| Why will world oil prices continue to fluctuate in the future? Why did world oil prices increase after OPEC+ policy decisions? |

This is pushing oil prices to face very unpredictable scenarios, leading to far-reaching impacts on the world and domestic economies.

The Middle East conflict is relentless.

Since the Hamas attack on Israel broke out on October 7, 2023, the political situation in the Middle East has been fraught with many potential risks. Tensions flared up again when recently, on the night of April 13, Iran launched an attack on Israel, in retaliation for Tel Aviv's military action against the Iranian embassy in Syria.

Tehran's direct involvement has raised market concerns that its 1.5 million barrels of crude oil per day exports will be affected.

|

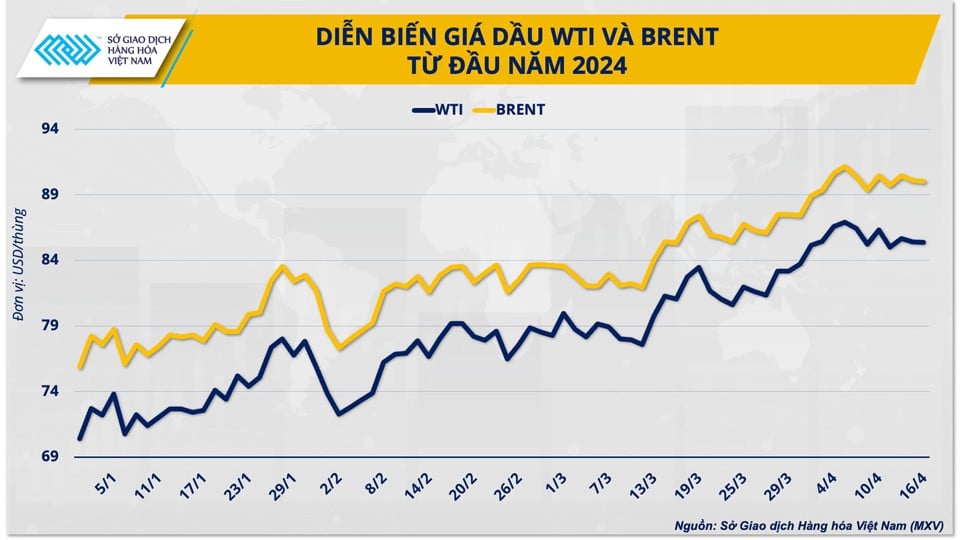

| WTI and Brent oil price developments since the beginning of the year |

However, contrary to market concerns, oil prices opened the first trading session of the week with little volatility, even under clear pressure. According to data from the Vietnam Commodity Exchange (MXV), WTI oil prices ended the first trading session of the week on April 15 with a decrease of 0.29% to 85.41 USD/barrel. Brent oil decreased by 0.39% to 90.10 USD/barrel.

|

| Mr. Nguyen Duc Dung, Deputy General Director of Vietnam Commodity Exchange |

Mr. Nguyen Duc Dung, Deputy General Director of MXV said: “Iran’s actions were warned in advance, the attack was not unexpected, so the impact was reflected in the price in advance. Moreover, the restraint of the parties involved also helped cool down the market.”

Immediately after the tension broke out, Israel temporarily showed no signs of wanting to escalate the conflict further. On the other side, Iran also emphasized that it would not go further unless Israel crossed the “red line” again.

In addition, the flow of crude oil from the Middle East has not shown any signs of being affected. However, any action from either side to increase tensions, spilling over to the oil industry in the region, could push the market into a new crisis.

Possible scenarios for oil prices this year?

Even without mentioning geopolitical risks, the crude oil market was already very hot due to the OPEC+ “pumping valve” move. According to the April report from the US Energy Information Administration (EIA), the market will have a deficit of 940,000 barrels/day in the current quarter and WTI oil prices will maintain a peak of around $85/barrel in the second and third quarters before the above impact.

Obviously, geopolitical risks cannot be eliminated from the market as this is a factor that strongly affects oil prices. Mr. Nguyen Duc Dung believes that the trend of oil prices will depend on the developments of tensions in the Middle East with two possible scenarios.

|

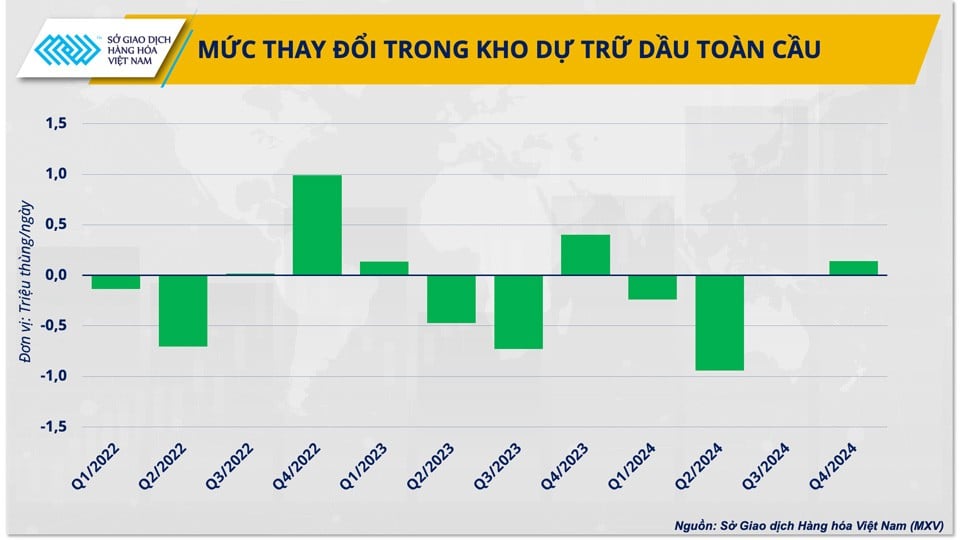

| Change in global oil inventories |

In the first scenario, tensions between Iran and Israel gradually cool down, oil prices will return to following supply and demand factors, with a focus on OPEC+ production policy. Entering the peak summer consumption period, Brent oil prices can still stabilize at above $80/barrel.

