Today (May 8), the State Bank continues to auction gold bars with a reference price of VND85.3 million/tael.

After 3 bidding sessions, so far only one bidding session on April 23 took place as planned.

Expected to bid 16,800 taels of gold

On May 7, the State Bank announced the auction at 9:30 a.m. on May 8 to credit institutions and enterprises participating in the gold auction.

Accordingly, the total volume of gold bars expected to be auctioned is 16,800 taels of gold; the volume of gold bars in a transaction lot is 100 taels. The type of gold auctioned is SJC gold bars produced by the State Bank.

The State Bank stated that the deposit rate when participating in the bidding is 10%, the reference price to calculate the deposit value is 85.3 million VND/tael. In addition, the minimum bidding volume that a member is allowed to bid is 7 lots equivalent to 700 taels, the maximum volume is 20 lots equivalent to 2,000 taels. The bidding price step is 10,000 VND/tael, the bidding volume step is 1 lot equivalent to 100 taels.

The State Bank also stipulates that each bidding member can only register 1 minimum price equal to or higher than the floor price announced by the State Bank.

Credit institutions and enterprises participating in the bidding must meet all conditions as prescribed by the State Bank. The State Bank organizes the bidding at the State Foreign Exchange Reserve Management Department (Hanoi City). The location for gold delivery and receipt is at the Issuance and Treasury Department - State Bank, in Ho Chi Minh City.

Previously, after 3 auctions, only one auction on April 23 took place as planned, with the result that 2 members won the bid, with a total volume of 34 lots (3,400 taels); the highest winning bid price was 82.33 million VND/tael, the lowest winning bid price was 81.32 million VND/tael.

State Bank continues to auction gold bars at reference price of 85.3 million VND/tael

Creating fairness in the gold market

According to economic experts, the State Bank has organized gold auctions to put a large amount of gold into circulation, contributing to stabilizing supply and demand, narrowing the gap between domestic and world gold prices, and between buying and selling prices.

But to stabilize the gold price, economic expert Nguyen Tri Hieu said that the State Bank may need to organize many similar auctions and those auctions must have a large amount of gold to pour into the market, at the same time there must be many gold traders participating in the bidding and winning the bids instead of the current modest amount.

In addition to the implementation of bidding, Decree 24/2012/ND-CP on the management of gold trading activities also needs to be amended. The monopoly of the national gold brand of SJC should be removed, creating fairness for all products on the market.

Mr. Nguyen Duc Do, Deputy Director of the Institute of Finance and Economics - Academy of Finance, said that after the State Bank's move, the gap between domestic gold prices and world gold prices may narrow. The extent of the narrowing depends on the scale of raw gold imports. Domestic gold prices in the coming time will continue to fluctuate according to world gold prices and this is very difficult to predict. Many forecasts say that gold prices may continue to increase, but there are also predictions that gold prices may peak at least in the short term and will decrease in the coming time.

According to VTV

Source

![[Photo] Close-up of Vietnam's sniffer dog team searching for earthquake victims in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/d4949a0510ba40af93a15359b5450df2)

![[Photo] President Luong Cuong and King Philippe of Belgium visit Thang Long Imperial Citadel](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/cb080a6652f84a1291edc3d2ee50f631)

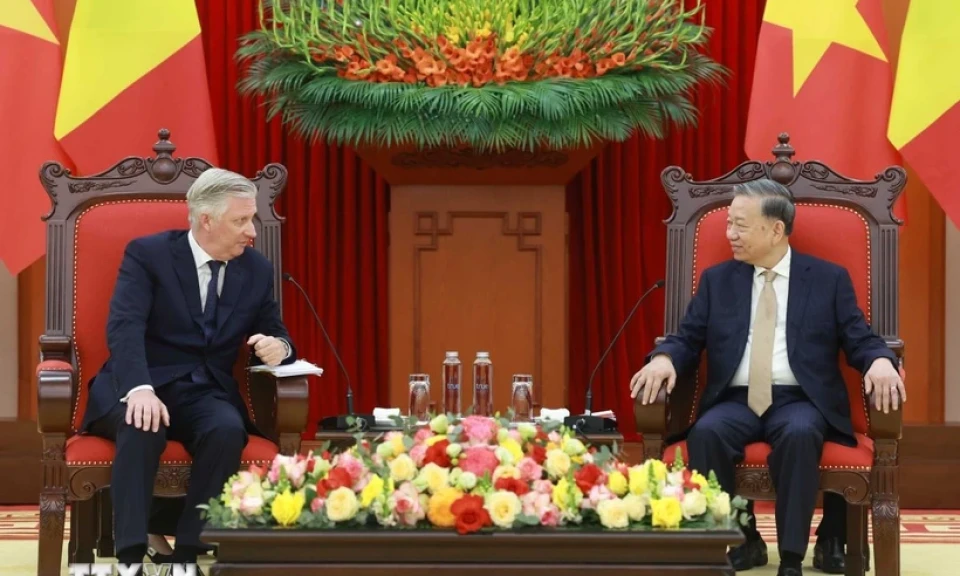

![[Photo] General Secretary To Lam receives King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/e5963137a0c9428dabb93bdb34b86d7c)

![[Photo] Prime Minister Pham Minh Chinh meets with King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/be2f9ad3b17843b9b8f8dee6f2d227e7)

![[Photo] Myanmar's capital in disarray after the great earthquake](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/7719e43b61ba40f3ac17f5c3c1f03720)

Comment (0)