Neutral recommendation for FPT stock

According to KB Securities Vietnam (KBSV), FPT Corporation's (FPT) revenue in the third quarter of 2024 reached VND 15,903 billion (up 22% year-on-year and 4% year-on-year), with a corresponding gross profit margin of about 38.7%. Profit after tax in the third quarter of 2024 was VND 2,478 billion (up 19% year-on-year and 8% year-on-year). In the third quarter, FPT's IT business in foreign markets saw a sharp increase in new sales of 13.5%, reaching VND 6,450 billion, thereby helping the total revenue of this segment reach VND 8,095 billion (up 26.5% year-on-year).

In the first 9 months, newly signed revenue reached VND 25,121 billion (up 21% over the same period), mainly due to the Group's early signing of new contracts since the end of 2023. In the first 9 months of 2024, FPT continued to record many large orders from foreign markets, winning bids for 33 large projects with a scale of over 5 million USD, 1.5 times higher than the same period last year, mainly concentrated in the Japanese and Asia-Pacific markets.

For 2025, the FPT AI Factory project in the field of GPU rental in cooperation with Nvdia and a number of other partners is expected to unlock growth momentum for FPT in the domestic and Japanese markets. Japan's aging population trend and the situation of insufficient supply to meet demand are ideal conditions supporting the success of the project, thereby estimated to achieve annual revenue of 100 million USD with an EBITDA profit margin of about 50%.

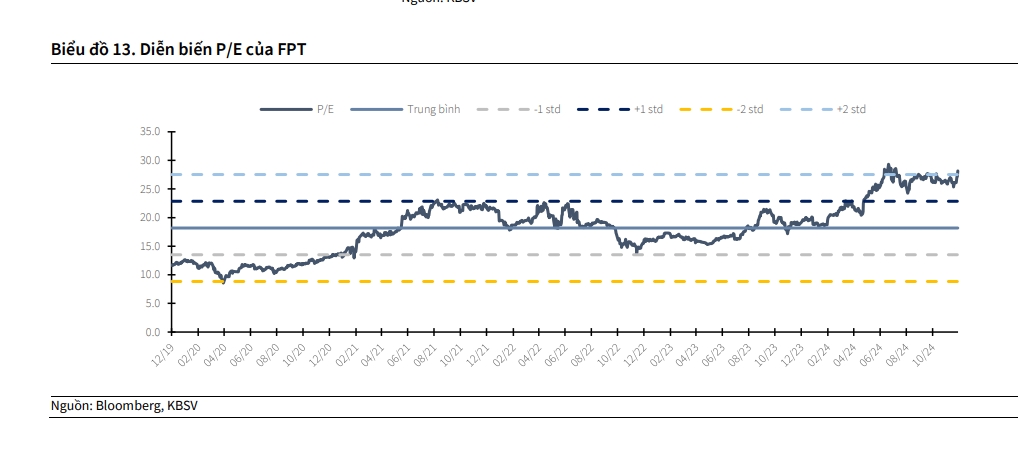

Based on FCFF and P/E valuation, business prospects as well as considering possible risks, KBSV recommends neutral for FPT stock. Target price is 148,500 VND/share.

Buy recommendation for VIX stock

Vietinbank Securities Company (CTS) recommends buying shares of VIX Securities Corporation (VIX), target price of VND 11,200/share based on the following technical analysis: Trading performance of VIX shares in the trading session on 5/124 recorded a recovery around the price of VND 10,350/share.

The stock is currently responding positively to the news of the market upgrade and has also successfully formed a positive divergence pattern on the daily chart. In the short term, VIX stock could completely enter a strong recovery rally.

CTS recommends investors to disburse VIX shares at the price of VND10,000 - 10,350/share, the target profit-taking price threshold is VND11,200/share, the expected profit percentage is 8.2 - 12%. The stop-loss threshold is when the closing price falls below VND9,500/share, the holding period is 2 - 3 months.

► Stock market commentary 12/10: The market may continue to rise

Source: https://vov.vn/thi-truong/chung-khoan/mot-so-co-phieu-can-quan-tam-ngay-1012-post1140934.vov

![[Photo] Unique folk games at Chuong Village Festival](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/cff805a06fdd443b9474c017f98075a4)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to discuss tax solutions for Vietnam's import and export goods](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/19b9ed81ca2940b79fb8a0b9ccef539a)

Comment (0)