At the end of the third quarter, Nam Long achieved net revenue of nearly VND357 billion, down 60% compared to the same period last year. After deducting the cost of goods sold, the remaining gross profit was nearly VND150 billion, less than half compared to the third quarter of 2022.

According to the explanation sent to investors, Nam Long said that the majority of revenue in the period was contributed by revenue from selling houses and apartments (accounting for 86% of total revenue in the quarter). In particular, Mizuki is a key project handed over in the period, but because it belongs to a joint venture company, it does not consolidate revenue but only records the allocated profit.

Financial revenue increased only slightly compared to the same period, while financial expenses increased by 38%, mainly interest expenses recorded at more than 66 billion VND, an increase of more than 70%.

The recorded expenses were lower, in line with the decline in business. However, this did not compensate for the poor performance. The real estate company's net profit from business activities was only over 7 billion VND, equal to 1/10 of the previous year.

The entire profit of the parent company's shareholders on the consolidated financial statements is based on the deferred corporate income tax expense for the period, at nearly VND81 billion.

Similar to the results of the first 9 months of the year, core business activities declined, in the context of an increase of nearly VND100 billion in interest expenses. As a result, Nam Long's net profit from core business activities decreased slightly compared to the same period. The profit after tax for parent company shareholders was nearly VND194 billion, up 63%, mainly due to deferred corporate income tax expenses.

Different from the growth results in the consolidated report, in the separate report, the profit figure of parent company Nam Long decreased dramatically.

In the third quarter, parent company Nam Long recorded net revenue of only over VND71 billion, mainly from project management revenue. This figure decreased sharply compared to the net revenue of over VND600 billion in the third quarter of last year.

Gross profit was only less than VND15 billion, compared to over VND200 billion in the same period. As a result, parent company Nam Long suffered a net loss of more than VND46 billion, an increase from the loss of more than VND42 billion in the third quarter of 2022.

Accumulated for 9 months, Nam Long's separate report recorded a net profit of only nearly 8 billion VND, compared to nearly 143 billion VND in the same period last year.

By the end of the third quarter, Nam Long's total consolidated assets recorded nearly VND27,700 billion, an increase of more than VND600 billion compared to the beginning of the year. Of which, the added value was mainly in inventory.

