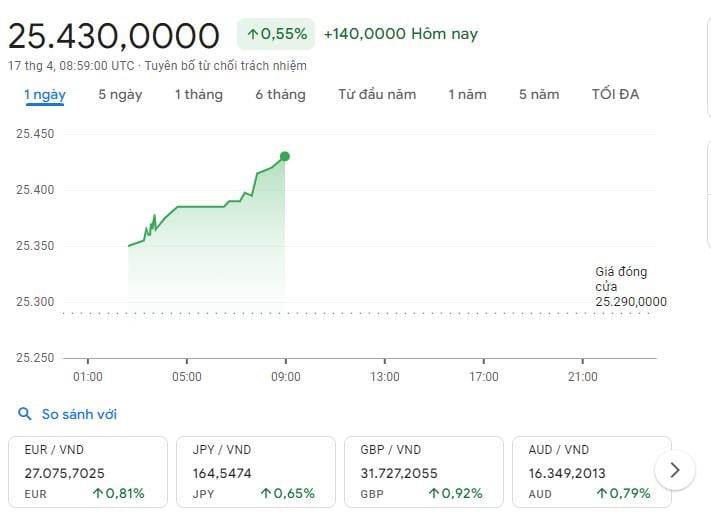

On April 17 alone, the central exchange rate increased by 90 VND, equivalent to an increase of 0.37% compared to April 16. The USD/VND exchange rate at commercial banks continued to increase to the ceiling, the USD price on the free market approached 26,000 VND...

Why is the USD still "climbing"?

According to analysts, the USD on the world market continued to climb, increasing by nearly 0.2% on April 16; at the same time setting a 5-month high against the EUR after Fed Chairman Jerome Powell said that high interest rates may have to be maintained for a longer period of time as inflation in the US has not shown signs of cooling down.

The Fed’s monetary policy and its role as a safe haven amid recent geopolitical tensions in the Middle East have helped strengthen the USD’s position in the global market. In addition, the sharp depreciation of the CNY against the USD will add further pressure on domestic exchange rates in the coming time.

“Recent data clearly do not give us greater confidence but instead suggest that it may take longer than expected to achieve that confidence,” the Fed chairman said at an economic conference before the agency begins its meeting on April 30.

The market is now expecting the Fed to consider cutting interest rates from September this year (instead of June) with 2 cuts possible. However, if inflation in the US continues to increase, this scenario is not completely guaranteed. The USD traded on the world market is benefiting greatly from the Fed's monetary policy and its role as a safe asset in the face of recent geopolitical tensions in the Middle East.

In addition, China’s yuan is at a five-month low after losing about 1.9% against the dollar this year as foreign capital continues to flow out of the country’s troubled financial markets. The yuan could weaken further if the Fed keeps its policy rate at its current high level until the end of 2024.

Analysts say that since China is Vietnam's leading trade partner, the weakening of the CNY will certainly increase pressure on the domestic exchange rate in the coming time.

In addition, according to analysis by experts at Mirae Asset Securities (Vietnam), the increase in the USD and the weakening of the CNY have had a strong impact on the domestic VND/USD exchange rate. However, the actual impact will be different from 2 years ago because the current economic context has seen significant improvements, combined with early intervention measures by the State Bank of Vietnam (SBV) through the amendment of Circular 02/2021/TT-NHNN, aiming to expand the scope of intervention by controlling swap gaps.

Meanwhile, Maybank Securities Company also provided many analyses on the recent hot issue that the VND exchange rate (listed by Vietcombank) continued to depreciate in March 2024, down 0.6% against the USD. Although the decrease was lower than the decrease of 0.7% and 0.9% in January and February 2024, respectively, this decrease brought VND to its lowest level ever.

Maybank pointed out three main reasons including: Fed interest rates are high, the gap between global and domestic gold prices is increasing, and domestic enterprises' imports of raw materials (such as fuel, steel, etc.) are increasing.

