billion).

The cautious plan is well-founded when VC3's first-half business results still grew strongly compared to the same period, but the plan implementation rate remained modest. In the first 6 months of the year, VC3 recorded net revenue of more than VND 372 billion and pre-tax profit of VND 62.5 billion, up 95% and 97% respectively compared to the same period in 2023. However, the enterprise has only achieved nearly 1/3 of the revenue plan and less than 1/4 of the annual profit target.

With the above results, VC3 still has a lot of work to do if it does not want to have 3 consecutive years of "broken plans". To be able to achieve the set goals, VC3 said it will step up research on new projects with great potential; participate in bidding for potential projects and focus on implementing projects with complete legal elements.

In addition, this year, VC3 will focus on implementing a number of projects including the Bao Ninh 2 urban area project with a scale of 18.3 hectares, implementing the high-rise segment in Bao Ninh commune, Dong Hoi city, Quang Binh province; The Charm Binh Duong high-end apartment complex project with a scale of 1.3 hectares in the new urban area, Hoa Phu ward, Thu Dau Mot city, Binh Duong province; Dong Hoi Commercial Service and Housing Complex project with a scale of 5.8 hectares in Dong Hoi city, Quang Binh province.

In fact, Bao Ninh 2 urban area is the project that has "shouldered" VC3 for the past 2 years but will not contribute significantly after 2024. In addition, VC3's projects are currently in a waiting state. Typically, The Charms Binh Duong, until the end of 2023, is still in the process of requesting approval for project transfer from Binh Duong Provincial People's Committee. After approval, VC3 will sign a transfer contract with Becamex and start implementing the project.

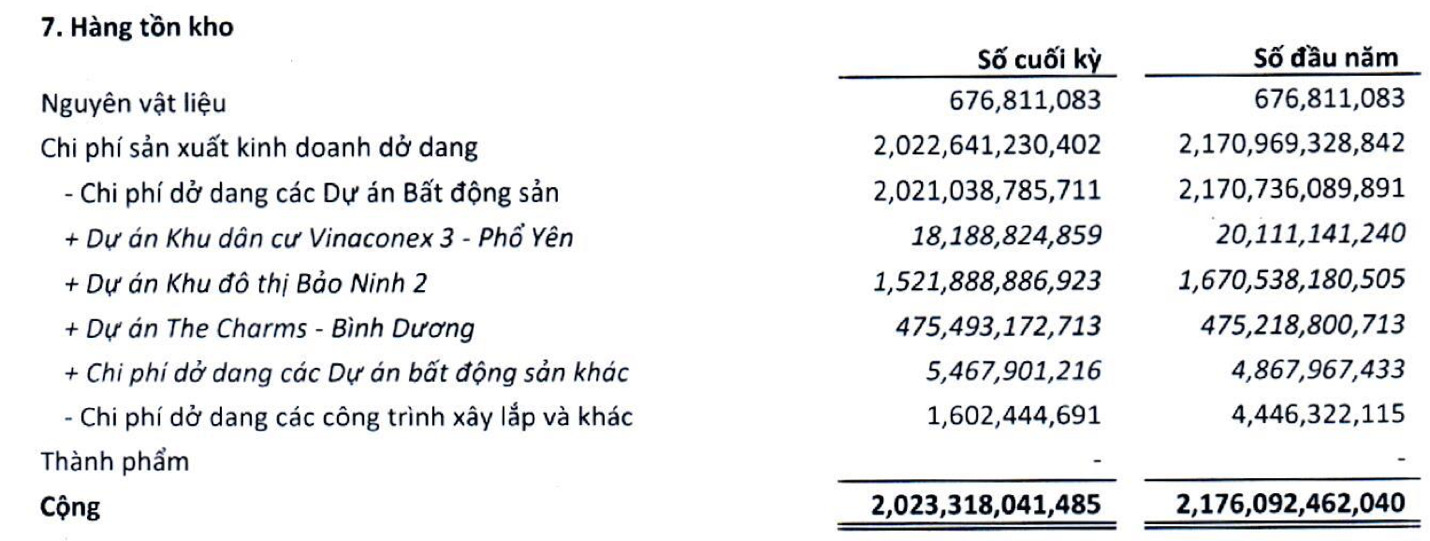

By the end of the second quarter of 2024, VC3's total assets had decreased by about VND 200 billion compared to the beginning of the year, down to VND 3,163 billion. Of which, the most notable is inventory accounting for 64% with an ending balance of more than VND 2,000 billion. Inventory is mostly located in the two urban area projects Bao Ninh 2 and The Charm - Binh Duong.

Regarding the capital source for project implementation, VC3 will issue a maximum of 37.5 million shares to existing shareholders (implemented after issuing 13.4 million shares to pay dividends in 2023). The expected amount of 375 billion VND mobilized will be used as counterpart capital to invest in implementing The Charms Binh Duong project (340 billion VND); the rest will be used to supplement capital for production activities, repay loans, pay interest, pay interest support for customers buying real estate of the company, etc.

Source: https://www.congluan.vn/nam-me-kong-vc3-thuc-hien-1-4-muc-tieu-loi-nhuan-sau-nua-nam-nguy-co-vo-ke-hoach-3-nam-lien-tiep-post306246.html

![[Photo] "Beauties" participate in the parade rehearsal at Bien Hoa airport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/155502af3384431e918de0e2e585d13a)

Comment (0)