Recommendation to follow for OCB stock

According to DSC Securities Company, the third quarter 2024 business results of Orient Commercial Joint Stock Bank (OCB) declined more sharply than DSC expected due to a sudden increase in provisioning costs as the bank strived to improve its reserve buffer. The bank's asset quality also declined in line with the general industry trend. On the contrary, the bright spot came from good control of capital costs.

For 2025, based on expectations of 16% credit growth, slightly improved net interest margin and cooling provisioning pressure, we forecast OCB's total operating income and pre-tax profit to reach VND11,073 billion and VND4,452 billion, respectively.

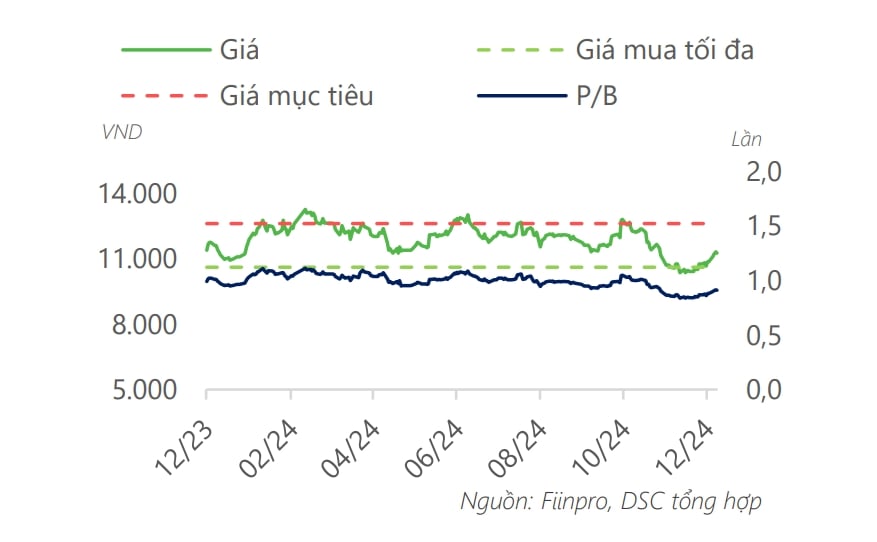

Maintain the target P/B at 0.9x, reflecting the ROE outlook lower than the industry average, the expected price for 2025 is VND 12,600/share, the safe price zone to consider disbursement is VND 10,600/share, and DSC recommends monitoring for OCB shares.

Buy recommendation for IDC stock

Vietcap Securities Company (VCSC) reaffirms our buy recommendation on IDC and raises our target price by 2% to VND71,500/share, mainly due to the impact of updating our target price from mid-2025 to end-2025.

VCSC revised up our 2024/2025/2026 profit after tax (PAT) forecasts by 4%/4%/3%, respectively, mainly due to the forecast of increased IP utility revenue, partly influenced by our slower ASP assumption for the IP segment based on the company's 9M24 business results.

VCSC forecasts that 2024F NPAT after minority interests will increase sharply by 45% YoY to VND2,000 billion, with 4Q24F mainly driven by the progress of handing over 22 ha of IP land. VCSC estimates that the unrecognized backlog at the end of 3Q24F from the handover of IP land is ~103 ha.

In 2025, VCSC forecasts NPAT after minority interest growth of 6% compared to 2024, mainly due to expectations of ASP growth and higher contributions from residential and energy segments, as well as stable IP land handover volume compared to the same period (110 ha).

Positive recommendation for HDG stock

VCSC adjusted up 5.8% target price for Ha Do Group Corporation (HDG) to VND31,000/share and upgraded recommendation from market perform to positive.

VCSC’s upward revision of the target price is mainly due to an 8% increase in VCSC’s valuation of the power segment (mainly due to an increase in hydropower gross profit forecast); higher parent company net cash balance and the positive impact of updating the target price to end-2025. These factors offset our 4% lower valuation of the real estate segment, mainly due to an 80% decrease in our valuation of the Dich Vong urban area project due to slow legal progress and disbursement of construction capital.

VCSC maintains our FY2024-2028 NPAT after MI forecasts, changing to -9%/-9%/+30%/-12%/+6% in FY2024/2025/2026/2027/2028, mainly due to an 11% increase in NPAT after MI from Charm Villas Phase 3 and a 9% increase in NPAT after MI from the power segment (mainly due to expected higher hydropower profits). These factors offset our forecasted lower Dich Vong project profits and our forecasted higher Holdco costs.

► Stock market commentary December 17: The market may fluctuate near 1,262 points

Source: https://vov.vn/thi-truong/chung-khoan/mot-so-co-phieu-can-quan-tam-ngay-1712-post1142522.vov

![[Photo] Unique folk games at Chuong Village Festival](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/cff805a06fdd443b9474c017f98075a4)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to discuss tax solutions for Vietnam's import and export goods](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/19b9ed81ca2940b79fb8a0b9ccef539a)

Comment (0)