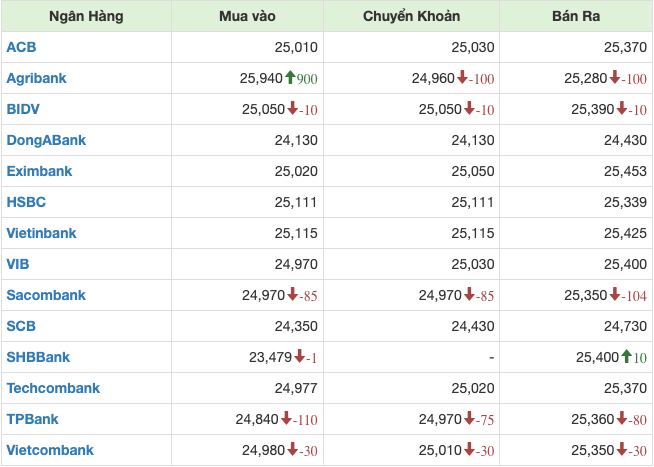

On the morning of August 5, the State Bank slightly adjusted the central exchange rate down by 1 VND compared to the end of last week (August 2), listing it at 1 USD equal to 24,241 VND. With a margin of +/-5% according to current regulations, the ceiling exchange rate is 25,453 VND/USD; the floor exchange rate is 23,028 VND/USD.

Viecombank sharply decreased 30 VND in both buying/selling directions compared to August 2, trading at 24,980 - 25,350 VND/USD.

Agribank reduced the buying price by 10 VND (25,030 VND/USD) and the selling price by 20 VND (25,360 VND/USD) compared to the session on August 2.

USD price at BIDV decreased by 10 VND for buying (25,050 VND/USD) and 10 VND for selling (25,390 VND/USD) compared to the end of last week.

At 10:00 a.m. on August 5, the exchange rate at Vietinbank remained unchanged, trading at 25,115 - 25,425 VND/USD.

Some private commercial banks such as TPBank and Sacombank adjusted exchange rates down sharply compared to August 2.

Specifically, at 10:00 a.m. on August 5, the exchange rate at TPBank was 24,840 - 25,360 VND/USD, down 110 VND for buying and 80 VND for selling compared to the end of last week.

At Sacombank, the USD price decreased by 85 VND for buying and 64 VND for selling, trading at 24,970 - 25,390 VND/USD.

This is the fifth consecutive session since July 30 that the exchange rate at commercial banks has been adjusted downward. After more than 3 months (from mid-April to July) anchored at the ceiling level according to the State Bank's regulation, since the beginning of August until now, the exchange rate has been far from the ceiling level.

On the morning of August 5, the free exchange rate was 25,600 VND/USD for buying and 25,680 VND/USD for selling, the buying price remained the same compared to the session on August 2 and decreased by 20 VND for selling.

During the week from July 29 to August 2, the interbank exchange rate traded in a downward trend. At the end of the session on August 2, the interbank exchange rate closed at 25,213 VND/USD, a sharp decrease of 97 VND compared to the previous weekend session.

The exchange rate on the free market fluctuated downward in most sessions last week. At the end of the session on August 2, the free exchange rate decreased by 90 VND in buying and 70 VND in selling compared to the previous weekend session, trading at 25,600 VND/USD and 25,700 VND/USD.

According to analysts, the weakening of the DXY index (measuring the strength of the dollar) along with the effective intervention of the State Bank through foreign exchange sales has reduced pressure on the VND/USD exchange rate.

Globally, the DXY fell 1.12% from 104.13 points on July 28 to 102.9 points on August 2. The weakening of the USD was due to newly released economic data from the US, which reinforced the possibility that the Fed will start cutting interest rates from September this year. Last week, the Bank of England (BOE) lowered its policy interest rate for the first time since 2020, a day after the Fed kept its base interest rate at its highest level in two decades.

Over the past week, the world's three largest central banks, the US, Japan and the UK, have adjusted policy interest rates in different directions, but the divergence in monetary policy is expected to be short-lived.

Once the Fed starts cutting rates (later this year), most major central banks will follow suit based on historical experience. The Jackson Hole conference in August will be a key moment when the world’s leading central bankers gather to help set common directions for coordinating monetary policy in the coming period.

At the same time, analysts assessed that the State Bank's maintenance of high interbank interest rates also contributed to reducing the interest rate gap between the USD and VND, thereby supporting against the devaluation of the Vietnamese Dong.

From July 29 to August 2, interbank VND interest rates fluctuated in a downward trend for all terms from 1 month and below. Closing on August 2, interbank VND interest rates were trading around: overnight 4.77% (-0.16 dong); 1 week 4.83% (-0.17 dong); 2 weeks 4.88% (-0.12 dong); 1 month 5% (-0.02 dong).

Interbank USD interest rates remained little changed last week. On August 2, the interbank USD interest rate closed at: overnight 5.3% (unchanged); 1 week 5.36% (+0.02 dong); 2 weeks 5.40% (+0.01 dong) and 1 month 5.44% (+0.01 dong).

In the open market last week from July 29 to August 2, in the mortgage channel, the State Bank offered 7-day term with a volume of VND28,000 billion, interest rate kept at 4.5%. There were VND23,965.73 billion in winning bids, VND59,044.97 billion maturing last week.

The State Bank offered 14-day State Bank bills for auction, bidding on interest rates in all sessions. At the end of the week, a total of VND61,300 billion was won, with the winning interest rate remaining at 4.5%; VND48,100 billion matured last week.

Thus, the State Bank withdrew a net VND48,279.24 billion from the market last week through the open market channel. The volume circulating on the mortgage channel was VND23,965.73 billion, the volume of circulating treasury bills was VND77,500 billion.

TH (according to VnEconomy)Source: https://baohaiduong.vn/ty-gia-giam-5-phien-lien-tiep-ngan-hang-nha-nuoc-hut-rong-hon-48-279-ty-dong-389430.html

![[Photo] Many young people patiently lined up under the hot sun to receive a special supplement from Nhan Dan Newspaper.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/6f19d322f9364f0ebb6fbfe9377842d3)

![[Photo] Party and State leaders attend the special art program "You are Ho Chi Minh"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/6895913f94fd4c51aa4564ab14c3f250)

![[Photo] Ready for the top competitions of Vietnamese table tennis](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/9c547c497c5a4ade8f98c8e7d44f5a41)

Comment (0)