For 6 years, Nam Mekong (VC3) has not paid a single cash dividend.

Looking at the development history of Nam Mekong Joint Stock Company, we can see two distinct stages. From 2008 to 2017 was the period when VC3 continuously paid cash dividends very regularly.

During these 9 years of operation, VC3's dividend rate was paid in cash at a rate ranging from 10% - 22% depending on the business situation each year. Only in 2016, VC3 paid a cash dividend of 5% and 29% in shares.

From 2017 to the end of 2022, VC3 will continuously pay dividends in shares and exercise the right to purchase additional issued shares.

Nam Mekong (VC3) has not paid a single cash dividend for 6 years, 80% of inventory is located at Bao Ninh 2 Project (La Celia City) (Photo TL)

Specifically, at the end of 2019, VC3 paid 2017 dividends in shares at a rate of 15%. At the same time, it issued shares to existing shareholders at a ratio of 1:1 at a price of VND10,000/share. This time, the number of additional shares issued was 28,379,461 shares, equivalent to an increase in charter capital of VND283.8 billion.

In 2021, VC3 will continue to pay dividends to shareholders in shares at a rate of 9.5% (of which 2.5% is the 2018 dividend and 7% is the 2019 dividend). This means that each shareholder owning 1,000 shares will receive 95 additional shares.

In 2022, VC3 will increase its capital again by issuing shares to shareholders at a ratio of 2:1 (each shareholder owning 2 shares will be able to buy 1 newly issued share). The newly issued shares are priced at VND 10,000/share with an issuance volume of 33,405,740 shares, equivalent to an increase in charter capital of VND 334.1 billion.

In 2023, VC3 issued shares to pay dividends at a rate of 11.5%. Thus, during the 6 years from 2017 to 2022, VC3 did not pay any dividends but only issued shares to pay dividends to shareholders. In addition, this unit has also increased the issuance of shares to shareholders twice to increase capital by hundreds of billions of VND.

Another paradox is that also in the period from 2017 to 2022, VC3 continuously reported profits from the lowest level of only 13.9 billion VND in 2020 to a 'record' profit of 73.4 billion VND in 2022, but the company could not pay a single cash dividend.

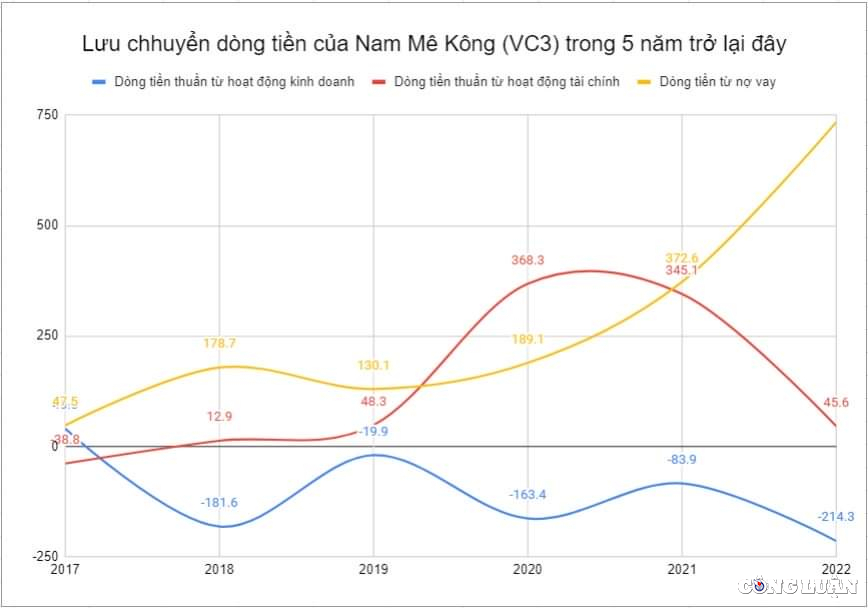

Even for 5 consecutive years, VC3's cash flow from business operations has continuously been negative by hundreds of billions of VND. This means that the company's profits have not been enough to cover operating costs over the past 5 years. And in fact, the additional source of money has only come from borrowing or issuing shares to increase capital.

5 years of negative cash flow, where does Nam Mekong get money to do Bao Ninh 2 project?

A strange thing about Nam Mekong's business operations is that during the 5 years from 2018 to 2022, this unit continuously had negative cash flow. The most positive cash flow during this period was in 2019, only negative 19.9 billion VND. The peak was in 3 years 2018, 2020 and 2022 with negative cash flow from business operations of -181.6 billion, -163.4 billion and -214.3 billion VND respectively.

For 5 consecutive years, VC3's cash flow has been negative by hundreds of billions of dong.

To compensate for this cash flow shortage, Nam Mekong must continuously increase its borrowings. The cash taken from borrowings shown in the cash flow statement from financing activities has continuously increased each year. From VND178.7 billion in 2018, it has reached a peak of VND734.6 billion in 2022.

In addition, VC3 has also increased capital twice by issuing shares to existing shareholders in 2020 and 2022. The amount of money raised from these two share issuances was VND 283.8 billion and VND 334.1 billion.

With negative cash flow of hundreds of billions of VND each year and constantly having to mobilize more from borrowing activities and increasing capital. So where has VC3's cash flow gone all these years?

Inventory up to 80% at Bao Ninh 2 project, equivalent to 1,847.7 billion VND

At the end of the second quarter of 2023, VC3's total assets reached VND 3,621.9 billion. Notably, the recorded inventory amounted to VND 2,340 billion, equivalent to 64.6% of the company's asset value.

These are all construction costs in progress at projects that VC3 is implementing. And 80% of this inventory comes from the Bao Ninh 2 project, equivalent to an inventory of up to 1,847.7 billion VND. This inventory also accounts for 51% of Nam Mekong's assets.

Another notable thing is the inventory fluctuation at the Bao Ninh 2 project. In 2022, the Bao Ninh 2 project recorded an inventory of 355.3 billion VND at the beginning of the year. By the end of 2022, the inventory was 1,911.4 billion VND. By mid-2023, the inventory of Bao Ninh 2 was still 1,847.7 billion VND.

Thus, it can be seen that throughout the past year, the inventory at Bao Ninh 2 project still accounts for a very large proportion of VC3's total assets.

Source

![[Photo] General Secretary To Lam arrives in Minsk, begins state visit to Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/76602f587468437f8b5b7104495f444d)

![[Photo] General Secretary To Lam meets and expresses gratitude to Vietnam's Belarusian friends](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/c515ee2054c54a87aa8a7cb520f2fa6e)

![[Photo] General Secretary To Lam concludes visit to Russia, departs for Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/0acf1081a95e4b1d9886c67fdafd95ed)

Comment (0)