The third factor is considered to be short-term and positive as the increase in import demand actually indicates that the Vietnamese economy is recovering, which will help strengthen the domestic currency in the long term. Meanwhile, the first two reasons are challenging the SBV’s accommodative monetary policy and will require urgent policy management as well as more favorable global developments in the coming months.

Will the State Bank sell futures contracts for USD?

Mirae Asset Securities believes that the SBV is gradually preparing further measures to reduce exchange rate pressure, which will likely start with the sale of USD forward contracts along with adjustments to interest rates issued in recent sessions, reflecting the SBV's flexibility and measured approach in intervening in the exchange rate.

Sharing the same view, Maybank also believes that to reduce pressure on VND, SBV can sell USD from reserves or increase domestic policy interest rates to narrow the interest rate gap. However, analysts point out that using foreign exchange reserves is not the SBV's priority option because these reserves are only equivalent to about 3.1 months of import value, very close to the 3-month threshold recommended by the World Bank. Meanwhile, SBV has doubled down on monetary easing because the country's economic recovery is the top priority.

Therefore, the SBV is still using lighter tools, including issuing treasury bills (T-bills) to absorb excess liquidity, increase interbank interest rates and narrow the interest rate differential trading opportunities of commercial banks and large foreign exchange trading enterprises. These tools have actually reduced some pressure on the market in the third quarter of 2023.

In 2024, as of March 29, the State Bank of Vietnam has withdrawn about VND 171 trillion/USD 7.1 billion through 28-day T-bills, helping to increase the 1-month interbank interest rate to about 3%.

Maybank emphasized that this increase only brought interbank interest rates back to normal levels and did not indicate a change in the SBV's monetary policy. More importantly, the SBV is willing to allow greater foreign exchange fluctuations while waiting for the Fed's interest rate cut. In the past, the SBV would sell USD strongly to stabilize the VND when the VND depreciated about 2% against the USD in the same period. But when the VND depreciated 4.3% against the USD in the same period in October 2023, the SBV has not intervened strongly.

According to Maybank, the SBV will hardly sell USD to intervene in the VND exchange rate in the third quarter of 2023 when the VND has depreciated by more than 4% since the beginning of the year. The SBV will likely maintain this level of acceptance as it is waiting for the first interest rate cut by the Fed this year as the SBV's foreign exchange reserves are only adequate and economic recovery is Vietnam's top priority.

“We believe that this is likely to continue this year. The official USD/VND exchange rate listed by Vietcombank has increased by 2.3% compared to the beginning of the year. Therefore, there is still about 2-3% for the VND to depreciate before we can see stronger intervention from the SBV,” Maybank experts concluded.

Meanwhile, the BIDV - ADB and NFSC research team forecasts that the world economy will stagnate or grow more slowly (2.4% compared to 2.6% in 2023) despite a gradual recovery in trade and investment, and global inflation will continue to decline (3.5 - 4% from 5.7% in 2023). For Vietnam, the research team forecasts that GDP growth in 2024 could reach 6 - 6.5% (baseline scenario) with growth drivers recovering better than in 2023, and inflation will increase by about 3.4 - 3.8% compared to the target of 4 - 4.5%.

Accordingly, Vietnam's financial sector in 2024 is forecast to be more positive. Monetary policy is forecast to be proactive and flexible, with interest rates maintained at low levels to promote growth. Although the exchange rate is still under great pressure before the Fed decides to cut interest rates, it will gradually cool down from the end of the second quarter of 2024, with an increase of about 2.5 - 3% in 2024. The capital supply structure of the economy in 2024 and the following years is expected to shift in a more positive direction when gradually reducing the proportion of the credit channel, increasing the proportion through the capital market channel and private investment. Market liquidity is expected to have positive improvements.

Source

![[Photo] Opening of the 11th Conference of the 13th Party Central Committee](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/f9e717b67de343d7b687cb419c0829a2)

![[Photo] April Festival in Can Tho City](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/bf5ae82870e648fabfbcc93a25b481ea)

![[Photo] Unique folk games at Chuong Village Festival](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/cff805a06fdd443b9474c017f98075a4)

Comment (0)