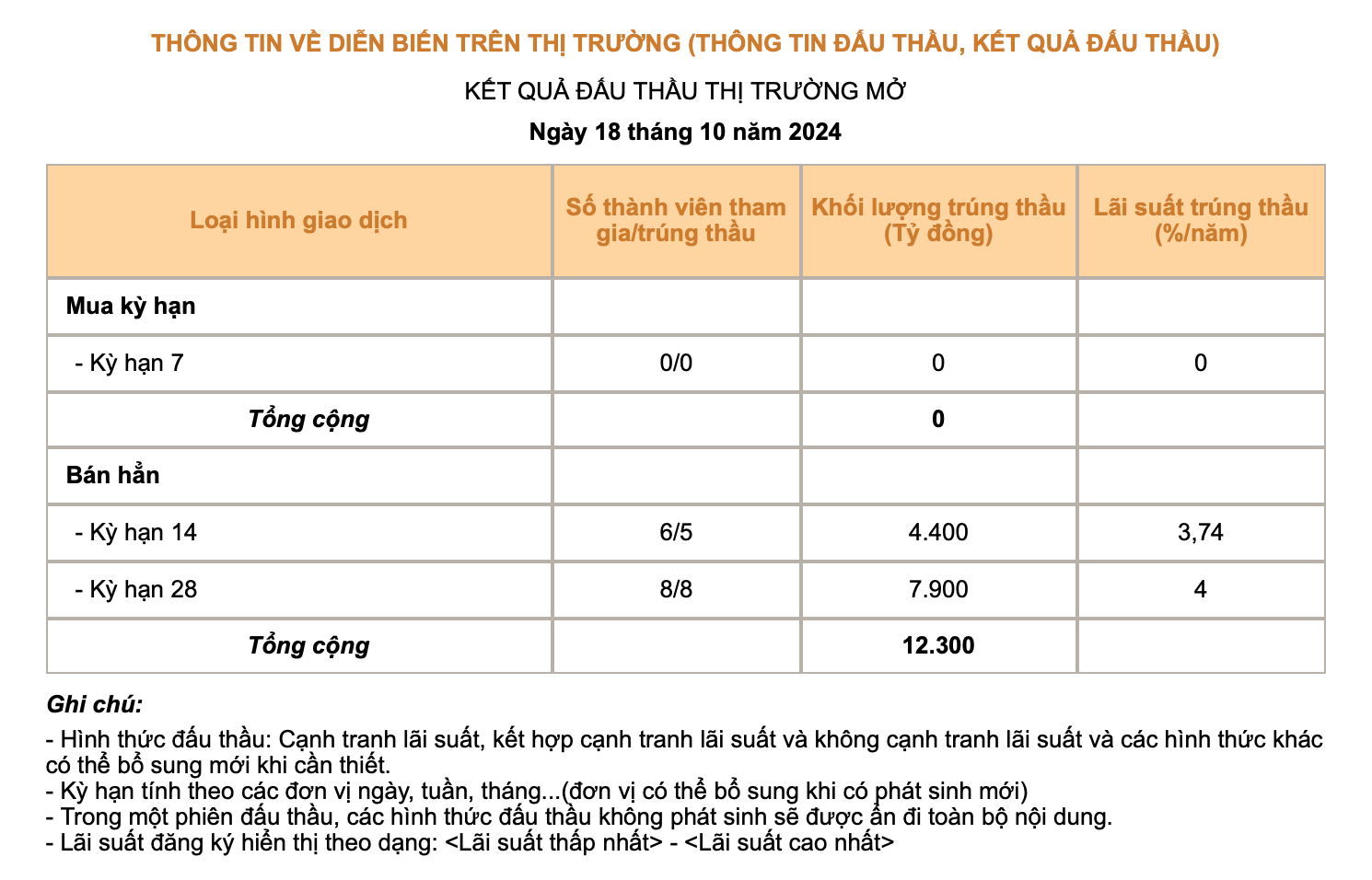

On the afternoon of October 18, the State Bank announced the results of the open market auction.

