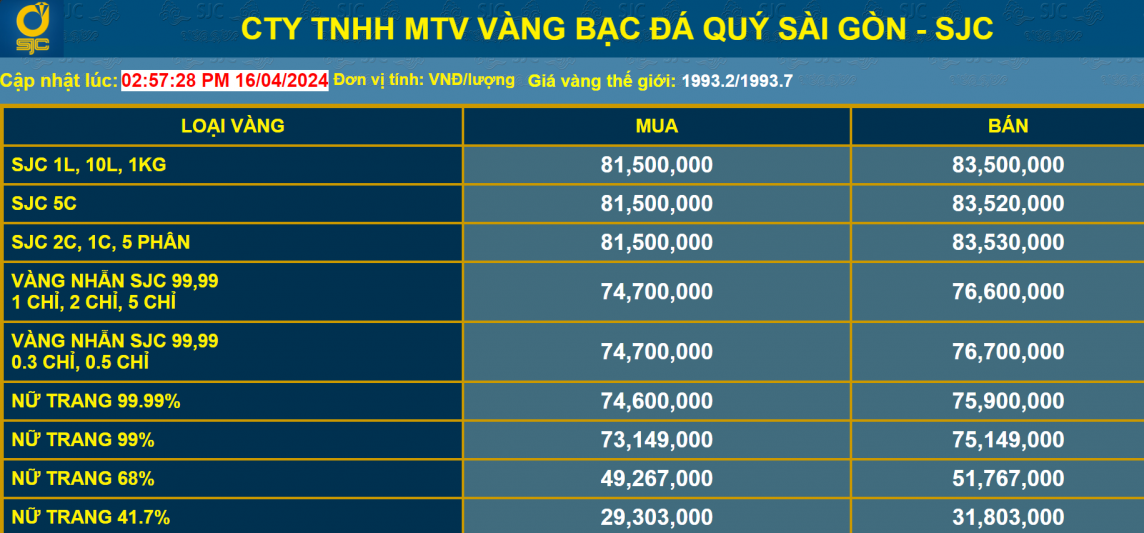

At 4:00 p.m. on April 16, 2024, the domestic SJC gold price decreased sharply compared to the early morning of the same day. Saigon Jewelry Company Limited - SJC listed it at VND 81.5 million/tael for buying and VND 83.5 million/tael for selling.

Compared to the early morning of the same day, the price of SJC gold at this unit was adjusted down by 600,000 VND/tael for buying and up by 620,000 VND/tael for selling. The difference between buying and selling prices at this unit is currently at 2 million VND/tael.

|

| Gold price listed at Saigon Jewelry Company Limited - SJC. Screenshot at 4:00 p.m. on April 16, 2024 |

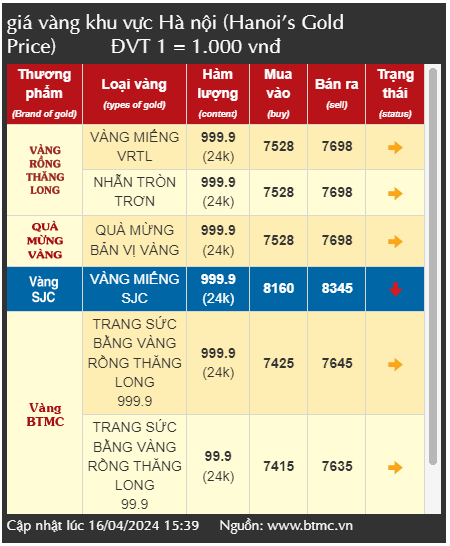

At the same time, the price of SJC gold at Bao Tin Minh Chau was also adjusted up and down in opposite directions. At 4:00 p.m., this unit listed the buying price of SJC gold at 81.6 million VND/tael and the selling price at 83.45 million VND/tael.