In a more negative scenario, oil prices could hit triple digits if Israel goes head-to-head with Iran. Of course, Iran’s energy infrastructure would not be out of the picture if Israel retaliates. The US is unlikely to leave its number one ally in the Middle East alone if tensions escalate.

On the other hand, Tehran considers the Strait of Hormuz, a vital artery for the flow of about 20 million barrels of crude oil per day to the world, as a “trump card” to directly confront Washington. In the context of the situation in the Red Sea remaining unstable, if the Hormuz trade gateway is challenged or even closed, a real “nightmare” will appear in the world oil market.

Although this negative scenario is unlikely to happen because it will directly affect the economies of countries in the region. In addition, exporting countries will find it difficult to accept high oil prices for a long time because this can cause a demand disruption. Therefore, OPEC+ may intervene to help cool the market with more than 5 million barrels/day of spare capacity available.

However, caution is not superfluous when the political situation is still uncertain. Moreover, market sentiment can also push prices up in the short term if the situation worsens, and the world economy will also be hard to avoid the consequences.

Oil prices, inflation and the exchange rate story

Oil prices have always been closely linked to economic growth and inflation. Oxford Economics estimates that a $10/barrel increase in oil prices would raise global inflation by 0.29 percentage points by 2024. The risk of higher oil prices would therefore be a hindrance in the final stretch of central banks’ war on inflation.

In the US in particular, expectations about the timing of the US Federal Reserve's policy pivot have been pushed back after inflation rose more than forecast for the third consecutive month, with 60% of the contribution coming from rising energy prices and housing prices.

Bank of America and Deutsche Bank even predict just one rate cut in December instead of three. This is entirely possible in the second scenario, when world oil prices hit $100/barrel. The US dollar would also be strongly supported.

|

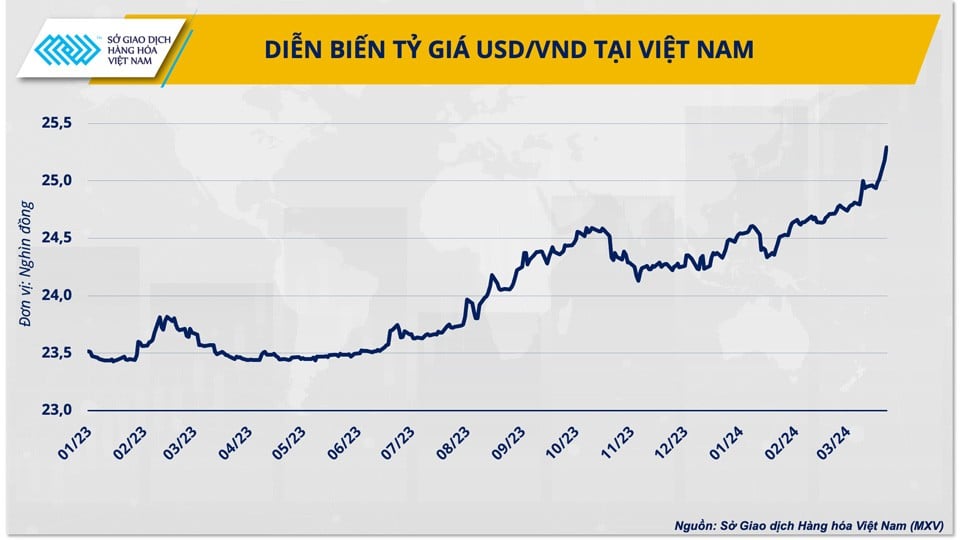

| USD/VND exchange rate developments in Vietnam |

Vietnam will also be under considerable pressure from the impact of the global energy and financial markets. According to Mr. Nguyen Duc Dung, Vietnam's exchange rate is forecast to remain high in the short term, under pressure from the rising value of the USD and the Fed's interest rate cut, which is currently being pushed back.

However, on the positive side, with the previous low interest rate maintained, Vietnam's exchange rate pressure may cool down in the second half of the year, gradually approaching the time when the Fed loosens its policy. In addition, the foreign exchange supply from import-export activities, with a trade surplus of 8.08 billion USD in the first quarter, will also be a factor that helps reduce pressure on the State Bank in its goal of stabilizing the exchange rate.

Source

![[Photo] Nhan Dan Newspaper announces the project "Love Vietnam so much"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/362f882012d3432783fc92fab1b3e980)

![[Photo] Closing of the 4th Summit of the Partnership for Green Growth and the Global Goals](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/c0a0df9852c84e58be0a8b939189c85a)

![[Photo] General Secretary To Lam receives French Ambassador to Vietnam Olivier Brochet](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/49224f0f12e84b66a73b17eb251f7278)

![[Photo] Promoting friendship, solidarity and cooperation between the armies and people of the two countries](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/0c4d087864f14092aed77252590b6bae)

![[Photo] National Assembly Chairman Tran Thanh Man meets with outstanding workers in the oil and gas industry](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/1d0de4026b75434ab34279624db7ee4a)

![[Photo] Welcoming ceremony for Chinese Defense Minister and delegation for friendship exchange](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/fadd533046594e5cacbb28de4c4d5655)

![[Video] Viettel officially puts into operation the largest submarine optical cable line in Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/f19008c6010c4a538cc422cb791ca0a1)

Comment (0)