Accordingly, the State Bank issued 14-day and 28-day bills with a total winning bid value of VND12,300 billion. At the 14-day term, 6 members participated and 5 members won the bid; the winning bid value was VND4,400 billion, the winning interest rate was 3.74%/year. At the 28-day term, 8 members participated and all won the bid with a value of VND7,900 billion, the winning interest rate was 4%/year.

The decision to withdraw money through the treasury bill channel was made in the context of the VND/USD exchange rate continuously escalating in recent days.

On October 18, the foreign exchange market recorded a rare phenomenon when the USD price at banks was 40 VND higher than the price on the free market per USD.

Specifically, at the end of the session on October 18, Vietcombank listed USD buying and selling transactions at 25,010 - 25,400 VND/USD, an increase of 30 VND each way compared to the close of the session on October 17.

BIDV listed the exchange rate at 25,040 - 25,400 VND/USD, buying down 15 VND, selling up 5 VND compared to the previous closing price.

Techcombank listed the USD buying and selling prices at 25,052 - 25,423 VND/USD, an increase of 60 VND for buying and 23 VND for selling compared to the closing price on October 17.

Vietinbank listed the exchange rate at 25,084 - 25,423 VND/USD, the buying price increased by 224 VND, the selling price increased by 63 VND compared to the end of yesterday, October 17.

Eximbank listed buying and selling prices at 25,050 - 25,423 VND/USD, an increase of 60 VND for buying and 43 VND for selling compared to the previous session's closing price.

Maritimebank listed buying and selling prices at 25,092 - 25,418 VND/USD, an increase of 138 VND in buying price and 23 VND in selling price compared to the previous closing price.

The USD exchange rate on the free market has remained unchanged in both buying and selling directions compared to the previous listing, currently trading at 25,260 VND/USD for buying and 25,360 VND/USD for selling, remaining unchanged for 3 consecutive sessions. The USD selling price on the free market is 4-60 VND lower than that of commercial banks.

On October 17, the interbank exchange rate increased sharply by 210 VND compared to the session on October 16, closing the listed session at 25,200 VND/USD. On October 18, the interbank exchange rate continued to increase by 50 VND compared to the previous session, closing the session at 25,250 VND/USD.

According to analysts, in addition to the monetary policy moves of the US Federal Reserve (Fed), the strength of the USD is also affected by the upcoming US presidential election. The USD Index (DXY), a measure of the strength of the greenback compared to other major currencies, is currently at 103.67 points, the highest in nearly 4 months.

Since August 2024, when exchange rate pressure eased, the State Bank of Vietnam has stepped up money injection through the open market operations (OMO) channel to establish a low interbank interest rate level, thereby supporting liquidity for the system, helping banks boost credit to the economy in the last months of the year to support growth.

On October 17, the average interbank VND interest rate was: overnight 2.74%/year; 1 week 2.98%/year; 2 weeks 3.2%/year and 1 month 3.62%/year. The average interbank USD interest rate in recent sessions increased slightly in short terms while remaining unchanged in 1-month terms. At the end of the session on October 17, the USD interbank interest rate was traded at: overnight 4.84%/year; 1 week 4.9%/year; 2 weeks 4.93%/year; 1 month 4.94%/year.

Thus, the State Bank's net withdrawal of more than VND12,000 billion on October 18 will impact the interbank interest rate level in VND in the coming sessions. The operator's goal is to narrow the USD/VND interest rate gap to stabilize the exchange rate.

VN (according to VnEconomy)Source: https://baohaiduong.vn/ty-gia-tang-manh-ngan-hang-nha-nuoc-phat-hanh-tin-phieu-de-hut-tien-396009.html

![[Photo] Award ceremony for works on studying and following President Ho Chi Minh](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/20/a08ce9374fa544c292cca22d4424e6c0)

![[Photo] Vietnamese shipbuilding with the aspiration to reach out to the ocean](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/20/24ecf0ba837b4c2a8b73853b45e40aa7)

![[VIDEO] - Enhancing the value of Quang Nam OCOP products through trade connections](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/17/5be5b5fff1f14914986fad159097a677)

Comment (0)