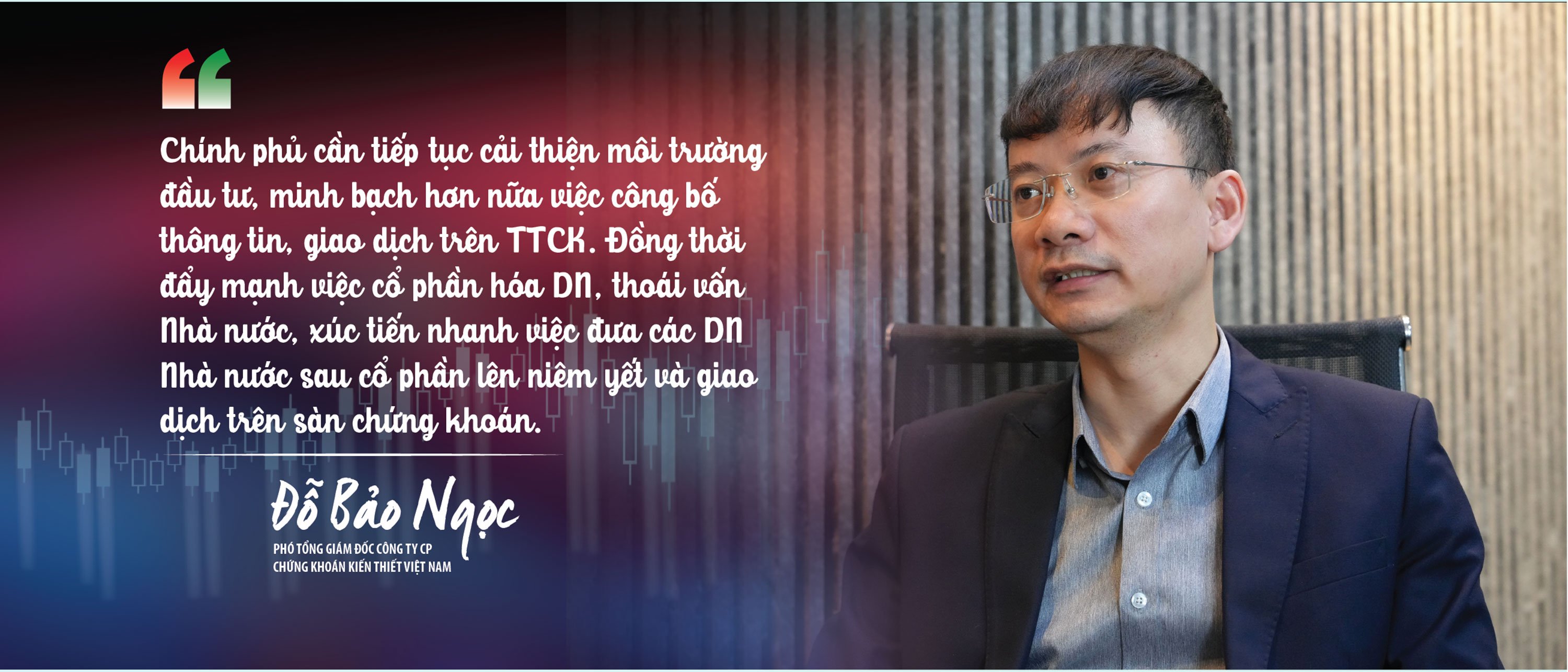

Speaking to reporters of the Economic & Urban Newspaper, Deputy General Director of Vietnam Construction Securities Joint Stock Company Do Bao Ngoc said.

After 2023, the stock market had many ups and downs, but there were still bright spots through improved liquidity as well as a positive increase in the number of newly opened investor accounts. How do you evaluate the market over the past year?

Vietnam's stock market in 2023 will experience many fluctuations and be under great pressure from the complicated developments of the international stock market. The main reasons are the decline in growth of major economies, persistent inflation, prolonged monetary tightening policies of major economies, and increasingly complicated geopolitical tensions. For the whole year, the average trading value reached VND 17,492 billion/session, down 13.3% over the same period last year. Along with that, the capitalization and listing scale of the stock market continued to increase, continuing to attract the active participation of investors.

Liquidity is still well maintained, averaging VND 10,000 billion/session, with an average of 800 million shares matched/session. The peak is VND 20,000 billion with 1.2 billion shares/session. Although this figure is not as high as in 2022, this is the low zone of the index and with this trading value and liquidity, this is a positive thing, because the principle of the market is that the higher the score, the higher the stock price, the more investors are interested and participate in the market, thereby increasing the trading value and liquidity.

