After scouring his savings and borrowing enough 269.8 million VND, Mr. Lam paid all at once for nearly 5 years of social insurance that he still owed to wait for his pension, but for the past three years he has not received it.

Mr. Nguyen Viet Lam, 63 years old, residing in Phan Thiet ward, Tuyen Quang city, used to be the owner of an iron door processing shop. He said that in 2005, a social insurance employee came to the workshop with a flyer to persuade him: "Every month, you pay a small amount, later you will have a pension, health insurance, when you die you will have a death benefit, you will not have to bother your wife, children, society...". After nearly a year of persuasion, Mr. Lam joined "out of respect, because at that time his income was only enough to support his wife, a teacher, to raise two children."

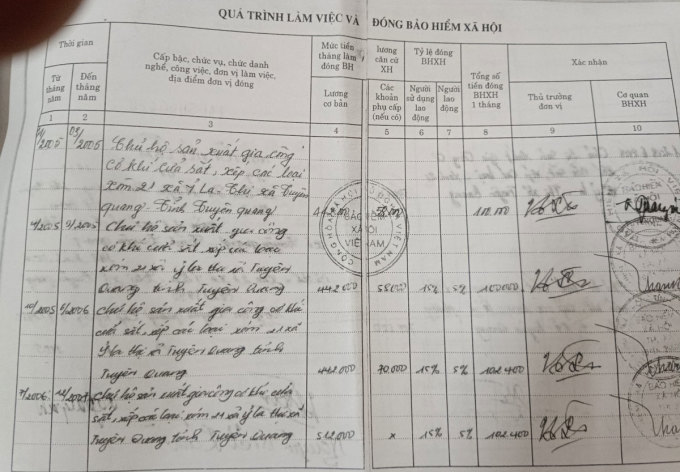

Paying as a sole proprietorship owner, his salary for social insurance at the beginning (January 2005) was 442,000 VND, allowance 58,000 VND, paid quarterly, social insurance staff came to collect. In the following years, the payment increased, he went to the post office to pay every three months.

Mr. Nguyen Viet Lam has been waiting for his pension for the past 3 years. Photo: NVCC

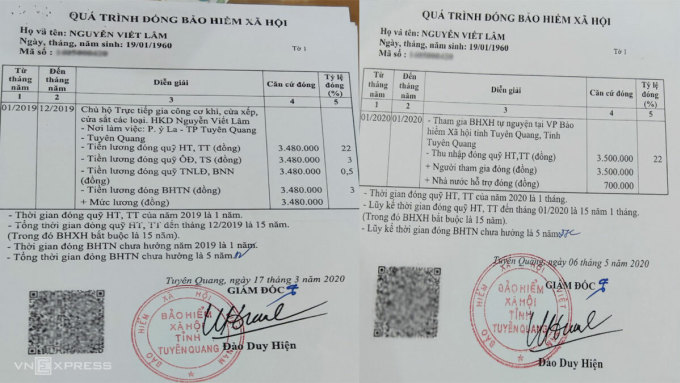

By 2019, the last year before retirement age, Mr. Lam's salary for social insurance contributions increased to 3.48 million VND. The contribution rates for the Retirement Fund, Death Fund 22%, Occupational Accident and Disease Fund 0.5%, Maternity and Sickness Fund 3% and Unemployment Insurance 3% respectively. These contribution levels and contribution rates are for people who are subject to compulsory social insurance, not business owners like Mr. Lam.

The end of 2019 was also the time when Mr. Lam turned 60 years old, the legal retirement age, but he was not eligible for a pension because he had only paid social insurance for 15 years while the law stipulates 20 years. The staff of Tuyen Quang province's social insurance called him to close the book. "After checking the documents, the consultant advised that if he had savings, he could pay a lump sum for the remaining nearly 5 years to receive a pension. Every year, the state adjusts the pension amount accordingly," he recounted.

The social insurance staff calculated that if he paid an additional 75 million VND for the remaining years, his monthly pension would be 1.4 million VND, which made him think. The two sides sat down to calculate the amount of money to pay to increase his pension to 2 million, then 2.5 million VND. Mr. Lam finally settled on a pension of 2,951,000 VND, with an additional payment of 269.8 million VND.

After scraping together his savings of 70 million VND, Mr. Lam convinced his wife and son to contribute more and borrowed from relatives to make up 269.8 million VND to pay in April 2020. He calculated that if he received a pension of nearly 3 million VND per month, he would receive about 35 million VND per year. He would pay his son that much for every penny he received, and it would be done in about 6 years. "If God lets me live to 70, that's when I'll receive my pension," he said. A month later, he still hadn't received his pension book, so he asked the Social Security officer.

