Why bank stocks account for 50% of PYN Elite Fund's portfolio

PYN Elite Fund is allocating 50% of its portfolio to Vietnamese bank stocks and still maintains a strong view on the strong growth potential from this group.

|

| Fund manager Petri Deryng of PYN Elite Fund (Finland) |

Growth stories can still be found in the 'not so sexy' sector

Sharing in the letter to investors in the third quarter of 2024, Mr. Petri Deryng - head of Pyn Elite Fund emphasized the fund's orientation when aiming to find significant profits by investing in strong growth sectors, targeting high-growth countries. Focusing on growth companies, one of the sectors highly appreciated by Pyn Elite Fund is the banking industry.

According to Mr. Petri Deryng, the most successful investments are often growth investments, in which timing is an important factor to ensure that growth expectations are not reflected in stock valuations.

Many cases show that companies with great growth stories but with overestimated valuations are challenges in the process of finding investment opportunities. A typical example is the case of Nokia shares, which lost 80% of the value of their investment over a five-year period if they had invested in 2000, even though Nokia's net income in 2005 was still higher than in 2000.

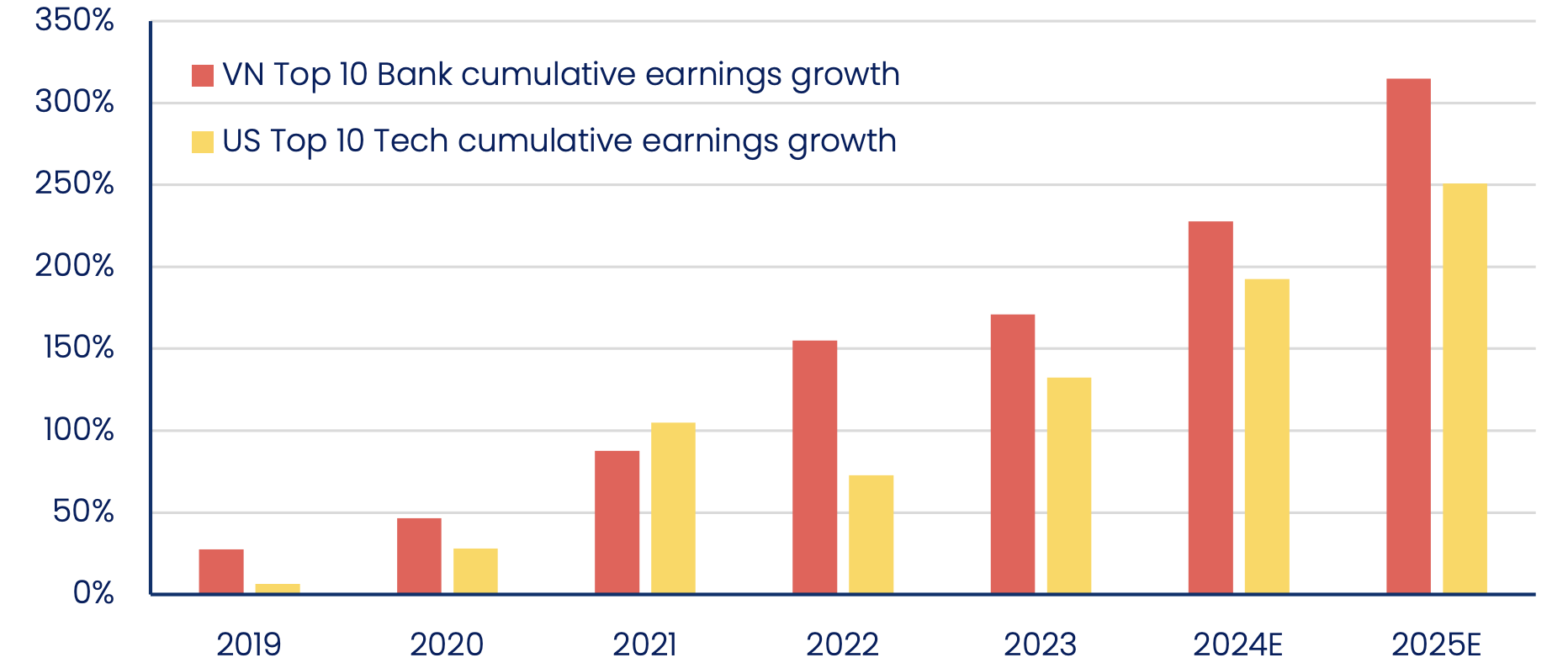

“Growth stories can still be found in the ‘not so sexy’ sector if the right country is chosen to invest. In the right country, the risk of identifying growth companies can remain reasonably low, even if the expected returns are quite attractive,” said Mr. Petri Deryng. According to the head of the Pyn Elite Fund, the results were “astonishing” when comparing the 10 largest banks in Vietnam with the 10 largest technology companies in the United States. Over the period 2019–2025, the income growth of Vietnamese banks was actually slightly better than that of US technology companies.