In addition, the two major events of the Vietnamese stock market are the launch of the Individual Corporate Bond Trading System, which helps management agencies in managing the individual bond market and people and businesses to monitor and improve the transparency of the market. The second event that resonates for the Vietnamese stock market is the story of "Planting the flag on American soil" with the initial successful listing of Vinfat (VFS). This is the premise for other Vietnamese enterprises to reach international standards, listing abroad with the aim of accessing major capital markets in the world.

It can be seen that, in the context of many difficulties and challenges at home and abroad, the Securities industry has made the right step towards a transparent market, healthy and fair development. What is your assessment of the solutions of the Government and the Ministry of Finance in recent times?

It can be affirmed that the policy of establishing order, discipline and discipline in the stock market is a completely correct step of the management agency in 2023. The activities of supervision, inspection, examination and strict handling of violations in the market have been promoted and brought about general effectiveness for the transparency and health of the stock market. In 2023, "hot" issues related to liquidity in the bond market have been somewhat adjusted appropriately through new regulations of Decree No. 08/2023/ND-CP dated March 5, 2023 amending, supplementing and suspending the implementation of a number of articles in the Decrees regulating the offering and trading of individual corporate bonds in the domestic market and the offering of corporate bonds to the international market. Thereby, clearly demonstrating the determination to bring the stock market closer to the goal of upgrading from a frontier market to an emerging market in the period of 2024-2025. In particular, it has strengthened investors' confidence in the market.

In addition, the official operation of the centralized private bond trading market is an important step in the process of developing a bond market that is increasingly transparent, trustworthy and safe for investors. The State Securities Commission's direction on solutions allowing securities companies to receive margin orders from foreign investors will help ease the market's difficulties and contribute to the roadmap for upgrading the market. Together with the solutions already implemented, this Prime Minister's dispatch is truly a positive signal for the market in the medium and long term.

What is your forecast for the future of the stock market in 2024? What are the supporting factors?

In 2024, a stronger recovery in economic activities, from domestic consumption to exports, will be triggered by loose interest rates and fiscal policies, along with a recovery from external demand. On that basis, the stock market will follow the macro context and enter the early stages of the bull cycle.

In the international market, the Fed has reached its peak interest rate and sent a message that it will cut interest rates 3-4 times in 2024. Accordingly, the loose monetary and policy environment will most likely be maintained throughout 2024 to support the economy, leading to similar actions from central banks in developed countries. The inflation story is no longer an important factor for next year when inflation is forecast to cool down and is no longer a concern for central banks.

Domestically, the economy has bottomed out and entered a growth cycle from the fourth quarter of 2023 and will accelerate in 2024. Along with that, the disbursement of public investment capital in 2023 will be concentrated in 2024. The delay in the Government's fiscal policy of increasing spending and reducing revenue through tax exemptions and reductions and land rents will be a positive factor helping the economy have a chance to recover.

On the other hand, factors such as controlled exchange rates, accelerated stock market upgrading, and boosted import-export activities as global demand increases are optimistic signals that investors can expect for a positive market trend next year.

The purpose of the stock market is to become a channel for capital mobilization for the economy. To develop the stock market as a truly major capital channel, which can go hand in hand with the banking system, what solutions are needed, sir?

The development of the stock market in recent times with the stock market and bond market channels has helped businesses and the Government mobilize capital effectively, making the structure of Vietnam's financial market much more sustainable. The role of the stock market is increasingly important and helps the capital market become more balanced in leading and supplementing medium and long-term capital sources for the economy as well as listed businesses on the stock exchanges. This also helps businesses have more resources to expand their operations, improve their competitiveness and contribute more to economic development.

First of all, the Government needs to diversify policies to encourage and develop corporate bonds. At the same time, establish a corporate credit rating organization to provide information transparency and control risks for investors. Credit rating organizations should provide information transparency and control risks for investors. In addition, the stock market must also promote information transparency and increase market reputation for further development.

On the other hand, management agencies need to proactively review the provisions of the Securities Law to include them in the law-making program. At the same time, speed up the review process to amend Decree 155, guiding circulars and related legal provisions. At the same time, it is necessary to maintain and strictly maintain order, discipline and discipline in the market, strictly handle violations, and support the securities market to operate more transparently and healthily.

Thank you!

12:35 20/01/2024

Source

![[Photo] "Beauties" participate in the parade rehearsal at Bien Hoa airport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/155502af3384431e918de0e2e585d13a)

Comment (0)