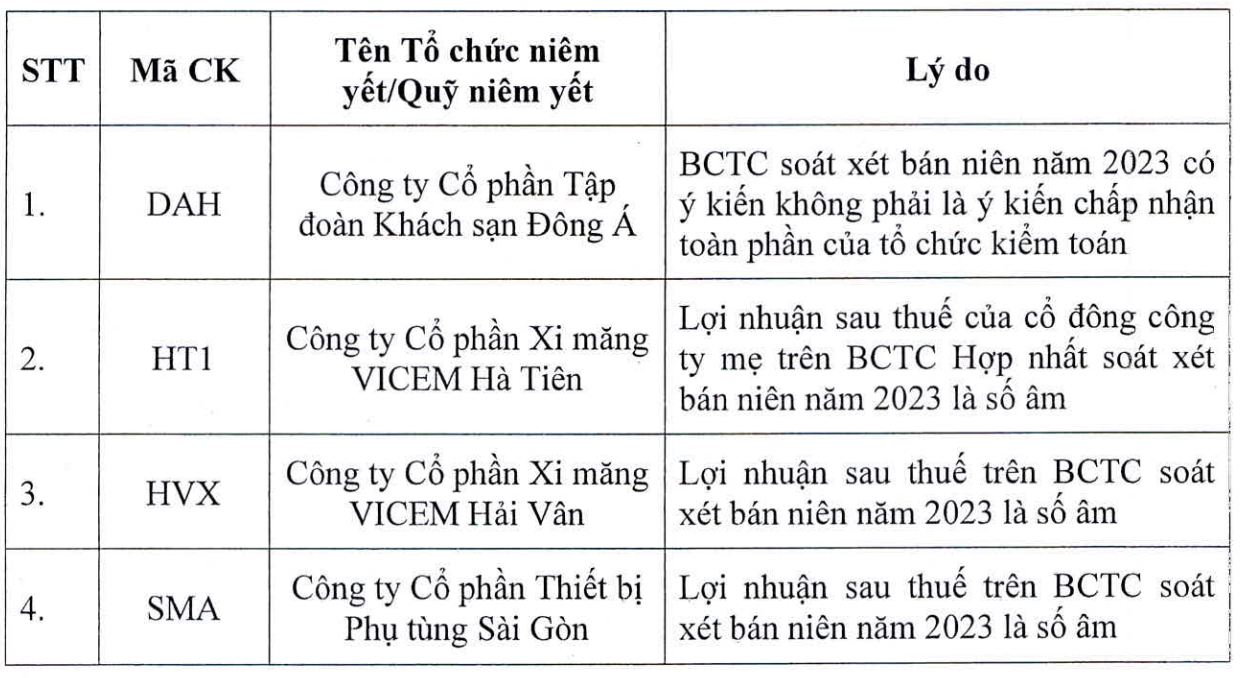

Ho Chi Minh City Stock Exchange (HoSE) has just announced 4 more stocks that are not eligible for margin trading.

Specifically, HoSE said that 4 stocks DAH, HT1, HVX and SMA were added to the list of securities ineligible for margin trading, thereby increasing the list to 83 securities ineligible for margin trading on HoSE.

In particular, DAH shares of Dong A Hotel Group Corporation are not eligible for margin trading because the audited semi-annual financial statements of 2023 have an opinion that is not a fully acceptable opinion of the auditing organization.

Similarly, HT1 shares of VICEM Ha Tien Cement JSC were not granted margin because the after-tax profit of the parent company's shareholders on the audited consolidated financial statements for the first half of 2023 was negative. In the first 6 months of 2023, HT1 recorded a after-tax profit of the parent company's shareholders of negative VND 27 billion compared to the same period of positive VND 167 billion.

The remaining shares of HVX and SMA belonging to VICEM Hai Van Cement JSC and Saigon Spare Parts Equipment JSC are not allowed to be traded on margin for the same reason: the after-tax profit on the audited semi-annual financial statements of 2023 is a negative number.

List of stocks not allowed for margin trading (Source: HoSE).

On the same day, the Ho Chi Minh City Stock Exchange also issued a notice reminding 4 companies of late submission of their 2023 semi-annual audited financial statements.

Accordingly, SPM of SPM JSC, SVD of Vu Dang Investment and Trade, TTB of Tien Bo Group and VDP of Vidipha Central Pharmaceutical were reminded by HoSE and asked to urgently disclose information in accordance with regulations.

SPM shares recently announced the content of the auditor's exception opinion, specifically, the company has accounted for corporate income tax paid in previous years with the amount of VND 1,893,796,974 into current corporate income tax expense for this period.

According to SPM, this tax must be retrospectively accounted for in comparative figures according to the guidance of current Vietnamese Enterprise Accounting Standards and Regimes.

As for SVD shares, according to the financial report, at the end of the second quarter of 2023, SVD reported a loss of more than 10 billion, while in the same period, it only lost more than 1.1 billion VND.

The reason is that revenue decreased, cost of goods sold increased, net revenue increased slightly and financial revenue decreased due to economic difficulties in many countries, the consumption market of cotton, knitting and textile industries decreased. Meanwhile, China, the main consumption market of the company's products (accounting for 80%) has almost frozen...

On the other hand, TTB shares are currently under warning from July 11, 2023, because the company has not held an annual general meeting of shareholders for more than 6 months from the end of fiscal year 2022.

For Vidipha Central Pharmaceuticals, the company has just explained that its audited semi-annual after-tax profit reached VND47.43 billion, up 24.55% over the same period due to a 6.04% increase in net revenue and a 224.10% increase in other profits .

Source

![[Photo] National Assembly Chairman Tran Thanh Man meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/4e8fab54da744230b54598eff0070485)

![[Photo] Tan Son Nhat Terminal T3 - key project completed ahead of schedule](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/85f0ae82199548e5a30d478733f4d783)

![[Photo] Reception to welcome General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/ef636fe84ae24df48dcc734ac3692867)

![[Photo] Prime Minister Pham Minh Chinh meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/893f1141468a49e29fb42607a670b174)

Comment (0)