|

| Profit growth of top 10 Vietnamese banks and top 10 US technology companies |

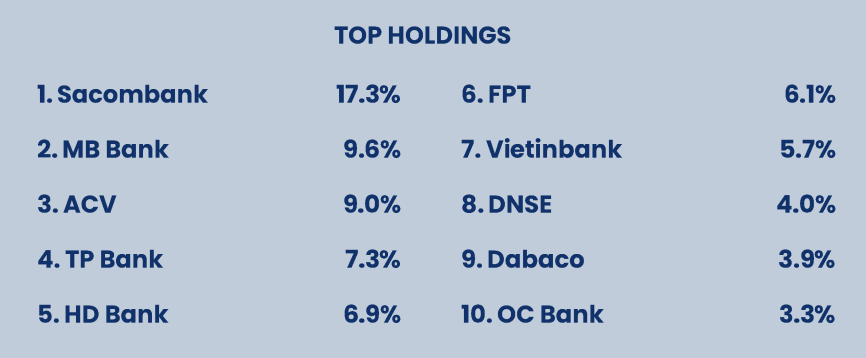

PYN Elite Fund's investment portfolio is currently allocated up to 50% to Vietnamese banks. This, according to the fund's head, represents a significant strategic investment. With the orientation of seeking significant profits by investing in strong growth sectors, the fund allocates the majority of its portfolio to specific businesses with the goal of generating the most attractive profits compared to the assessed risks.

Sharing the reasons for choosing banking stocks, Mr. Petri Deryng said that Vietnamese banks tend to achieve significant industry growth over several-year cycles. Banks' earnings continue to increase even during years when the stock market is gloomy and some cyclical industries announce surprising profits.

Banks are increasing their provisions, slowing their profit growth. However, thanks to the profit growth, banks' equity continues to increase. The head of PYN Elite Fund predicts that the P/B ratio of some bank stocks in the fund's investment portfolio will fall below 1.0 times in the next 6-12 months, unless the stock price increases dramatically.

|

| Top 10 stocks in PYN Elite Fund's portfolio at the end of August 2024 |

“Banks remain a large weighting in the PYN Elite portfolio. Our view on the strong growth potential from banking stocks remains firm. We are in the process of reallocating some weightings among individual banking stocks depending on the actual performance of each stock compared to our earnings expectations,” said Petri Deryng.

Vietnam stocks will have some pretty significant price increases.

Assessing the recent 18-month period, PYN Elite Fund representative said that the Vietnamese stock market has gone through “a challenging period”. However, while the market has not had many reasons to trade well, the growth rate of earnings of listed companies in Vietnam is now starting to accelerate again.

With forecasts for listed companies' profits in 2024, Mr. Petri Deryng believes that the P/E of the stock market will be at 11.9 times. With forecasts for business results in 2025, the P/E ratio will decrease to 9.9 times.

The head of PYN Elite Fund highly appreciated the possibility that "the stock market cannot maintain such low valuations for a long time". Earnings growth will push the stock market up. According to him, there will even be times when the stock market has quite significant price increases when domestic and foreign investors increase their investment in Vietnam. In Mr. Petri Deryng's opinion, market uncertainty is being replaced by positive expectations of earnings growth in the coming years and positive trends in monetary policy around the world.

The statement of the Chairman of the US Federal Reserve (Fed) in August and the strong actions in the interest rate decision meeting on September 19 showed the trend of shifting from fighting inflation to promoting employment. This, according to the representative of the fund from Finland, will be an important turning point for emerging markets. In the next few years, the actions of the Fed or ECB will likely give the State Bank of Vietnam more room to implement the most optimal monetary policy for growth by reducing concerns about exchange rates, interest rates and cash flows.

While Vietnam's financial market has been struggling due to domestic issues, Indian stocks have performed remarkably in recent times. PYN Elite Fund believes that similar performance can be achieved in Vietnam, as the market is supported by a strong recovery in listed companies' business results and reasonable valuations.

There are still challenges in opportunities

In addition to the opportunities from market valuations, Mr. Petri Deryng also emphasized the risks that need attention. In particular, sudden strong fluctuations in the US stock market are likely to have a widespread impact in the short term on all stock markets around the world, including Vietnam. In recent times, the Vietnamese and US stock markets have had a relatively low correlation because fluctuations in the US stock market are largely affected by technology stocks, while the number of this group in Vietnam is not large.

Mr. Petri Deryng said that it is necessary to prepare for high volatility in technology stocks in the future. However, even if this happens, the impact on the Vietnamese market is expected to be relatively small.

Second, the representative from PYN Elite Fund also noted that the Fed's interest rate cut could be a consequence of expectations of slower economic growth in the world's number one economy in the next few years. Together with the slowing growth rate in China, this could create a rather gloomy outlook for the global commodity market, which could be accompanied by negative impacts on emerging markets whose export activities are heavily dependent on commodities, even if they benefit from the Fed's interest rate cut.

Source: https://baodautu.vn/ly-do-co-phieu-ngan-hang-chiem-toi-50-danh-muc-dau-tu-cua-pyn-elite-fund-d226192.html

Comment (0)