Compared to the early morning of the same day, the price of SJC gold at this unit was adjusted down by 150,000 VND/tael for buying and 500,000 VND/tael for selling. After slightly adjusting the buying price and sharply reducing the selling price, the difference between buying and selling prices at this unit is at 1,850 million VND/tael.

|

| Gold price listed at Bao Tin Minh Chau. Screenshot at 4:00 p.m. on April 16, 2024 |

According to some experts, the domestic gold price suddenly turned down today because the gold market has just received news that in order to increase supply to the market, the State Bank is preparing to bid for SJC gold bars after 11 years of suspension. Currently, there are 26 units, including commercial banks and gold trading enterprises, establishing gold bar trading relationships with the State Bank. Of these, about 15 units are qualified to participate in the bidding.

Along with that, the gold bar auction also aims to reduce the gap between domestic and international gold bar prices.

In fact, since yesterday afternoon, when the State Bank announced that it would auction gold bars, the price of SJC gold has dropped sharply, down by more than 1 million VND per tael. From 3:00 p.m. on April 15, 2024 to 4:00 p.m. on April 16, 2024, the price of SJC gold at Saigon Jewelry Company Limited - SJC decreased by 900,000 VND/tael for buying and 1.1 million VND/tael for selling.

However, many experts believe that the solution of auctioning SJC gold bars to supplement the gold supply to the market is only a short-term solution to cool down gold prices, before waiting for the amendment of Decree 24/2012/ND-CP of the Government on gold market management.

|

| In the context of the current sharp drop in gold prices, many investors and people have sold their gold, fearing that the price will continue to fall. Illustrative photo |

In the context of the current sharp decline in gold prices, many investors and people have sold their gold because they are worried that the price will continue to decrease in the coming days. Ms. Huong Lan (Nghia Tan, Cau Giay, Hanoi) said that today she just brought the gold rings she bought for investment and storage at the end of last year because the profits so far have been attractive. "The domestic gold market is on a downward trend after the Government's close management instructions. If you are "greedy" for profit and hold gold for a while longer, if the gold price increases, the profit will be higher, but if the gold price decreases, the profit will be less, even a loss" - Ms. Huong Lan shared.

Sharing the same view, today Ms. Thanh Thao (My Dinh, Hanoi) also brought gold to sell because the profit was extremely attractive. "I bought gold rings at Bao Tin Minh Chau for 66 million VND/tael, this afternoon the price of gold rings at this unit was still at 75 million VND/tael for the afternoon purchase. Thus, for each tael of gold invested, I made a profit of about 900,000 VND per tael" - Ms. Thanh Thao shared and said that this is a quite high profit compared to the initial calculation when buying gold for investment.

Giving advice to investors who have previously held gold, many experts recommend that if the profit level is attractive, investors and people should sell and take profit. At this time, investors should limit buying gold to store, waiting for management instructions from the Government or the State Bank. If buying gold when the price is at its peak, investors face the risk of greater losses.

Forecasting the price of gold in the coming time, some experts believe that the price of gold will continue to be affected by the world market. The escalating tension between Iran and Israel is pushing economists to rush into the gold market. The demand for gold is still very strong and there is no sign of a decrease in demand for this precious metal. The world price of gold still has room to increase due to the demand for gold from Asia. Analysts at Kitco also believe that gold is still maintaining its upward momentum and will continue to increase in the coming time, despite the fact that high inflation may force the US Federal Reserve (Fed) to maintain high interest rates.

Source

![[Photo] Promoting friendship, solidarity and cooperation between the armies and people of the two countries](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/0c4d087864f14092aed77252590b6bae)

![[Photo] General Secretary To Lam receives French Ambassador to Vietnam Olivier Brochet](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/49224f0f12e84b66a73b17eb251f7278)

![[Photo] National Assembly Chairman Tran Thanh Man meets with outstanding workers in the oil and gas industry](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/1d0de4026b75434ab34279624db7ee4a)

![[Photo] Closing of the 4th Summit of the Partnership for Green Growth and the Global Goals](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/c0a0df9852c84e58be0a8b939189c85a)

![[Photo] Nhan Dan Newspaper announces the project "Love Vietnam so much"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/362f882012d3432783fc92fab1b3e980)

![[Photo] Welcoming ceremony for Chinese Defense Minister and delegation for friendship exchange](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/fadd533046594e5cacbb28de4c4d5655)

![[Video] Viettel officially puts into operation the largest submarine optical cable line in Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/f19008c6010c4a538cc422cb791ca0a1)

Comment (0)