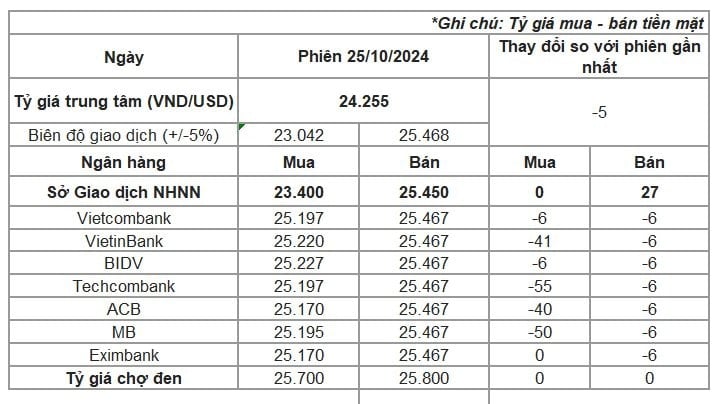

Today, October 25, the central exchange rate continued to be announced by the State Bank of Vietnam (SBV) at 24,255 VND/USD, down 5 VND compared to yesterday's trading session. This is the first time the SBV has reduced the central exchange rate after 8 consecutive increases.

With a margin of 5%, the current USD exchange rate that commercial banks are allowed to trade is between 23,042 - 25,468 VND/USD.

The selling rate was also continued to be listed at 25,450 VND/USD by the State Bank of Vietnam. Previously, on the afternoon of October 24, the State Bank of Vietnam increased the listed USD intervention selling price at the Exchange from 25,423 VND/USD to 25,450 VND/USD.

At the same time, according to some sources in the interbank market, the operator has notified banks about resuming foreign currency sales to intervene in foreign currency in the form of spot transactions, at an exchange rate of 25,450 VND/USD.

Previously, from April 19, the State Bank officially announced the sale of foreign currency intervention to banks with negative foreign currency status to convert the foreign currency status to 0, with the intervention exchange rate of 25,450 VND. At that time, Mr. Pham Chi Quang, Director of the Monetary Policy Department, said that this was a very strong measure of the State Bank to ensure market sentiment is relieved, ensure market supply, and ensure adequate legitimate foreign currency demand of the economy . And just from April to early June, the State Bank had to sell about 6 billion USD to stabilize the foreign currency market.

In response to the regulator's move, the USD exchange rate on the interbank market closed on October 24 at VND25,400/USD, down VND35 compared to the October 23 session and below the SBV's intervention price. However, since the beginning of October, the USD price on the interbank market has increased by more than VND800, equivalent to 3.2%.

According to ACB 's Market Research Department, the information that the State Treasury (KBNN) continued to buy an additional 240 million USD on Friday had a certain impact on the trading psychology in the market. However, the announcement by the State Bank yesterday afternoon to resume the supply of USD from October 24 at the price of 25,450 has somewhat helped to untie the bottleneck in the supply of foreign currency in the market at this time.

"The interbank USD exchange rate is forecast to remain around 25,400 today before signs of cooling begin to appear next week," said ACB's research team.

In line with the trend of the interbank market, the USD/VND exchange rate listed at banks was also adjusted down this morning, October 25. Accordingly, all major banks are currently listing the USD selling price at 25,467 VND/USD, down 6 VND compared to the same time yesterday and equivalent to the adjustment of the central exchange rate. However, the USD selling price is still listed by banks at the ceiling, only 1 VND lower than the maximum price traded.

On the other hand, many banks also reduced the price of buying USD from residents with a stronger adjustment than the selling price, fluctuating between 6 - 55 VND/USD compared to the level recorded at the same time yesterday, October 24.

Since the beginning of October, the USD price at banks has increased by about 730 VND, equivalent to an increase of nearly 3%; thereby bringing the total depreciation of the VND against the USD since the beginning of the year to 4.3%. At the same time, the USD price listed at banks has approached the historical peak of nearly 25,500 VND set in April 2024.

In the free market, the USD price is being traded at foreign exchange points at 25,700 VND/USD for buying and 25,800 VND/USD for selling, unchanged from yesterday's survey. Since the beginning of October, the free USD price has increased by about 700 VND, equivalent to an increase of 2.8%.

After plunging in August and September, the USD/VND exchange rate has rebounded sharply in October. This development occurred in the context of the greenback preparing to enter its fourth consecutive week of price increases. Accordingly, the USD index - a measure of the greenback's strength against other major currencies - has increased by more than 3% since the beginning of October.

The US dollar rose after positive US economic data reduced investors' expectations that the US Federal Reserve would continue to cut interest rates aggressively. The US dollar is also said to benefit from demand for safe-haven assets due to concerns about escalating conflicts in the Middle East and the possibility of Mr. Trump winning the US presidency.

For the domestic market, besides pressure from the international market, exchange rates are also under pressure due to the increasing demand for foreign currency.

According to analysts, the demand for foreign currency payments from import and FDI enterprises arising in the first half of October combined with the strong increase of the USD in the world market is the main factor supporting the increase of the USD/VND exchange rate in October. In addition, the demand to buy foreign currency from the State Treasury is also one of the factors causing the rapid increase in foreign currency prices recently.

VN (synthesis)Source: https://baohaiduong.vn/ngan-hang-nha-nuoc-co-dong-thai-moi-ty-gia-usd-lap-tuc-quay-dau-giam-396485.html

![[Photo] Prime Minister Pham Minh Chinh inspects the progress of the National Exhibition and Fair Center project](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/35189ac8807140d897ad2b7d2583fbae)

![[VIDEO] - Enhancing the value of Quang Nam OCOP products through trade connections](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/17/5be5b5fff1f14914986fad159097a677)

Comment (0)