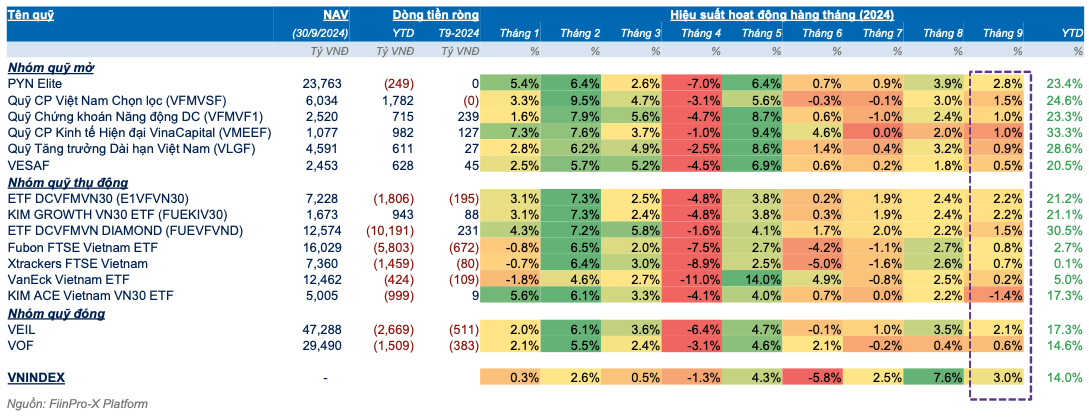

Fiingroup's report on investment fund performance in Vietnam shows that many stock investment funds are recording performance far exceeding the VN-Index.

|

Specifically, in September 2024, 87% of equity funds (55/61 funds counted) recorded performance exceeding the VN-Index, led by ETFs such as SSIAM VNFINLEAD and KIM Growth VN30 ETF, with performance of 5% and 4.4% respectively thanks to their portfolios of stocks in the banking and securities sectors. Two other investment funds, United Vietnam Opportunity Fund and TCFIN, also had performance of over 4%.

However, overall performance declined compared to August 2024 due to a less favorable overall market environment. Compared to August 2024, most funds performed lower in September 2024 amid a less favorable overall market environment with liquidity falling for the third consecutive month to its lowest level in nearly a year; retail investors increased net selling and there was no leading sector.

Since the beginning of 2024, the VN-Index has increased by 14%, while 38/61 stock investment funds recorded growth far exceeding the VN-Index. Notably, the VinaCapital Modern Economic Stock Fund (VMEEF) increased by 33.3%, the DCVFMVN Diamond ETF (FUEVFVND) increased by 30.5% and the Vietnam Long-Term Growth Fund (VLGF) increased by 28.6%. The common point of these 3 funds is that they all have FPT and ACB in their top holdings. Many other investment funds also have high performance of over 20% such as PYN Elite, VFMVF1, VFMVFS, VESAF, E1VFVN30 and FUEKIV30.

|

Performance of some prominent equity funds. |

In the group of bond investment funds, 17/23 funds recorded profits better than savings interest rates.

Leading in September was Bao Viet Bond Investment Fund (BVBF) with an increase of 1.1% - the fund's best monthly performance since the beginning of 2024. BVBF's holdings include VietinBank (CTG) bonds and Agribank bonds.

In contrast, Techcom Bond Fund (TCBF) had a much lower performance (0.3%) when holding mainly corporate bonds of Masan, Vingroup and Novaland. However, in terms of cumulative 9 months, this was the bond fund with the highest performance (11.5%), far surpassing the second-ranked fund with a performance of 8.9%, Lighthouse Bond Fund. TCBF also recorded its 8th consecutive month of net capital inflow, reaching 6.9 trillion VND, accounting for 62% of the total net inflow value of bond funds in the past year.

The signal was also more positive when capital inflows into the Vietnamese stock market through investment funds were positive in September 2024, with a net inflow value of more than VND 1.1 trillion after being withdrawn for 9 consecutive months before. Capital inflows maintained a net inflow trend in the open-end fund group, reaching VND 655 billion, while closed-end funds and ETFs were withdrawn net, but the withdrawal momentum has "cooled down" compared to before.

Investment capital flows into bond funds continued to maintain net inflow momentum in September 2024, reaching VND 2.1 trillion, up 18.3% compared to August 2024. This is the 10th consecutive month of positive net inflows and the highest level since the beginning of 2024.

Source: https://baodautu.vn/loat-quy-dau-tu-co-phieu-chien-thang-thi-truong-d227378.html

![[Photo] Promoting friendship, solidarity and cooperation between the armies and people of the two countries](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/0c4d087864f14092aed77252590b6bae)

![[Photo] General Secretary To Lam receives French Ambassador to Vietnam Olivier Brochet](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/49224f0f12e84b66a73b17eb251f7278)

![[Photo] Nhan Dan Newspaper announces the project "Love Vietnam so much"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/362f882012d3432783fc92fab1b3e980)

![[Photo] National Assembly Chairman Tran Thanh Man meets with outstanding workers in the oil and gas industry](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/1d0de4026b75434ab34279624db7ee4a)

![[Photo] Closing of the 4th Summit of the Partnership for Green Growth and the Global Goals](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/c0a0df9852c84e58be0a8b939189c85a)

![[Photo] Welcoming ceremony for Chinese Defense Minister and delegation for friendship exchange](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/fadd533046594e5cacbb28de4c4d5655)

![[Video] Viettel officially puts into operation the largest submarine optical cable line in Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/f19008c6010c4a538cc422cb791ca0a1)

Comment (0)