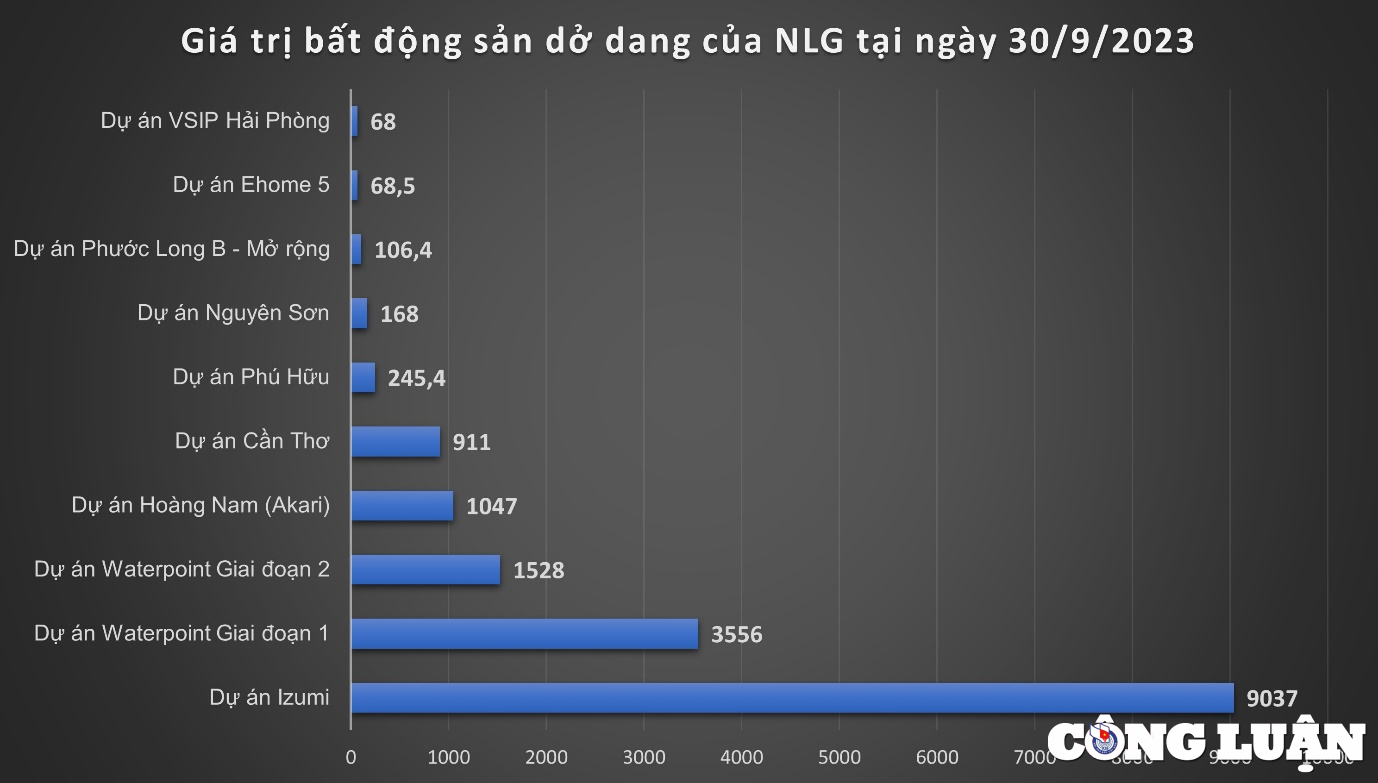

The total value of Nam Long's inventory by the end of the third quarter reached more than VND16,800 billion, an increase of VND2,000 billion compared to the beginning of the year, mostly unfinished real estate projects. In particular, the value of unfinished construction at the Izumi project was at the top, recording more than VND9,000 billion, an increase of more than VND700 billion compared to the beginning of the year. Inventory at the Waterpoint project phase 1 was VND3,556 billion, phase 2 was VND1,527 billion; Hoang Nam project (Akari) was more than VND1,047 billion...

Total liabilities by the end of the third quarter were nearly VND14,560 billion, an increase of VND790 billion compared to the beginning of the year, of which short-term financial lease debt was VND2,325 billion and long-term financial lease debt was VND3,336 billion. Total short-term and long-term financial lease debt was more than VND5,660 billion.

Nam Long's loans are mostly secured by land use rights, interest guarantee rights and some are unsecured loans. Bond loans are mainly secured by shares.

Nam Long’s biggest creditor on the banking side is Orient Commercial Bank (OCB) with a total outstanding debt of over VND1,100 billion. It is known that OCB also “holds” VND500 billion of Nam Long’s bonds.

Among notable bond debts, bondholder International Finance Corporation has an outstanding debt of VND1,000 billion, secured by more than 182.5 million Nam Long VCD shares. Some insurance companies holding Nam Long bonds include Manulife Vietnam (VND510 billion); AIA Vietnam Insurance (VND120 billion); Generali Vietnam Life Insurance (VND30 billion). These bonds are guaranteed by more than 56.1 million Nam Long VCD shares.

Source

![[Photo] Nhan Dan Newspaper announces the project "Love Vietnam so much"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/362f882012d3432783fc92fab1b3e980)

![[Photo] General Secretary To Lam receives French Ambassador to Vietnam Olivier Brochet](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/49224f0f12e84b66a73b17eb251f7278)

![[Photo] Promoting friendship, solidarity and cooperation between the armies and people of the two countries](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/0c4d087864f14092aed77252590b6bae)

![[Photo] National Assembly Chairman Tran Thanh Man meets with outstanding workers in the oil and gas industry](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/1d0de4026b75434ab34279624db7ee4a)

![[Photo] Closing of the 4th Summit of the Partnership for Green Growth and the Global Goals](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/c0a0df9852c84e58be0a8b939189c85a)

![[Photo] Welcoming ceremony for Chinese Defense Minister and delegation for friendship exchange](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/fadd533046594e5cacbb28de4c4d5655)

![[Video] Viettel officially puts into operation the largest submarine optical cable line in Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/f19008c6010c4a538cc422cb791ca0a1)

Comment (0)