When he first joined the system as a "manufacturing household head", Mr. Lam's salary as the basis for social insurance contributions was 442,000 VND, with 58,000 VND in allowance. Photo: NVCC

In the official dispatch responding to Mr. Lam dated August 31, 2021 of Tuyen Quang Social Insurance signed by Deputy Director Ha Thi Nhung, this agency cited Decree 01/2003 stipulating that individual business households are subject to compulsory social insurance. The Social Insurance Law of 2006 (expired) and 2014 (current law) continue to stipulate the above. However, the documents do not clearly stipulate that the owner of an individual business household is not subject to compulsory social insurance because he does not receive a salary and does not have a labor contract.

Tuyen Quang Social Insurance explained that the staff in charge of collecting social insurance did not fully understand the regulations, so in addition to receiving application documents and collecting compulsory social insurance from employees working under contracts for household owners, they also collected compulsory social insurance from individual business owners, which was incorrect. This problem exists because the staff "thinks simply, wanting to help people participate in compulsory social insurance". This agency "hopes that you continue to share" and wait for guidance documents from competent authorities.

"It was not until I went to claim my pension book that I found out that the owner of a sole proprietorship was not in the mandatory contribution group, while they told me to pay as much as I wanted," Mr. Lam said, adding that he had sent petitions to the People's Council and People's Committee of Tuyen Quang province many times. In February 2022, he filed a lawsuit with the Tuyen Quang People's Court, which refused to accept mediation until he could claim his pension.

Looking back at 15 years of paying social insurance and three more years of claiming retirement benefits, Mr. Lam said he trusted paying social insurance because it was a state agency, not a private one. His trust was further strengthened when he was late in paying and immediately received a letter from the social insurance agency asking him to pay 12,000 VND in interest for the delay. What made him most regretful was that he had used up all of his family's savings to pay for the remaining 5 years.

Mr. Lam's transitional payment process from late 2019 to early 2020 coincided with his retirement age. Photo: NVCC

About 300 km from Mr. Lam's house, Ms. Nguyen Thi Ha, 48 years old, and her husband, Mr. Luu Tran Chinh, 51 years old, the owner of a leather shoe business in But Son town (Hoang Hoa, Thanh Hoa) have participated in social insurance for 19 years. Since 2004, when they started their business, Ms. Ha's family paid for 7 hired workers and participated immediately at the request of social insurance officials.

She still pays social insurance for her husband and two salaried employees, but she does not remember the salary level for social insurance contributions, only that she deducts one million VND per month, paid periodically every 6 months. She also does not know whether the business owner is in the mandatory payment group or not, only affirming that she "complies with the state's social insurance payment regulations".

Mr. Lam and Ms. Ha are just two of more than 4,200 individual business owners in 54 provinces and cities who have had their social insurance collected illegally, as of September 2016. According to the Petition Committee of the National Assembly Standing Committee, many people who have paid for 20 years but have not received their pension have filed complaints and sued the provincial social insurance agency in court.

The representative of the National Assembly's Petition Committee explained that in 2003, the compulsory social insurance policy began, and individual business owners were obliged to pay insurance for their contracted employees. When paying for their employees, they also paid for themselves. Local social insurance staff "thought that the more people paid, the better, without classifying, so they collected money from people who were not eligible to pay."

The Petition Committee assessed that the collection of compulsory social insurance premiums was not for the right subjects under the responsibility of the social insurance sector, affecting the legitimate rights of individual business owners. The Committee proposed that the Government direct the Ministry of Labor, War Invalids and Social Affairs and the Vietnam Social Security to review the implementation of compulsory social insurance for individual business owners nationwide. "The Government must direct the Vietnam Social Security to learn from experience and avoid mistakes when implementing the provisions of the law on social insurance," the Petition Committee recommended.

"I just want to be paid all the months of pension and interest that have not been received in the past three years, as a way to get back the portion I have paid to pay my children. At this age, I cannot wait any longer because life is very unpredictable," Mr. Lam stated his wish. The flyer with the logo of a blue five-petal flower with the superior content of the social security policy since 2004 has worn corners and faded colors, but Mr. Lam still keeps it.

A business household owned by an individual or a group of individuals who are Vietnamese citizens aged 18 years or older with full civil act capacity, or a household, is registered to do business at one location and employs less than 10 workers.

The owner of a business household is an individual or a person in the household authorized by other members to represent the business household. This is the legal representative, with unlimited authority over their business household.

The draft revised Law on Social Insurance has just finished collecting opinions, adding business owners, business managers, and cooperative executives who do not receive salaries to the group of people who must pay social insurance. The salary used to pay social insurance for these groups will be chosen by the person himself, ranging from 2-36 million VND and after one year of payment, he can choose again.

Hong Chieu - Le Hoang

Source link

![[Photo] "Beauties" participate in the parade rehearsal at Bien Hoa airport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/155502af3384431e918de0e2e585d13a)

Comment (0)