► Stock market commentary March 26: VN-Index heading towards the price range around 1,340 points

At the end of the trading session on March 25, the VN-Index closed at 1,331.92 points +1.60 points (+0.12%). Accumulated to the end of the trading session, liquidity on the HSX floor reached 964 million shares (+10.93%), equivalent to VND 22,343 billion (+14.29%) in trading value.

Leading the market recovery and trading sentiment in today's session are industry groups such as: Industrial Park Real Estate (+1.21%), Electricity (+1.01%), Aviation (+0.79%), Textiles (+0.63%),... On the contrary, the adjustment pressure overshadows industry groups such as: Telecommunications Technology (-1.48%), Securities (-0.92%), Consumer Food (-0.83%),...

Need to pay attention to DPM stock

An updated report by VNDIRECT Securities Joint Stock Company shows that it maintains a neutral recommendation with a target price of VND 36,900 for shares of PetroVietnam Fertilizer and Chemicals Corporation - JSC (Phu My Fertilizer, HOSE: DPM).

According to VNDIRECT, DPM's target price was adjusted down 1.1% to VND36,900/share, still based on the DCF valuation method and target P/B with equal weight. DPM's target P/B in 2025 is 1.2x, equivalent to the three-year average P/B of businesses in the same industry from December 2021 to December 2024.

Explaining the lower target price, VNDIRECT stated: Lowering the 2025-26 EPS forecast; Increasing the WACC assumption from 10.9% to 12.2% due to raising the risk-free interest rate assumption from 2.66% to 3.0% (based on the 10-year government bond yield as of December 31, 2024) and increasing the market risk premium from 7.78% to 8.35% according to the Damodaran model.

Recommendation to buy MWG stock

A newly updated report by MBS Research recommends that investors should pay attention to shares of Mobile World Investment Corporation (HOSE: MWG).

MBS Research's market analysis team gives a positive assessment of MWG with a target price of VND 81,700/share.

"We use the SOTP method with an unchanged target price due to: Shifting the valuation model to 2025, and adjusting EPS 25-26 down 3%/7% from previous forecast. Currently, MWG has an attractive valuation with P/E 25 fw at 17.2x, lower than P/E 20-22 (19x). In addition, with the remaining foreign fund room of 3%, the market upgrade this year will be somewhat an advantage for MWG shares", MBS Research report stated.

Source: https://vov.vn/thi-truong/mot-so-co-phieu-can-quan-tam-ngay-263-post1163792.vov

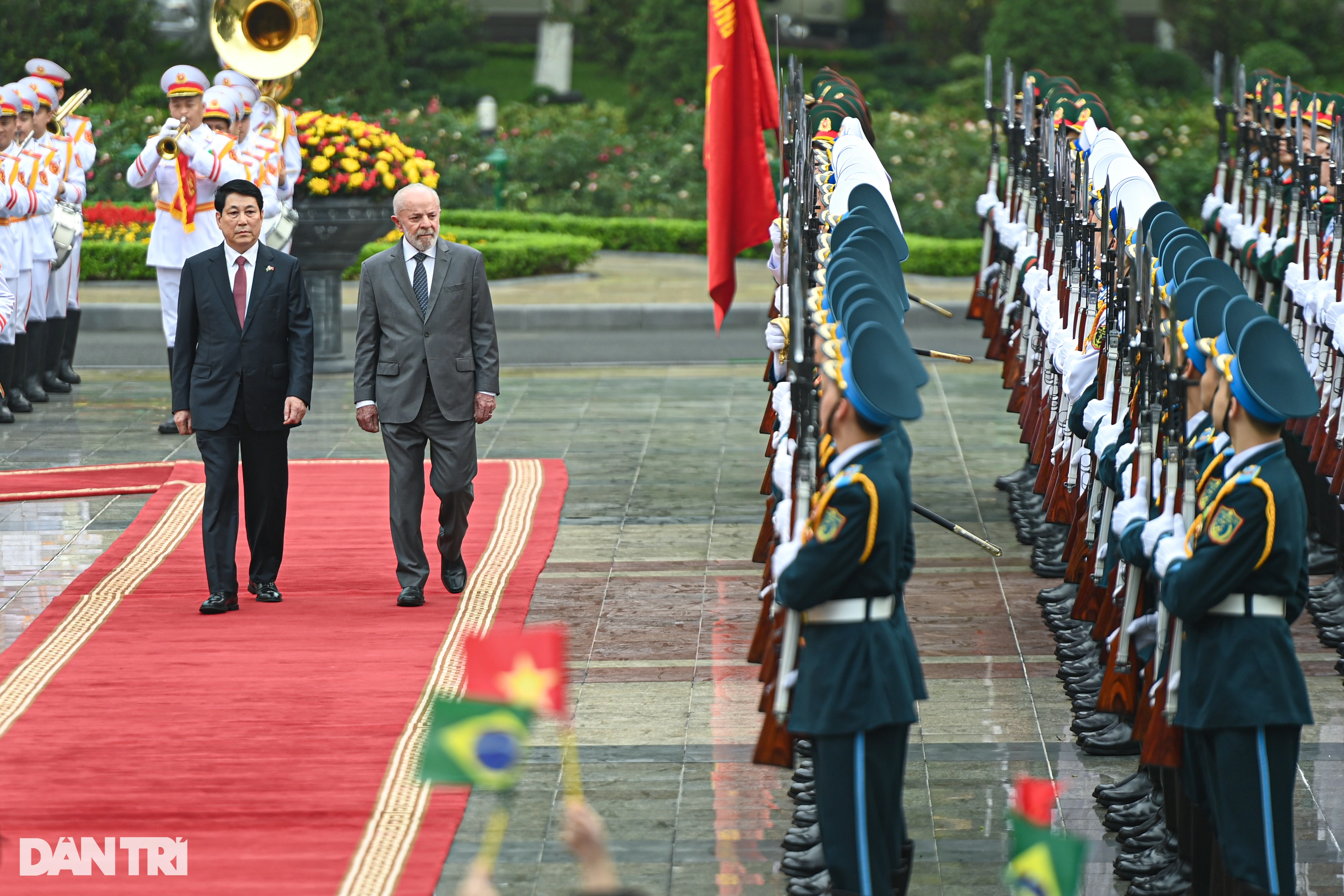

![[Photo] General Secretary To Lam receives Brazilian President Luiz Inácio Lula da Silva](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/28/7063dab9a0534269815360df80a9179e)

![[Photo] Vietnam and Brazil sign cooperation agreements in many important fields](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/28/a5603b27b5a54c00b9fdfca46720b47e)

Comment (0)